Forex Reserves are back above USD 690 bn, Credit Growth dips further:

India’s forex reserves increased sharply to USD 693bn on strong increase (USD 5bn) in Foreign Currency Assets Component. This is the highest level of reserves YTD. The keenly watched credit growth was released. Credit growth dipped further below 10%. Deposit growth had also dipped below 10%.

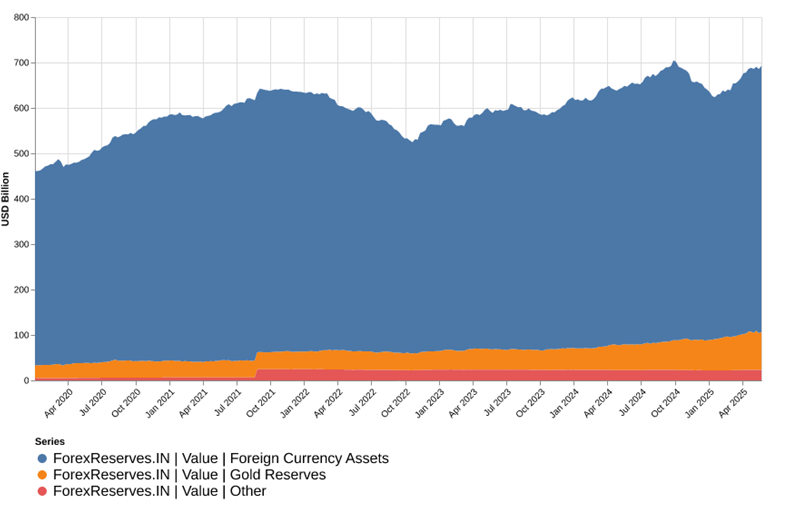

A sharp buildup in forex reserves:

As per the latest RBI data, India’s forex reserves increased by USD 7 bn week over week to USD 693 bn. The rise is mostly due to increase in foreign currency assets. Foreign currency assets are the largest component in forex reserves and contribute to more than 80%. They were up USD 4.5bn during the week ended 23 May 2025 and contributed substantially to the gains.

Gold reserves had also increased by USD 2.4bn and contributed partially to the gains. Gold price had witnessed a sharp increase in the week of 23rd May (5%). As such, the increase in gold reserves is almost entirely due to the appreciation in the value of gold. The share of gold in forex reserves has increased due to its sharp appreciation of the past 1 year. In 2025, while gold accounts for only 12% of total reserves, it contributed to 25% of incremental reserves.

Figure: Gold Bounced Back. Foreign Currency Assets Increase Sharply

Source: RBI

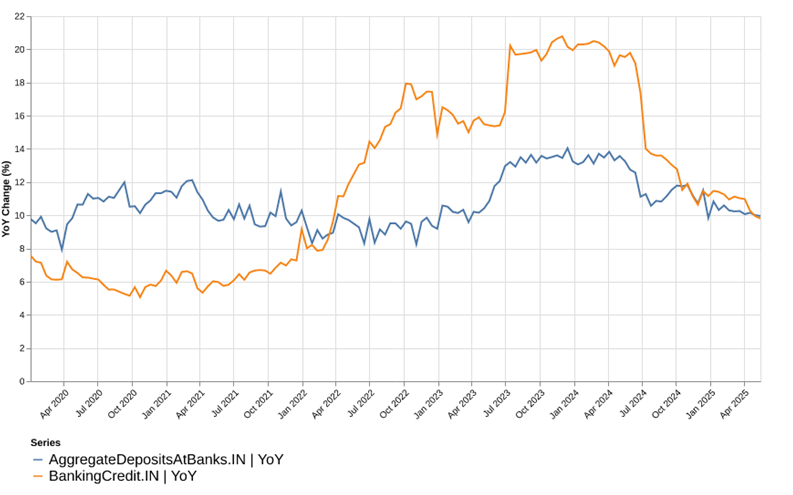

Credit Growth Continues to Dip. Deposit growth also moderates to below 10%:

In the latest instalment of fortnightly credit growth data, banking credit shows a further deterioration. For the first time in three years, banking credit growth had dipped below 10% in early May. The latest credit growth data shows that it has dipped further to 9.8% (from 9.9%).

