What is Buy Now Pay Later (BNPL)?

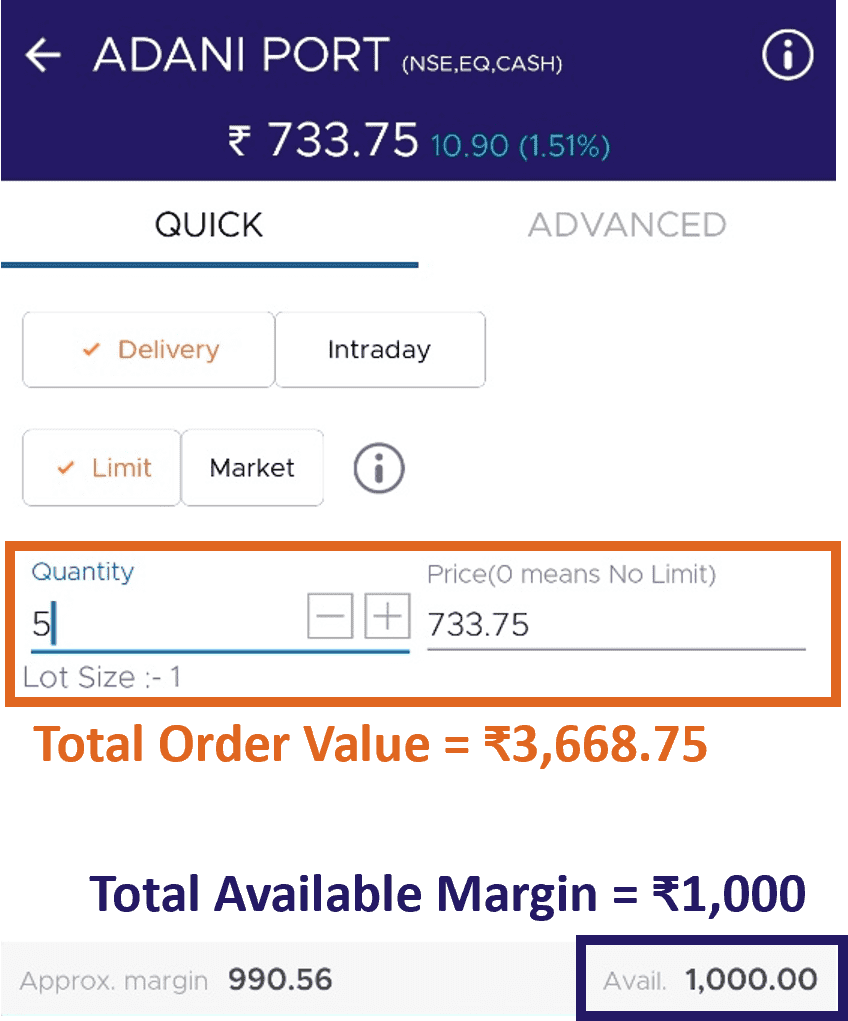

Buy Now Pay Later is a form of short-term financing to buy more stocks with the same capital amount. When you place a BNPL order, you invest a fraction of the stock's total purchase value and the stockbroker lends the remaining amount at a nominal interest rate to be repaid later.

How does BNPL with IIFL Securities work for investors?

As you have to invest a small portion of the total investment amount, and IIFL Securities invests the remaining on your behalf at a nominal interest rate of 0.05%*, you can buy up to 5x quantity of stocks. This option results in a better Return on Investment as compared to normal delivery trade. Let's understand this with a simple example.

Watch Video to Understand the Power of Buy Now Pay Later

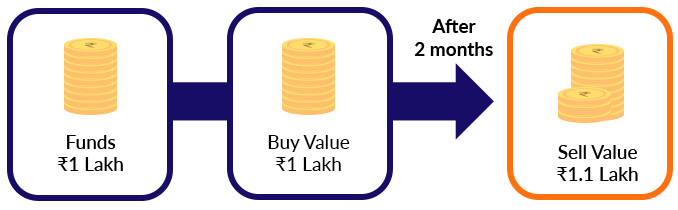

Let's understand this with a simple example.

Your stock market investment = Rs 1 lakh

Stock value after two months = Rs 1.1 lakh

Net profit after selling the stock = Rs 10,000.

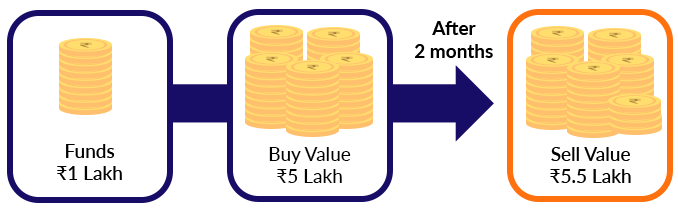

Later Trade

Your stock market investment = Rs 1 lakh

IIFL Securities investment (on your behalf) = Rs 4 lakh

Total buy value of stocks = Rs 5 lakh

Stocks values after 2 months = Rs 5.5 lakh

Net profit after selling the stock = ₹50,000

Interest charged at 0.05%* per day = ₹12,000

With Buy Now Pay Later, your 10% returns have been increased to 38% returns!

Eligibility for BNPL Trading Facility: A Margin Account

To avail of the BNPL facility, you must have a Demat account and an active margin account. A margin account is where the stockbroker lends the amount to purchase more stocks. Once you have opened a margin account, you are eligible to make BNPL trades while placing an order for BNPL-eligible stocks. For ease of BNPL trading, IIFL Securities has designed the margin account opening process in just a single click while placing the first BNPL order.

Benefits of Buy Now Pay Later

Up to 5x Leverage: You can buy up to five times more stocks as the purchased stock amount is up to four times more.

Effective Risk Management: The excess money allows you to buy various stocks to spread the risk and diversify your portfolio.

Helpful in case of shortage of funds: You can make bigger investments when you are low on funds and cannot buy high-value stocks.

Benefit From Corporate Actions: Dividends earned through the stock purchased via BNPL will be credited to your bank account. Therefore, if you have purchased 5 times stock through BNPL, you will get 5x benefit through corporate actions.

Why choose BNPL with IIFL Securities?

Easy management of BNPL trades via the "Buy Now Pay Later account"

Check your total BNPL amount in a single click

Only stockbroker in the industry to offer the facility of placing partial unpledged requests

Attractive and affordable interest rates for effective repayment of the leverage amount

No need to wait till the end of the day for OTP confirmation (Live from August 30, 2022)

How to Place a Buy Now Pay Later Order with IIFL Securities?

Select the product as "BNPL" or "Buy Now Pay Later" while buying the stock.

After 6 PM, complete the 3-step OTP confirmation on CDSL/NSDL website. You will receive intimation from IIFL Securities & CDSL for the same.

Note: After August 30, 2022, you can enter the OTP in real-time so that you do not have to wait till the end of the trading day.

Confirm the OTP to pledge BNPL stocks within two trading days. However, this step will not be required after August 30, 2022.