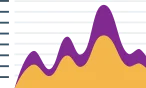

US October inflation tapers to 7.7% but MOM inflation is higher

Since March 2022, when the Fed hawkishness first manifested, the Fed has hiked rates by 375 basis points. However, till June 2022, inflation was on the ascendant, when the US consumer inflation peaked at 9.1%. Since then, the inflation has gradually tapered from 9.1% to 7.7%. While a 140 bps fall may not sound substantial, what is notable is that in October 2022, the consumer inflation was lower than the consensus street expectation.

M&M Financial Services hits upper circuit today, find why here?

Mahindra & Mahindra Financial Services (M&M Finance), which posted better-than-expected profits for the September quarter, increased by as much as 10% during early trade on Thursday.

Board of Steelcast recommends Second Interim Dividend?

Steelcast announced that the Board of Directors of the Company at its meeting held on 20 October 2022, has recommended a Second Interim dividend of Rs.1.35 per share (i.e.27%), subject to the approval of the shareholders

RBI to do pilot project on its digital currency this year

T. Rabi Sankar, the deputy governor of the Reserve Bank of India (RBI), announced on Wednesday that the central bank will introduce its digital currency as a pilot project this year.

How many Sectors are there to invest in Stock Market?

You can invest in 11 different sectors in the stock market. This type of industry categorization helps the portfolio manager create a diverse portfolio and allocate funds more efficiently.

What is nifty and sensex ?

Nifty and Sensex are benchmark index values for measuring the

overall performance of the stock market. Nifty is the Index used

by the National Stock exchange, and Sensex is the Index used by the Bombay Stock Exchange.