1 Jun 2022 , 12:52 PM

Business Wire India

Green hydrogen is key to achieving a circular economy. Graforce has developed a plasma electrolysis technology that can produce hydrogen from residual materials – with significantly lower manufacturing costs and higher yields. Graforce will be demonstrating its marketable methane and wastewater electrolysis plants and refueling systems at IFAT, the world’s leading trade fair for water, sewage and waste management. They demonstrate the immense market potential of green hydrogen and the range of applications for CO2-free or even CO2-negative energy and fuel.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220525005029/en/

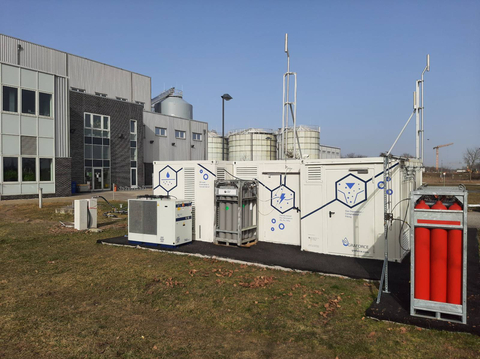

Graforce plasma electrolysis plants (here a plant in Berlin) produce green hydrogen from methane, wastewater, liquid manure or ammonia. Whereas water electrolysis needs 50kWh/kg H2, the production of 1kg hydrogen from methane takes only 10kWh or 20kWh from wastewater. (Photo: Graforce)

Green hydrogen is projected to have a game changing impact in the mobility, industry, and decentralized energy segments. It plays an important role in meeting global climate goals. The global hydrogen market is forecast to grow by a factor of 6 by 2050. Germany makes up 20 percent of the current European hydrogen consumption and is also forecast to remain the largest hydrogen off-take market in the EU, driven by strong decarbonization commitments across sectors.

The production of hydrogen using plasma electrolysis requires considerably less energy than water electrolysis and leads to significant cost reductions. Whereas water electrolysis needs 50kWh/kg H2, the production of 1kg hydrogen from methane takes only 10kWh or 20kWh from wastewater.

“Whether as fuel, heat source or a raw material, green hydrogen can make a significant contribution to achieving climate targets in many industries,” explains Dr. Jens Hanke. “Our plants produce green hydrogen from methane, wastewater, liquid manure or ammonia. We thus close energy and material cycles and make a significant contribution to a future without fossil fuels and CO2 emissions. And we deliver this quickly and cost-effectively."

For the development and customer-specific scaling of its modular plants, Graforce works with global leaders in the fields of engineering, procurement, and construction. The company is currently in the process of expanding its strategic partnerships with financial as well as strategic investors to quickly scale its technology worldwide.

About

The German company Graforce is a technology leader in sustainable solutions and carbon dioxide removal technologies. The power-to-X plants produce CO2-free or CO2-negative hydrogen and synthetic feedstocks – with the highest efficiency and lower infrastructure costs in the multi-megawatt range. Thus, Graforce decarbonizes fossil energies, industrial sectors and the heat, transport and building sectors. www.graforce.com/EN

View source version on businesswire.com: https://www.businesswire.com/news/home/20220525005029/en/

![]()

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Securities Support WhatsApp Number

IIFL Securities Support WhatsApp Number

+91 9892691696

www.indiainfoline.com is part of the IIFL Group, a leading financial services player and a diversified NBFC. The site provides comprehensive and real time information on Indian corporates, sectors, financial markets and economy. On the site we feature industry and political leaders, entrepreneurs, and trend setters. The research, personal finance and market tutorial sections are widely followed by students, academia, corporates and investors among others.

Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.