Table of Content

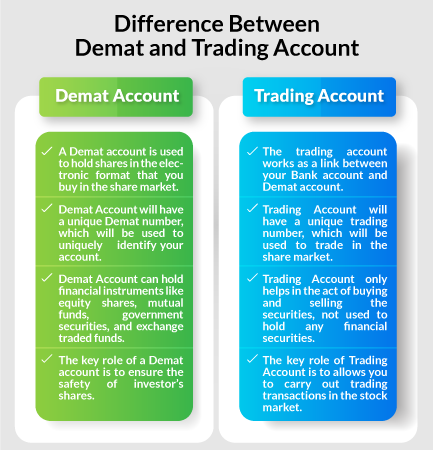

The main difference between a Demat and a trading account is that a Demat account holds shares and securities in digital mode, while a trading account provides the platform to place buy and sell orders.

Although both are important for trading in the stock market, they serve two different purposes. In this blog, we’ll delve into how these accounts work and their unique features. Let’s demystify the difference between demat and trading account.

Converting your physical shares into an electronic format is called dematerialization. Holding physical shares involves risk, and shares in the Demat Account are stored easily. Once you open a Demat account, it is also known as a dematerialized account. In other words, converting or dematerializing your physical shares into an electronic format is known as holding a Demat Account.

A trading account is used to buy/sell shares in stock markets. Once you have a Demat Account, you need a Trading Account, which has a unique trading number used to trade in shares. Once you start trading in share markets, you need three accounts: Bank/Demat/Trading Account. A Trading Account acts as a link between your bank account and Demat account, allowing you to trade in the stock markets. Having an online trading account helps you to secure access to multiple stock markets.

A demat account stores your securities in electronic form. A trading account lets you buy or sell those securities on the stock exchange, creating a seamless pipeline when linked to the electronic vault.

Investors often search online for the phrase difference between demat and trading account when starting out. Another common search is trading account vs demat account, which underscores the same comparison from the opposite angle.

| Aspect | Demat Account | Trading Account |

| Purpose | Holds shares, bonds, mutual funds, and other securities in electronic form. | Facilitates the buying and selling of securities in the stock market. |

| Functionality | Acts as a digital locker for securities. | Serves as a platform to execute trades in the stock market. |

| Connection | Linked to a trading account for seamless transfer of securities. | Linked to both a Demat and a bank account to manage transactions. |

| Role in Transactions | Stores securities bought or sold through the trading account. | Executes buy/sell orders and transfers securities to/from the Demat account. |

| Provided By | Depository participants (NSDL or CDSL agents). | Stockbrokers registered with SEBI and exchanges. |

| Examples | Securities storage for long-term investments. | Short-term trading or speculative activities. |

| Account Requirement | Mandatory for holding securities in dematerialized form. | Essential for participating in stock market transactions. |

A demat account is your electronic vault for shares. A trading account is the gateway that routes your orders to the exchange. Globally, both may be bundled together and referred to as a brokerage account.

Charges vary by broker but follow a predictable template. Most leading discount brokers waive the account-opening fee for both accounts as part of promotional drives. Where a fee is levied, it is a one-time cost. After opening, a demat account attracts an annual maintenance charge (AMC), while the trading account often carries no AMC at all. Every sell instruction from the demat ledger triggers a depository transaction fee. Separately, buy or sell orders routed through the trading platform incur brokerage and statutory levies.

| Component | Demat Account | Trading Account |

| Account Opening | Usually free; ₹200–₹500 at some brokers | Usually free; similar if charged |

| Annual Maintenance | ₹0–₹400 per year | Often zero; occasionally ₹100–₹300 |

| Transaction Fee | ₹10–₹25 per security debit | Brokerage per order (flat ₹20 or % of value) |

| Custodian | Up to ₹0.05 per ISIN monthly at a few brokers | Not applicable |

| Other Charges | Statement requests, pledge, DIS slips | Call-and-trade, platform add-ons |

Owning equities in India is a two-step process. The dematerialised ledger maintained by depositories such as NSDL or CDSL keeps your securities safe, but it cannot interact directly with an exchange’s order book. That role is performed by a linked trading handle that sits with your broker. When you hit the “Buy” button, funds move from your linked bank account to the broker, the trade is executed on the exchange, and on settlement day, the purchased shares flow into your demat ledger.

The reverse chain runs when you sell. Maintaining separate ledgers keeps the market infrastructure secure: depositories focus on safe custody, while brokers concentrate on execution, compliance checks, and risk management. Having both accounts, therefore, allows instant trading without compromising on ownership safety, lets you pledge shares for margin, and simplifies corporate-action credits such as dividends or bonus issues into the same electronic locker.

Opening the two accounts is now largely paperless and can be finished in under fifteen minutes if your KYC details are already on file. The broad sequence is as follows:

Thus, whether you need to open a trading account or a Demat account or both depends on the intended purpose.

To buy shares, you need to start by funding your trading account via NEFT/RTGS/IMPS, which could be used to buy shares.

The working of a Demat account is similar to that of a savings bank account. In a savings account, cash is stored in an electronic form, and a Demat account holds physical securities in the same way. All Demat accounts are associated with a depository participant like NSDL or CDSL. A Demat account is credited when shares are bought, and it is debited when the securities are sold.

A trading account functions as a reserve for funds used in trade activities. Money from your bank accounts needs to be transferred to a trading account to be used for buying or selling securities. Any shares not squared off during the intraday trade go for delivery in your trading account. A trading account is debited when shares are bought, and it is credited when the securities are sold.

A Demat Account is required to hold your shares in an electronic format, and to trade in stock markets, you require a trading account. Post opening, you must begin your trading journey with a thorough understanding of the market.

While trading in the share market, both a Demat and a trading account are crucial. When you buy shares of any company, you require a trading account to process the transaction. The money is debited from the trading account, and the bought shares are credited to your Demat account.

In the same way, when shares are sold, they are debited from your Demat account. The money credited in this transaction will reflect in your trading account. Therefore, to trade in the stock market, it is crucial to have both these accounts and link them through a Demat account app.

The trading account and Demat account work in tandem with each other. For trading in equity, you must have both these accounts. It is essential to pick a broker service that is suitable to your investment needs.

IIFL Capital Services Limited is your one-stop solution to trading in everything from equities and mutual funds to commodities and currencies. To learn more about opening a Demat and Trading account, reach out to our financial experts and begin your investment journey.

Ans.

Individual

Non-individual

Ans.India Infoline does not charge any account opening fee.(AMC) for 1 year. However, you will have to pay an AMC of Rs. 250 from second year onwards.

Ans.Individual beneficial owners must add a nominee while opening a Demat or trading account as this makes the process of transfer of shares much more convenient.

Ans.Yes, you can easily transfer shares from one Demat account to another. It can be done in two possible ways – manual and online.

Ans.Yes, you can open a joint Demat or trading account with India InfolineIIFL allows you to open your Demat or trading account in a single account name, multiple account names, or joint account name.

Ans. A trading account without a Demat account can only be used to trade in options or futures. If you wish to trade in equity, you must have both – Demat and Trading accounts.

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.