While the RBI has lowered the repo rate, transmission of lower interest rates takes time. Most of the banks are yet to lower their lending rates to the extent of repo rate cuts. As bank transmission improves, credit growth trends will also likely improve.

One of the reasons for the sharp fall in credit growth has also been a moderation after the excessively “hot” conditions seen over the last year. During 2024, banking credit had jumped 20% on a year-on-year basis, supported by strong demand from corporates, retail borrowers as well as from services sector. The high pace was unsustainable and carried risks of asset quality deterioration and overheating in pockets of the economy.

A slowdown in both retail and corporate credit resulted in the slowdown. A variety of factors including tighter norms for NBFC credit and unsecured retail credit (credit cards, personal loans etc) are being attributed to. While a moderation was expected, the sharp fall is increasingly a cause for worry.

Figure: Credit Growth had dipped to a 3-year low. Slower than deposit growth now

Source: RBI

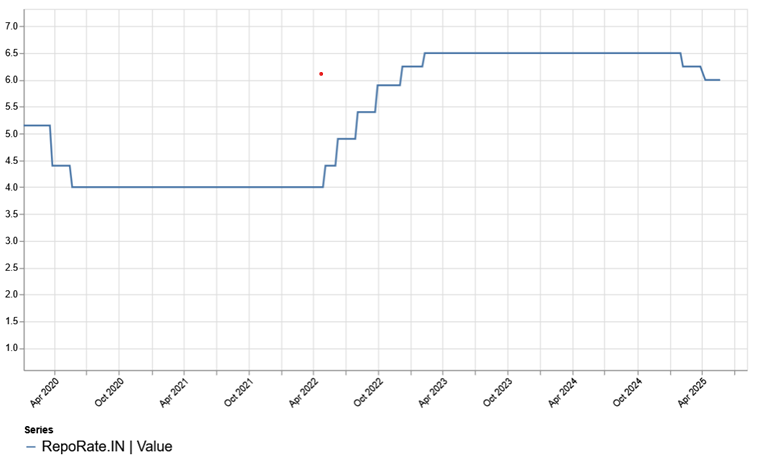

RBI’s Repo Rate Cut: A Pro-Active Move That Is Yet to Stimulate Growth

After having maintained the benchmark policy interest rate (repo rate) at 6.5% for more than a year, Reserve Bank of India (RBI) had cut the benchmark rates in 2025. The RBI has cut the rate twice so far in 2025. After the latest cut in April, the repo rate is 6%. The move signals a shift in RBI’s monetary policy from ‘Neutral’ to ‘Accommodative’. In light of slowing credit growth and macroeconomic uncertainties, RBI has been proactive with its policy tools to offer support. Given the sharp fall in credit growth, further repo rate cuts cannot be ruled out.

Figure: Repo Rate is coming off and policy stance is turning accommodative

Source: RBI

What is Repo Rate – A Primer

The repo rate is the rate at which the RBI lends to commercial banks. A lower rate of interest reduces the cost of borrowing for banks and can ultimately mean lower interest rates for loans to consumers and businesses. It is the primary device employed by the RBI to manage the economic activity in the country.

Goals behind a cut in the Repo Rate

Encouraging Credit Demand: By making borrowing cheaper, it encourages households, firms to borrow and spend on consumption and investment goods. That can be particularly good for rate sensitive areas like housing, auto and small business.

Boosting The Economy: Economists say Reserve Bank of India’s cut will help lift economic activity by bringing down the cost of spending and investment.

Inflation Management: The RBI’s move to reduce the repo rate comes against the backdrop of inflation moderating particularly in food prices. Retail inflation dropped, giving the central bank a room to have a more accommodative stance without actually contravening its inflation targets.

Boost Liquidity: The rate reduction is combined with steps to provide liquidity to the banking system, so banks have the required cash to lend more money.

