In the first trading week of 2026, which ended on 2 January 2026, the NIFTY 50 extended its recovery, rising 1.10%, supported by broad-based buying across heavyweight stocks. The NIFTY BANK gained 1.93%, rebounding after three consecutive weeks of declines, while the NIFTY MIDCAP SELECT advanced 1.90%, staging a technical rebound. NIFTY ENERGY also recorded a strong outperformance, surging 3.47%, reflecting renewed buying interest in power and PSU energy stocks.

Sectoral performance highlighted clear rotation. NIFTY FMCG slipped sharply by 3.72%, weighed down by heavy selling in ITC, while NIFTY AUTO built on recent consolidation, rising 3.83% amid broad-based buying. NIFTY IT declined 0.65%, extending recent weakness, whereas NIFTY PHARMA edged up marginally by 0.17%, and NIFTY REALTY recovered 1.77% (ending four weeks of declines). Overall, the gains reflected short-covering and selective buying in cyclical sectors after recent weakness, even as defensives and IT remained under pressure.

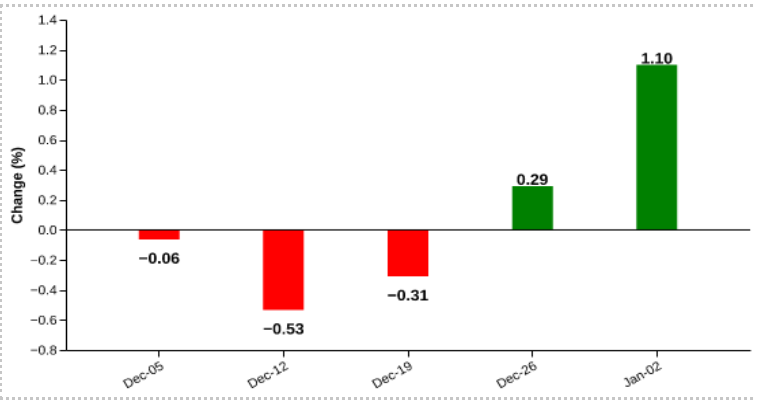

NIFTY 50 – A Strong Start to 2026

Weekly Performance: 1.1%

| date | open | high | low | close |

| 2025-12-26 | 26121.2 | 26144.2 | 26008.6 | 26042.3 |

| 2025-12-29 | 26063.3 | 26106.8 | 25920.3 | 25942.1 |

| 2025-12-30 | 25940.9 | 25976.8 | 25878.0 | 25938.8 |

| 2025-12-31 | 25971.0 | 26188.0 | 25969.0 | 26129.6 |

| 2026-01-01 | 26173.3 | 26197.5 | 26113.4 | 26146.5 |

| 2026-01-02 | 26155.1 | 26340.0 | 26118.4 | 26328.5 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY 50 rose 1.10% in the week ended 2 January 2026, extending the recovery after consecutive declines in the preceding weeks. Gains were led by Reliance Industries (+2.12%), HDFC Bank (+0.97%), NTPC (+8.64%), Mahindra & Mahindra (+3.10%), and Larsen & Toubro (+2.85%), which together contributed to the index’s upside. However, the move was partially capped by sharp weakness in ITC (-13.39%), along with declines in Infosys (-1.42%), TCS (-1.18%), HCL Technologies (-1.05%), and Bajaj Finance (-0.96%), which collectively weighed on the index. Market breadth was strong, with 40 stocks advancing against 10 declining.

