Business Wire India

Taiyo Pacific Partners (TPP) is excited to announce it has formed a partnership and will become a part of the Yamauchi No.10 Family Office (YFO). The Yamauchi family famously started and built up the global gaming giant Nintendo. Dedicated to creativity, pushing boundaries, and proactively investing in Japan, YFO and TPP found a common bond to build on and expect to grow the Taiyo business through this unique tie-up.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220207005983/en/

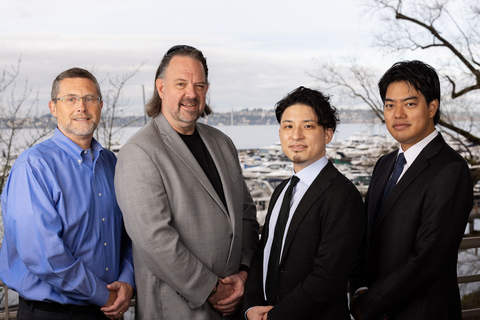

From L to R: Michael A. King, Brian K. Heywood, Banjo Yamauchi, Hirowaka Murakami (Photo: Business Wire)

Brian K. Heywood will be joined by Hirowaka Murakami from YFO in the role of Co-CEO while Michael A. King will remain as CIO of Taiyo Pacific Partners. Michael King noted, “We expect to maintain the focus and tight knit team that has driven our success in the past. While there will not be any significant changes to our style, we have always looked for new ways to innovate and improve and we expect this partnership to bring out the best in both firms.”

Hirowaka Murakami stated that “YFO had been looking for a partner focused on working with and improving the many legacy companies in Japan. We have always challenged traditions and have supported challengers who are passionate about improving the lives of people around the world with innovative technologies for a better future. We have globally developed partnerships to nurture and expand the growth of young venture talent, and the partnership with TPP will further help us expand our reach to the mature public and private markets, and enable us to provide a higher level of support to those who challenge such markets.” He added, “We are very focused on ensuring that the spark of creativity never dies in Japan. TPP will play an important role in our efforts to fulfill our obligation of passing down Yamauchi’s legacy – the fortune, philosophy, and assets – to achieve an innovative and enduring society.”

“The most dramatic and game-changing transformations in Japan have historically come when dynamic outside forces team up with domestically respected innovators,” commented Brian Heywood. “To us, TPP and YFO feel like the perfect marriage needed to spark change and rejuvenate the market. We are excited to integrate the creative DNA of the founders of Nintendo into the unique investment process developed at Taiyo.” He also noted, “The ancient Japanese tradition of Tokowaka, or perpetual renewal, involves a form of creative restructuring every 20 years. We have been preaching this concept to Japanese companies and as we approach our 20th year it seemed appropriate that we practice what we have been preaching. We are hopeful that the integration of TPP and YFO will make Taiyo a more exciting place for our employees, provide even better returns for our investors, and make a meaningful impact on Japan and India. “

Taiyo Pacific Partners, located in Kirkland, Washington, was founded in 2003 by Asia-focused professionals dedicated to friendly shareholder activism in Japan and India. The firm currently manages over $3.7 billion in Japan and India-focused funds. All strategies employ a friendly engagement approach.

Yamauchi No.10 Family Office, located in Tokyo, is a Family Office established by the founding family of Nintendo. Its mission of “Dream. Leap. Live.” is a philosophy embedded in the Yamauchi family since 1889. YFO is dedicated to continuous and sustainable philanthropy and incubation. With a portfolio of global public and private investments YFO seeks to support talent and management who creatively challenge tradition.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220207005983/en/

![]()

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.