16 Aug 2022 , 11:43 AM

Business Wire India

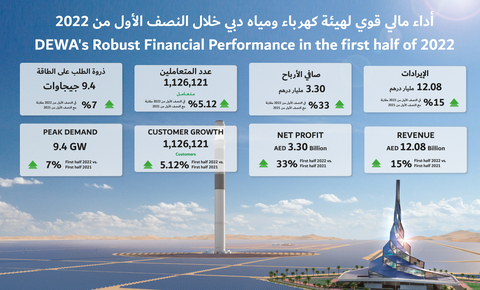

Dubai Electricity and Water Authority PJSC (ISIN: AED001801011) (Symbol: DEWA), the Emirate of Dubai’s exclusive electricity and water services provider, which is listed on the Dubai Financial Market (DFM), today reported its second quarter 2022 financial results, recording quarterly revenue of AED 7.01 bn and net profit of AED 2.61 bn. For the first half of 2022, DEWA’s revenue is AED 12.08 bn and net profit is AED 3.30 bn.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220812005416/en/

Dubai Electricity and Water Authority PJSC announces AED 12.08 billion revenue and 3.30 billion net profit in the first half of 2022 (Photo: AETOSWire)

DEWA’s first half revenue increase of 15% to AED 12.08 bn was mainly driven by an increase in energy and water demand in Dubai. During the first half of 2022 energy demand increased by 6.3% and water demand by 6.4% compared to the same period in 2021.

Revenue of DEWA’s majority owned subsidiary, EMPOWER, was 1,154 million AED and net profit was 432 million AED. DEWA is reviewing the possibility of an IPO of EMPOWER.

“These financial results demonstrate our commitment to a sustainability-focused smart growth, enhancing customer happiness, operational excellence and providing an attractive return for our shareholders. We continue to implement pioneering projects to diversify Dubai’s clean and renewable energy sources and achieve our wise leadership’s vision for a bright and sustainable future for generations to come,” said HE Saeed Mohammed Al Tayer, MD & CEO of DEWA.

DEWA reiterates its dividend policy and expects to pay a minimum dividend of AED 6.2 billion per year over the next five years. The dividends are intended to be paid twice each fiscal year in April and October. The first dividend payment of AED 3.1 billion is expected in October 2022.

For full second quarter earnings announcement: https://www.dewa.gov.ae/en/investor-relations

or https://www.dfm.ae/en/issuers/listed-securities/securities/company-profile-page?id=DEWA

For investor relations, please contact: dewainvestors@dewa.gov.ae

For media, please contact: media@dewa.gov.ae

Click HERE to download the Video.

*Source: AETOSWire

View source version on businesswire.com: https://www.businesswire.com/news/home/20220812005416/en/

![]()

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.