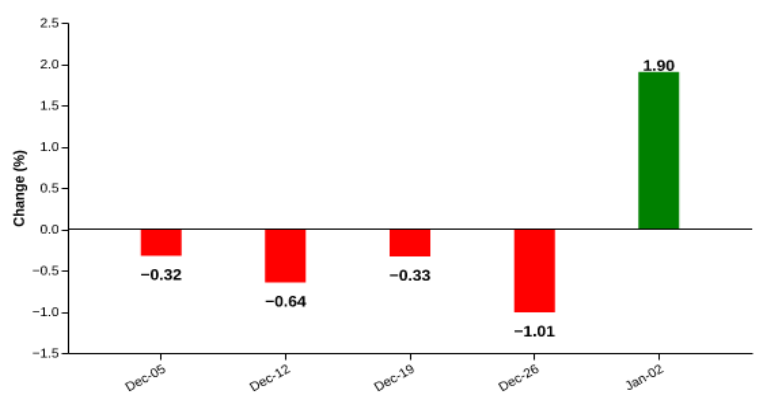

NIFTY MIDCAP SELECT – Weekly Rebound Breaks Four-Week Losing Run

Weekly Performance: 1.9%

| date | open | high | low | close |

| 2025-12-26 | 13809.0 | 13876.1 | 13708.5 | 13722.9 |

| 2025-12-29 | 13742.2 | 13772.5 | 13634.5 | 13651.5 |

| 2025-12-30 | 13649.4 | 13664.5 | 13579.3 | 13601.4 |

| 2025-12-31 | 13644.4 | 13821.9 | 13641.2 | 13777.2 |

| 2026-01-01 | 13809.9 | 13852.4 | 13729.2 | 13843.6 |

| 2026-01-02 | 13884.3 | 13995.4 | 13847.0 | 13984.0 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY MIDCAP SELECT index gained 1.90% in the week ended 2 January 2026, recovering after four consecutive weeks of declines. The rebound was driven by renewed buying interest across select mid-cap stocks. Gains were led by Ashok Leyland (+8.07%), along with Indus Towers, Hindustan Petroleum, BHEL, and Yes Bank, which together contributed to the index’s upside. However, the advance was partly capped by PolicyBazaar (-6.68%), while Max Health, Coforge, Dixon, and SRF also saw modest declines, collectively weighing on the index. Market breadth was positive, with 15 stocks advancing against 10 declining.

NIFTY IT – Weekly Decline Persists Amid Heavyweight Selling

Weekly Performance: -0.7%

| date | open | high | low | close |

| 2025-12-26 | 38921.6 | 39019.9 | 38495.4 | 38572.3 |

| 2025-12-29 | 38622.6 | 38721.7 | 38206.8 | 38282.7 |

| 2025-12-30 | 38281.6 | 38281.6 | 37906.6 | 37998.6 |

| 2025-12-31 | 38051.7 | 38108.5 | 37822.1 | 37884.1 |

| 2026-01-01 | 37884.1 | 37884.1 | 37884.1 | 37884.1 |

| 2026-01-02 | 38251.4 | 38359.0 | 38085.4 | 38320.3 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY IT index fell 0.65% in the week ended 2 January 2026, extending recent weakness after a brief rebound in mid-December. Losses were led by Infosys (-1.6%), Tata Consultancy Services (-1.3%), HCL Technologies (-1.2%), Coforge (-1.4%), and Mphasis (-1.1%), which together weighed on the index. Limited support came from Wipro (+0.9%) and L&T Infotech (+0.6%), though these gains were insufficient to offset pressure from heavyweight constituents. Market breadth was weak, with 2 stocks advancing against 8 declining.

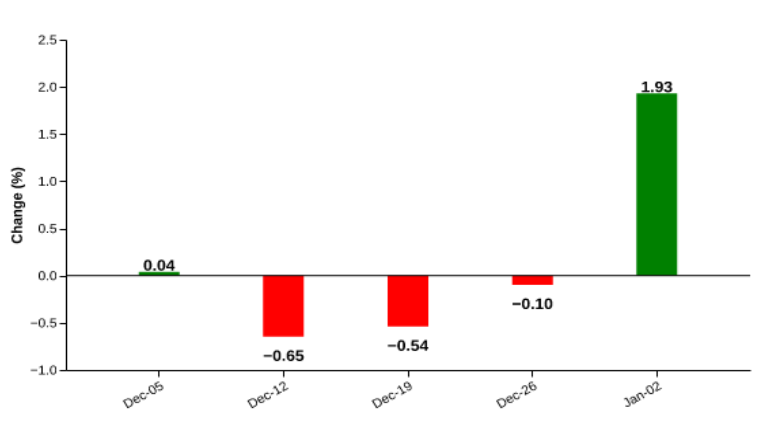

NIFTY BANK – Sharp Weekly Rally Follows Multi-Week Decline

Weekly Performance: 1.9%

| date | open | high | low | close |

| 2025-12-26 | 59092.9 | 59180.6 | 58947.1 | 59011.4 |

| 2025-12-29 | 59007.1 | 59140.4 | 58809.6 | 58932.4 |

| 2025-12-30 | 58885.9 | 59272.7 | 58737.6 | 59171.2 |

| 2025-12-31 | 59194.6 | 59766.2 | 59187.1 | 59581.9 |

| 2026-01-01 | 59581.9 | 59581.9 | 59581.9 | 59581.9 |

| 2026-01-02 | 59757.4 | 60203.8 | 59738.2 | 60150.9 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY BANK index advanced 1.93% in the week ended 2 January 2026, ending three weeks of decline. The upside was driven by strong gains in State Bank of India (+4.6%), Axis Bank (+3.9%), IndusInd Bank (+3.5%), Bank of Baroda (+3.2%), and HDFC Bank (+1.8%), which together anchored the weekly move. Other stocks, including ICICI Bank (+1.2%) and IDFC First Bank (+1.0%), also contributed positively. Market breadth was exceptionally strong, with all 12 constituents advancing and no declines.

