Business Wire India

Nexign, a leading provider of BSS and digitalization solutions, announces that its article has been included in TM Forum’s benchmark report “Telco Revenue Growth: Taking It to the Next Level”. The report investigates the primary sectors and services affecting communications service providers (CSPs) and the areas of growth and decline. It draws on research collected from 33 of the world’s largest operators and serves as a source of valuable information about factors influencing successful telco-to-techco transformation.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220930005236/en/

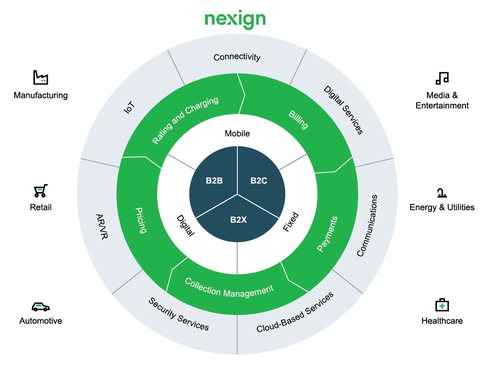

Nexign’s Article Included in TM Forum’s Benchmark Report (Photo: Business Wire)

Nexign’s article “Harnessing Traditional and New Revenue Streams on Track to Maturity: Harmonization of the BSS Core” discusses key challenges faced by modern CSPs while shifting beyond traditional communications and exploring vertical markets. The authors state that operators rolling out next-generation services have to manage multiple siloed systems, but this process is complicated and negatively affects customer billing experience. According to the article, CSPs can successfully tap into new revenue sources by implementing a holistic and synergetic BSS and ensuring a convergent user experience. They should increase flexibility at the core BSS layer by internalizing the Open Digital Architecture and 5G and providing network-agnostic convergence.

The article also discusses Nexign’s new cloud-native, microservices-based solution designed to help operators overcome these challenges and harmonize all revenue sources on a single convergent platform. Nexign Revenue Management lets CSPs get unlimited flexibility to capitalize on emerging monetization models and services beyond connectivity while balancing operational efficiency in the increasingly complex environment. It also covers the entire revenue management process and is ready to work with any telecom services, digital subscriptions, or third-party products and bundles.

TM Forum’s benchmark report was released during Digital Transformation World 2022, an annual international conference dedicated to the latest trends and achievements in the telecommunications industry.

A complete version of Nexign’s article “Harnessing Traditional and New Revenue Streams on Track to Maturity: Harmonization of the BSS Core” is available at the link.

About Nexign:

Over 30 years in the market, Nexign has been supporting digital transformation of businesses around the globe. The company offers convergent BSS systems for telecom operators and cutting-edge solutions designed to advance employee experience management and enable digital ecosystems. We strive to strengthen partnerships with our clients by offering them innovative products based on state-of-the-art technologies and extensive expertise in the field of IT and telecommunications. For more information, visit: www.nexign.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220930005236/en/

![]()

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.