Weekly Capital Flows Commentary: Jan 12 – Jan 16, 2026

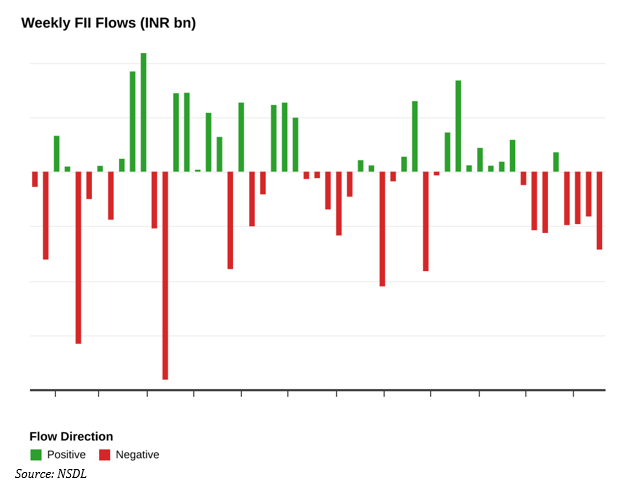

Foreign institutional sentiment remained cautious in the week ended on January 16, 2026, with net outflows widening sharply to INR 143.06 billion compared to INR 82.27 billion in the previous week, reflecting sustained risk aversion amid fragile market conditions and continued pressure across core asset classes, particularly equities and debt.

Equity Markets: Equity flows were dominated by heavy selling in the secondary market, which saw outflows of INR 121.19 billion, highlighting aggressive trimming of existing positions by investors, while the primary market recorded modest inflows of INR 5.22 billion, indicating selective participation in new issuances despite broader equity caution.

Debt and Alternative Segments: The debt segment recorded net outflows of INR 26.47 billion, reflecting continued selling pressure in fixed income, while activity in alternative segments remained muted, with mutual funds and hybrid instruments seeing marginal outflows of INR 0.49 billion and INR 0.14 billion, respectively, and AIFs posting a negligible inflow of INR 0.0062 billion.

Table:Net Investment Data (Jan 12 – Jan 16, 2026)

| Asset Class | Net Investment (INR bn) |

| Foreign_Investors | -143.063 |

| Foreign_Investors.AIF | 0.01 |

| Foreign_Investors.Debt | -26.4738 |

| Foreign_Investors.Equity | -115.9647 |

| Foreign_Investors.Equity.Primary | 5.22 |

| Foreign_Investors.Equity.Secondary | -121.1847 |

| Foreign_Investors.Hybrid | -0.14 |

| Foreign_Investors.Mutual_Fund | -0.4907 |

Source: NSDL

Table: Recent history of FPI flows

| Week Ending | Net Investment (INR bn) |

| 2026-01-16 | -143.06 |

| 2026-01-09 | -82.27 |

| 2026-01-02 | -96.41 |

| 2025-12-26 | -98.09 |

| 2025-12-19 | 35.37 |

| 2025-12-12 | -112.6 |

| 2025-12-05 | -107.49 |

| 2025-11-28 | -24.68 |

| 2025-11-21 | 58.18 |

| 2025-11-14 | 18.14 |

Source: NSDL

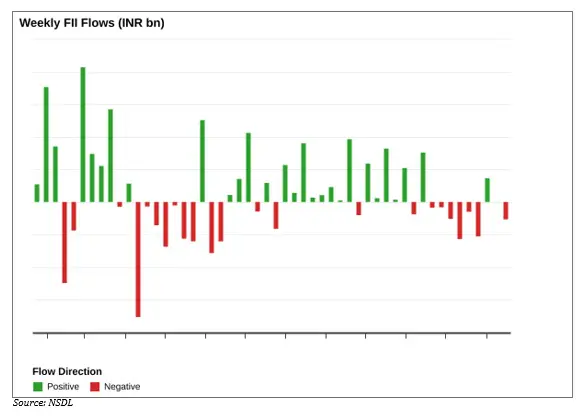

FPI flows in Equity

Foreign investor sentiment stayed weak in equities as FPIs pulled out INR 115.96 billion from Indian stocks in the week ended January 16, 2026, led by heavy selling in the secondary market worth INR 121.18 billion. The outflows intensified compared to the previous week’s net selling of INR 85.15 billion and extended the equity outflow streak to four consecutive weeks, underscoring sustained foreign investor caution toward Indian equities.

The selling pressure was driven by a shift in global capital toward developed markets such as the US, amid rising geopolitical concerns and delays in the US–India trade agreement. A weakening rupee and declining foreign allocation to India also weighed on sentiment, even as robust domestic institutional support and expectations of a strong IPO pipeline for 2026 provided partial offsets. Overall, FIIs continue to prefer higher-yielding developed market opportunities over emerging market risk at present.

Table: Recent history of FPI flows in equity

| Week Ending | Foreign_Investors.Equity | Foreign_Investors.Equity.Primary | Foreign_Investors.Equity.Secondary |

| 2026-01-16 | -115.96 | 5.22 | -121.18 |

| 2026-01-09 | -85.15 | 0.29 | -85.44 |

| 2026-01-02 | -131.65 | 1.29 | -132.94 |

| 2025-12-26 | -43.89 | 5.38 | -49.27 |

| 2025-12-19 | 58.03 | 49.69 | 8.35 |

| 2025-12-12 | -59.84 | 37.35 | -97.19 |

| 2025-12-05 | -83.47 | -17.29 | -66.18 |

| 2025-11-28 | -18.49 | 4.83 | -23.32 |

| 2025-11-21 | 53.48 | 36.72 | 16.76 |

| 2025-11-14 | -59.23 | 41.89 | -101.12 |

Source: NSDL

FPI flows in Debt

The latest weekly data shows that foreign investors turned net sellers in Indian debt, recording outflows of INR 26.47 billion in the week ended on January 16, 2026, reversing the marginal inflow of INR 0.22 billion seen in the previous week. This shift marks a return to the broader selling trend, with debt flows remaining negative in most of the past ten weeks, highlighting sustained caution toward the fixed-income segment.

The renewed selling was driven by macroeconomic pressures, including rupee depreciation, rising repatriation costs, and global trade uncertainties, alongside concerns over potential tariff-related disruptions. Investor appetite has also softened as the initial optimism around bond index inclusion has faded, with stretched valuations and an unfavourable yield differential further reducing the attractiveness of Indian debt for foreign investors.

Table: Recent history of FPI flows in debt

| Week Ending | Foreign_Investors.Debt |

| 2026-01-16 | -26.47 |

| 2026-01-09 | 0.22 |

| 2026-01-02 | 36.18 |

| 2025-12-26 | -52.67 |

| 2025-12-19 | -14.84 |

| 2025-12-12 | -56.67 |

| 2025-12-05 | -25.82 |

| 2025-11-28 | -8.03 |

| 2025-11-21 | -8.60 |

| 2025-11-14 | 75.60 |

Source: NSDL

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.