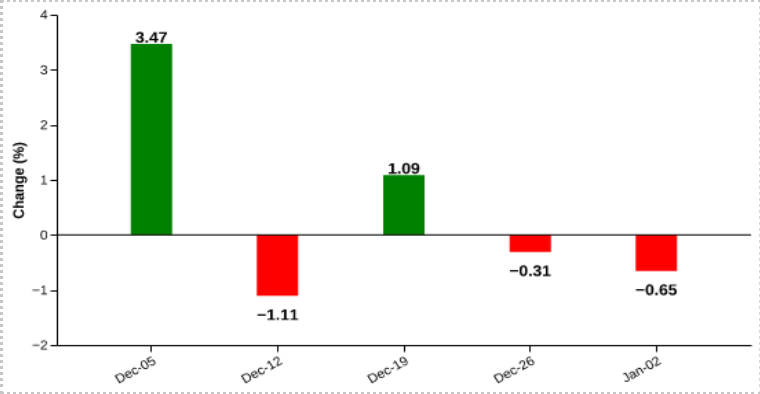

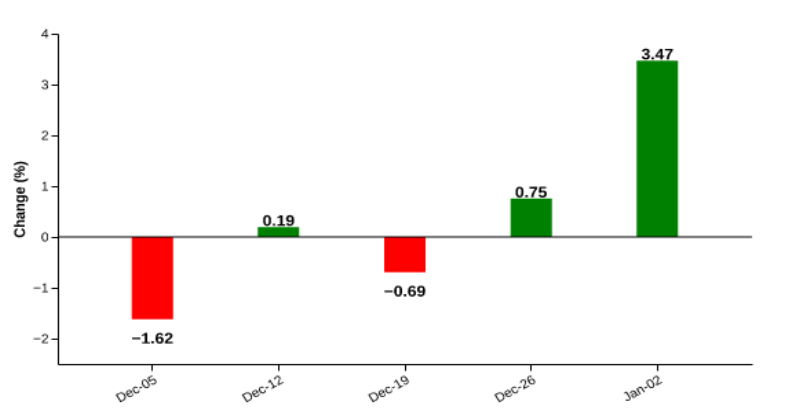

NIFTY ENERGY – Sector Leads with Strong Weekly Outperformance

Weekly Performance: 3.5%

| date | open | high | low | close |

| 2025-12-26 | 35101.4 | 35296.2 | 35007.9 | 35058.8 |

| 2025-12-29 | 35096.6 | 35129.2 | 34808.9 | 34868.8 |

| 2025-12-30 | 34872.8 | 34911.3 | 34702.0 | 34813.9 |

| 2025-12-31 | 34833.2 | 35409.4 | 34827.1 | 35325.6 |

| 2026-01-01 | 35325.6 | 35325.6 | 35325.6 | 35325.6 |

| 2026-01-02 | 35559.5 | 36306.8 | 35540.9 | 36275.6 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY ENERGY index rose 3.47% in the week ended 2 January 2026, supported by broad-based buying after mixed performance in recent weeks. The rally was supported by Coal India (+6.4%), NTPC (+8.6%), ONGC (+3.0%), Reliance Industries (+2.1%), and BHEL (+6.4%), which together anchored the advance. Additional strength was seen in SJVN (+12.0%), Gujarat Gas (+10.7%), NLC India (+8.8%), and GSPL (+7.9%), while Reliance Power, Castrol India, CG Power, and Siemens weighed modestly. Market breadth was strong, with 35 stocks advancing against 5 declining.