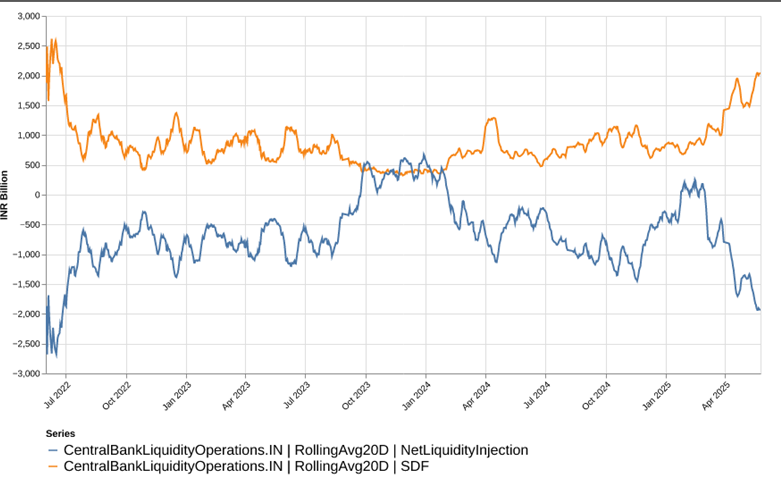

SDF Balances Have Increase Again:

As per RBI’s latest release, SDF balances have increased to their highest level in the year. A rapid acceleration in the RBI’s daily SDF started in April 2025. In April 2025, 20D average SDF utilization has increased to nearly INR 2 trn – a high not seen since 2022. This rise resulted in overall liquidity conditions tightening after the improving conditions witnessed during the early part of 2025. Subsequently, they had moderated to less than INR 1trn in the 3rd week of April. However, an analysis of recent data, shows that they have increased again and have crossed INR 2trn.

Figure: SDF utilization continues to be high

Source: RBI

What is SDF – A Primer

The SDF is a non-collateralised instrument which the banks can use for parking their surplus funds at the RBI and earn interest at a slightly lower rate than the repo. It was implemented in April 2022 as a cleaner and more efficient alternative to the conventional reverse repo.

Unlike reverse repo, the SDF does not mandate the RBI to transfer government securities as collateral, making it a more efficient tool to absorb liquidity. This has now become the de-facto floor of the RBI’s LAF corridor.

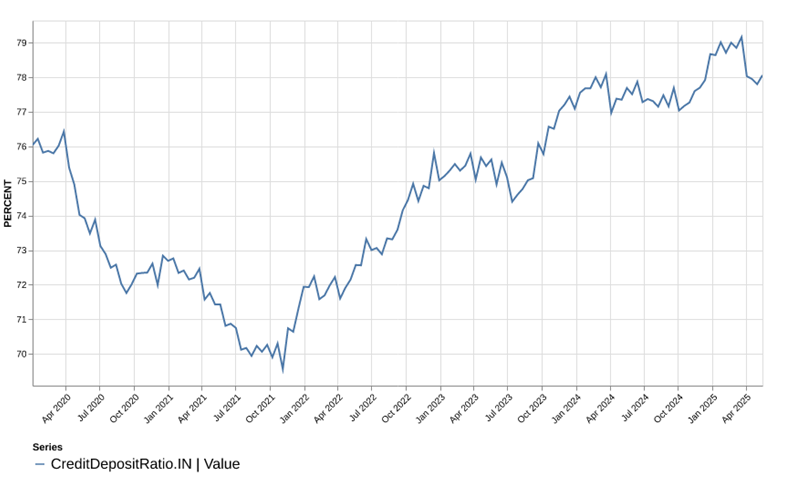

Credit Deposit Ratio – No longer a worry:

Not too long ago, credit deposit ratio was a closely watched metric as banks competed to raise deposits to meet the strong credit growth. However, the narrative on liquidity in banking has changed significantly. As credit growth slowed, banks are no longer worried about tight liquidity conditions.

As per latest RBI data, CDR has moderated from its recent peak to ~78%. A moderating CDR indicates either the relative pace of credit slowed, or deposits picked up or a combination of both happened. A closer look at the net liquidity in the system indicates that the banks parked excess funds in low interest earnings SDF facilities as the demand for credit moderated.

Figure: Credit Deposit Ratio Drops

Source: RBI

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.