Pension Account for retirement savings

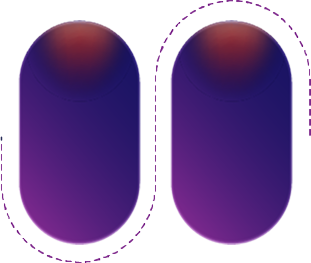

Mandatory to open in order to join NPS

Withdrawal from this account is conditional

Tax deduction can be claimed on investment

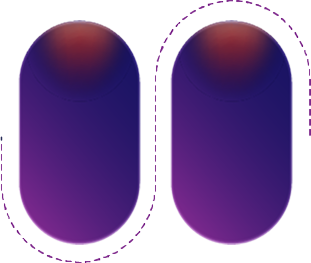

Investment Account for emergency needs

No tax deduction available on Investment

Optional for Customer. It can be opened later as well

Withdrawal from this account is permitted any time

Tier I

Pension Account for retirement savings

Mandatory to open in order to join NPS

Withdrawal from this account is conditional

Tax deduction can be claimed on investment

Tier II

Investment Account for emergency needs

No tax deduction available on Investment

Optional for Customer. It can be opened later as well

Withdrawal from this account is permitted any time

Subscribers choose from Equity and Fixed Income funds to grow savings

Its administered and regulated by Pension Fund Regulatory and Development Authority (PFRDA)

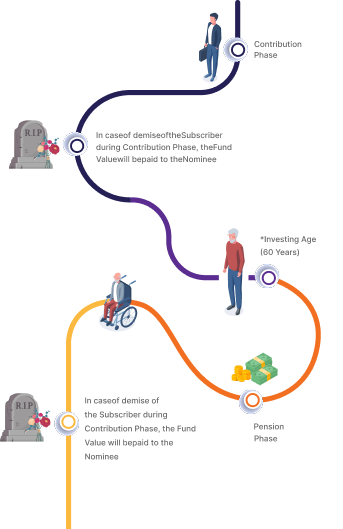

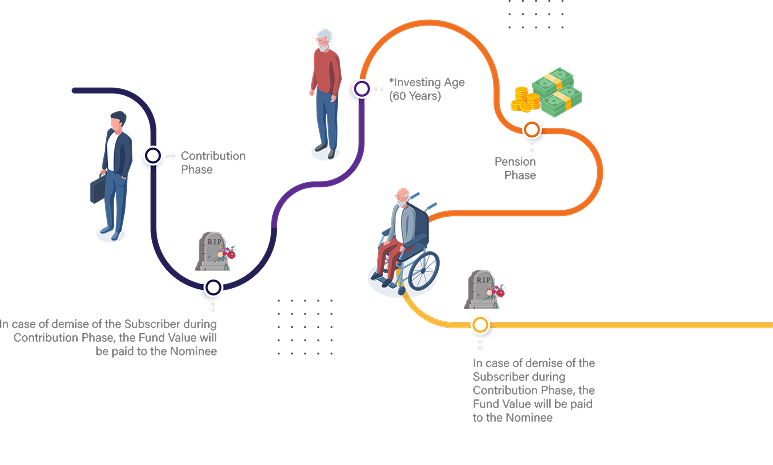

Allows regular contribution to a pension fund during working life

On retirement, a part of the corpus can be withdrawn in lump sum

Balance corpus is invested in an annuity plan to secure regular income

National Pension System is a pension system introduced and driven by Government of India from 2004.