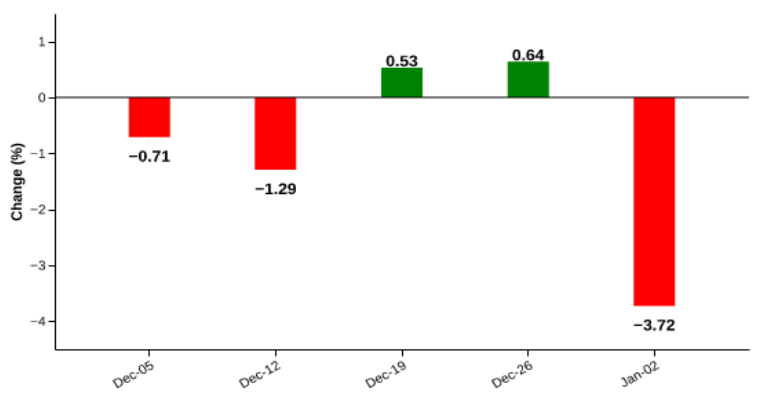

NIFTY FMCG – Sharp Weekly Fall Driven by ITC Sell-off

Weekly Performance: -3.7%

| date | open | high | low | close |

| 2025-12-26 | 55083.9 | 55233.4 | 54957.2 | 55132.1 |

| 2025-12-29 | 55143.2 | 55227.1 | 54969.4 | 55192.4 |

| 2025-12-30 | 55231.4 | 55246.9 | 54918.6 | 55033.1 |

| 2025-12-31 | 55069.0 | 55559.1 | 55055.1 | 55475.6 |

| 2026-01-01 | 55475.6 | 55475.6 | 55475.6 | 55475.6 |

| 2026-01-02 | 53562.5 | 53579.4 | 52741.9 | 53078.8 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY FMCG index declined sharply by 3.72% in the week ended 2 January 2026, reversing gains from the previous two weeks. The weakness was driven primarily by ITC (-13.4%), whose sharp fall weighed heavily on the index due to its large weight. Heavy tobacco tax was the key reason for ITC’s fall with many downgrades following the announcement. Gains in Hindustan Unilever (+2.1%), Dabur (+1.8%), and Godrej Consumer Products (+2.4%) provided partial support but were insufficient to offset the drag. Market breadth remained positive, with 9 stocks advancing against 6 declining.

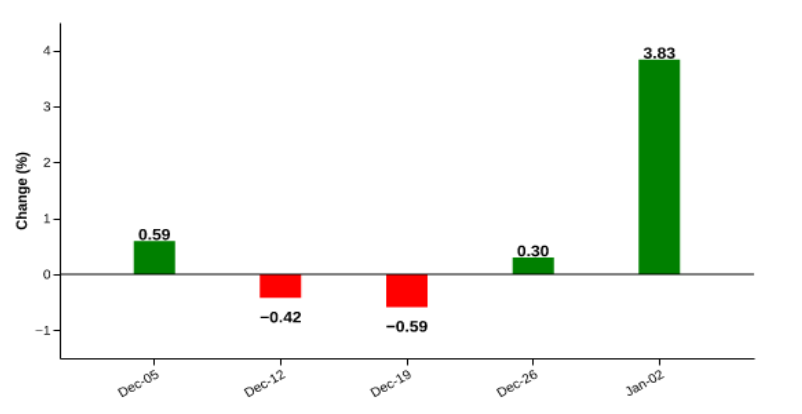

NIFTY AUTO – Strong Weekly Rally Fueled by Auto Leaders

Weekly Performance: 3.8%

| date | open | high | low | close |

| 2025-12-26 | 27881.0 | 27959.2 | 27683.3 | 27739.8 |

| 2025-12-29 | 27738.9 | 27833.7 | 27561.7 | 27592.5 |

| 2025-12-30 | 27595.1 | 27991.8 | 27516.8 | 27889.7 |

| 2025-12-31 | 27901.9 | 28226.8 | 27858.7 | 28189.6 |

| 2026-01-01 | 28189.6 | 28189.6 | 28189.6 | 28189.6 |

| 2026-01-02 | 28548.2 | 28867.1 | 28486.6 | 28803.7 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY AUTO index rose 3.83% in the week ended 2 January 2026, delivering its strongest weekly gain in the past five weeks after two consecutive weekly declines. The rally was led by heavyweight stocks, Mahindra & Mahindra (+4.95%), Bajaj Auto (+4.80%), TVS Motor (+5.99%), Maruti Suzuki (+2.19%), and Hero MotoCorp (+5.25%), which together anchored the advance. Additional strength was seen in Bosch (+9.94%) and Ashok Leyland (+8.07%), while TI India (-0.12%) and a few others lagged marginally. Market breadth was strong, with 13 stocks advancing against 1 declining.

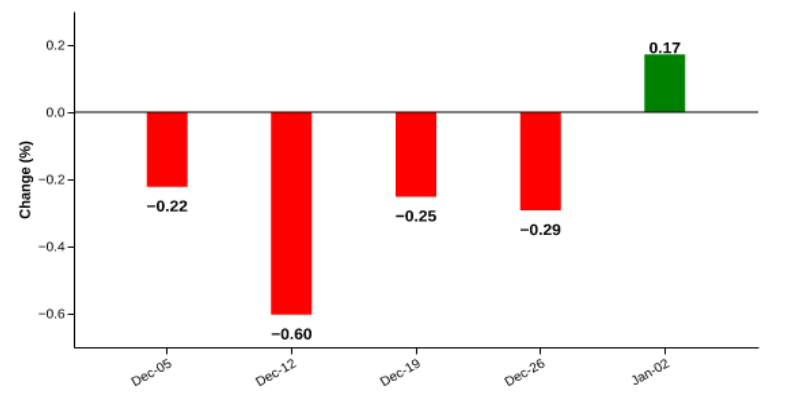

NIFTY PHARMA – A Small rebound ends fourweek slide

Weekly Performance: 0.2%

| date | open | high | low | close |

| 2025-12-26 | 22761.9 | 22807.9 | 22631.6 | 22684.7 |

| 2025-12-29 | 22697.2 | 22721.2 | 22552.6 | 22578.3 |

| 2025-12-30 | 22604.5 | 22615.9 | 22395.2 | 22540.1 |

| 2025-12-31 | 22620.7 | 22765.7 | 22536.4 | 22723.7 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY PHARMA index inched up 0.17% in the week ended 2 January 2026, snapping a four-week run of declines. Gains were led by Ajanta Pharma (+9.9%), with support from Sun Pharmaceutical Industries (+0.5%), Torrent Pharmaceuticals (+1.8%), Glenmark Pharmaceuticals (+2.7%), and Gland Pharma (+3.8%). However, declines in Dr. Reddy’s Laboratories (-1.0%), along with Ipca Laboratories, Divi’s Laboratories, Abbott India, and Lupin, capped the upside. Market breadth was mildly positive, with 12 stocks advancing against 8 declining.

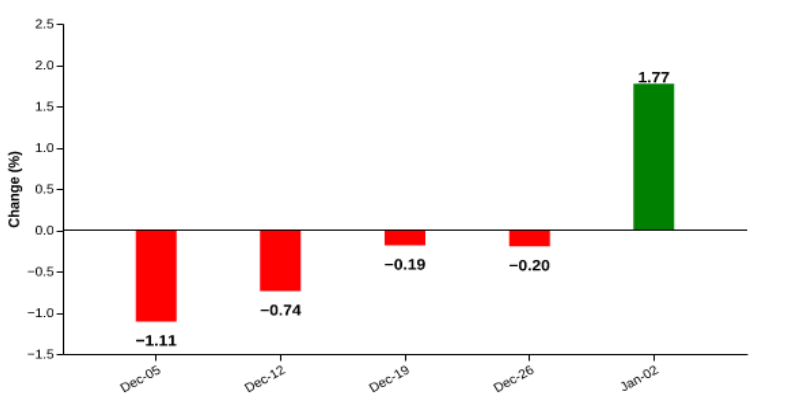

NIFTY REALTY – Strong Reversal on RealEstate Rally

Weekly Performance: 1.8%

| date | open | high | low | close |

| 2025-12-26 | 883.5 | 889.3 | 880.0 | 883.1 |

| 2025-12-29 | 883.9 | 886.2 | 875.0 | 877.2 |

| 2025-12-30 | 876.0 | 876.1 | 865.7 | 869.8 |

| 2025-12-31 | 871.4 | 881.5 | 869.2 | 878.0 |

| 2026-01-01 | 879.9 | 886.5 | 874.1 | 885.3 |

| 2026-01-02 | 886.5 | 899.8 | 884.9 | 898.8 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY REALTY index rose 1.77% in the week ended 2 January 2026, recovering after four consecutive weeks of declines. The advance was supported by Godrej Properties (+3.29%), Phoenix Mills (+2.86%), and Oberoi Realty (+2.94%), which together provided strong support to the index. Additional strength was seen in Anant Raj (+5.30%) and Lodha Group, while DLF (+0.46%) added incremental support. Market breadth was strong, with all 10 stocks advancing.

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.