Low cost on investment

Fully portable across jobs and locations

Low cost on investment

Fully portable across jobs and locations

Low cost on investment

Fully portable across jobs and locations

Online accessibility of account details

Flexible Contribution and withdrawal option

Total Payment

₹ 0

Total Amount Invested

Total Corpus Accumulated

Lumpsum Withdrawal

Amount used for Annuity Purchase

Monthly Pension generated annually before taxes

Tax Benefits

| For Salaried Individuals | ||

|---|---|---|

| Category | Section | Investment Limit |

| Additional Contribution | 80 CCD (1B) | 50,000 |

| Own Contribution | 80 CCD (1) | 10% of Salary (upto 1.5 lakh)* |

| Employer Contribution | 80 CCD(2) | 10% of Salary (upto 7.5 lakh)# |

| For Self Employed Individuals | ||

|---|---|---|

| Category | Section | Investment Limit |

| Own Contribution | 80 CCD (1) | 20% of Gross Annual Income (upto 1.5 lakh)* |

| Additional Contribution | 80 CCD (1B) | 50,000 |

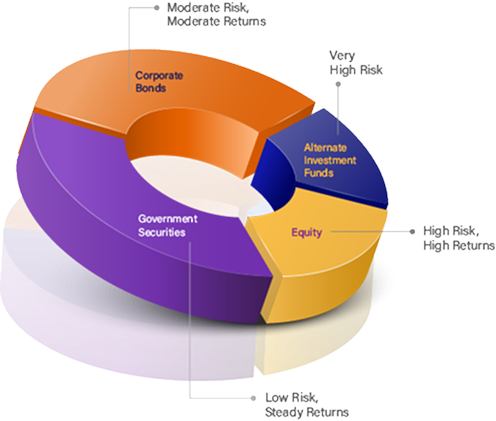

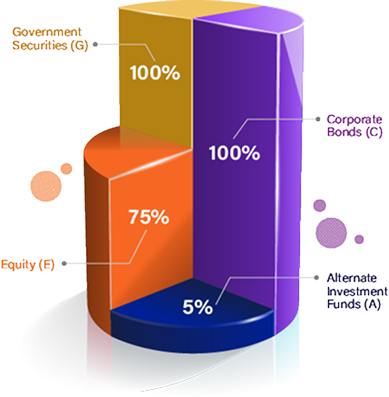

| Asset Class | Cap on Investment |

|---|---|

| Equity (E) | 75%* |

| Corporate Bonds (C) | 100% |

| Government Securities (G) | 100% |

| Alternate Investment Funds (A) | 5% |

| Asset Class | Cap on Investment |

|---|---|

| Equity (E) | 75%* |

| Corporate Bonds (C) | 100% |

| Government Securities (G) | 100% |

| Alternate Investment Funds (A) | 5% |

*Equity is capped at max 75%

*A is capped at max 5%

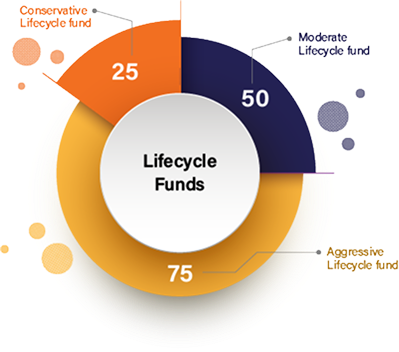

Funds are managed as per pre-defined pattern depending on the age of the subscriber. Also known as Lifecycle fund

Funds are managed as per pre-defined pattern depending on the age of the subscriber. Also known as Lifecycle fund

Below are Three Lifecycle funds under Auto Choice

Subscriber can switch between Investment Pattern and asset classes twice times in a year

The charge structure for PoPs under NPS (All Citizen and Corporate) are as below:

| Intermediary | Service | Charges | Method of Deduction |

|---|---|---|---|

| POP | (i) Initial Subscriber Registration | Upto maximum ₹400/- | To be collected upfront |

| (i) Initial Contribution | Upto 0.50% of the contribution, subject to maximum ₹25000/- | ||

| (ii) All Subsequent Contribution | |||

| (iv) All Non-Financial Transaction | Upto maximum ₹30/- | ||

| (v) Persistency* | ₹50/- p.a. for annual contribution ₹1000/ to ₹2999/- ₹75/- p.a. for annual contribution ₹3000/ to ₹6000/- ₹100/- p.a. for annual contribution above ₹6000/- (Only for NPS All Citizen model) | Through cancellation of units | |

| (vi) e-NPS (for subsequent contribution) | Upto 0.20% of the contribution, subject to maximum ₹10,000/- (Only for NPS All Citizen and Tier - II Accounts) | To be collected upfront | |

| (vii) Trail commission for D-Remit Contributions | Upto 0.20% of the contribution subject to maximum ₹ 10,000/- (Only for NPS All Citizen and Tier - II Accounts) | Through unit deduction on periodical basis | |

| (viii) Processing of Exit/Withdrawal | Upto 0.125% of Corpus subject to maximum ₹500/- | To be collected upfront | |

| *1. Persistency charges is payable to such POPs to which the subscriber is associated for more than six months in a financial year. 2. Minimum contribution per transaction is ₹500/- and minimum annual contribution is ₹1000/- 3. GST or other taxes as applicable, shall be additional. | |||

Central Record Keeping Agency (CRA) Charges

| Charge Head | NSDL | KFintech | Frequency of deduction | Mode of deduction |

|---|---|---|---|---|

| PRAN Generation | ₹40.00 | ₹39.36 | One time | |

| Annual Maintenance | ₹69.00 | ₹57.63 | Each year | |

| Financial Transaction Processing | ₹3.75 | ₹3.36 | On each transaction |

Other Intermediaries Charges

| Intermediary | Charge Head | Charge | Frequency of deduction | Mode of deduction |

|---|---|---|---|---|

| Custodian | Asset Servicing | 0.0032% | Per annum | Recovered through NAV |

| NPS Trust | Trust Management | 0.005% | ||

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.