How will the capital raised through green bonds be used?

How will the capital raised through green bonds be used?

At present, about Rs. 25 crore every month is spent on electricity cost by the Indore Municipal Corporation on pumping and supply of drinking water. To reduce the said cost, Indore Municipal Corporation is installing 60 MW Ground Mounted Captive Solar PV Power Plant at village Samraj & Ashukhedi, District Khargone in Madhya Pradesh. The cost of this project will be met through Public Issue of Green Bonds.

Indore has been the cleanest city for 6 consecutive years, what measures are you taking to not break the streak?

Indore city of Madhya Pradesh has won the title of the cleanest city in India for the sixth consecutive years. The active participation and habits of the people of Indore are a big contributor to the city’s cleanliness. While segregation of garbage into `dry’ and `wet’ categories is common, in Indore segregation happens in six categories at a collection point. The bio-CNG plant that runs on the wet waste collected from the city is the focal point of the IMC’s waste disposal procedure. There are various other measures which will be taken in the future to maintain the cleanliness in the city.

How much time will the solar power plant take to build?

The solar power plant will take approximately 18 months to build.

Why should investors invest in Indore Municipal Corporation (IMC) green bonds?

Indore Municipal Corporation become the first city of India which is going to raise the fund through public issue. Ministry of Housing & Urban affairs is also promoting the Muni Bond market by way of interest subvention. In the recent budget 2023, Hon’ble Finance Minister also gave weightage for the Municipal Bond.

The proposed issue is fully secured through escrow on revenue streams of IMC through waterfall mechanism. The interest rate is fixed at 8.25% per annum payable half yearly. The investor will get regular return on the same. Credit rating performs the critical function of providing an independent and credible assessment of the inherent risk of an instrument. This bond is highly rated bond which is AA+ rated by India Ratings and AA rated Care Ratings, which are relatively a low risk and safer investment option for the investors.

The proposed green bonds are proposed to be listed on National Stock exchange. A thousand-rupee bond comprises of 4 strrps having maturity period of 3 years, 5 years, 7 years, and 9 years which are independently tradable at the Exchange. This will provide higher liquidity to Investors.

Every bond holder will get the notification periodically for the number of solar units generated. Will add value to the subscriber & bond holders’ contribution in green revolution. In addition to the attractive interest this Green would be an encouraging element.

Provide us with a snapshot of the IMC’s financial profile. What are its key strengths thereof?

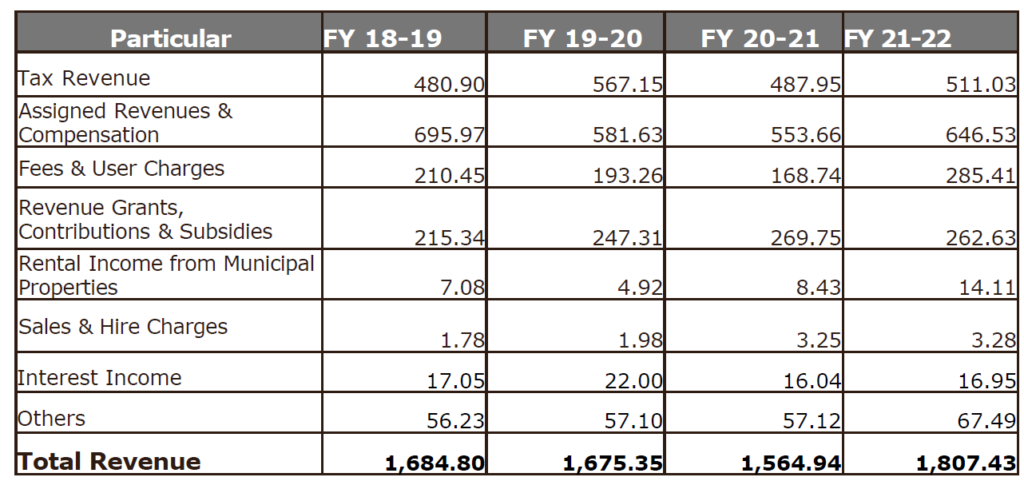

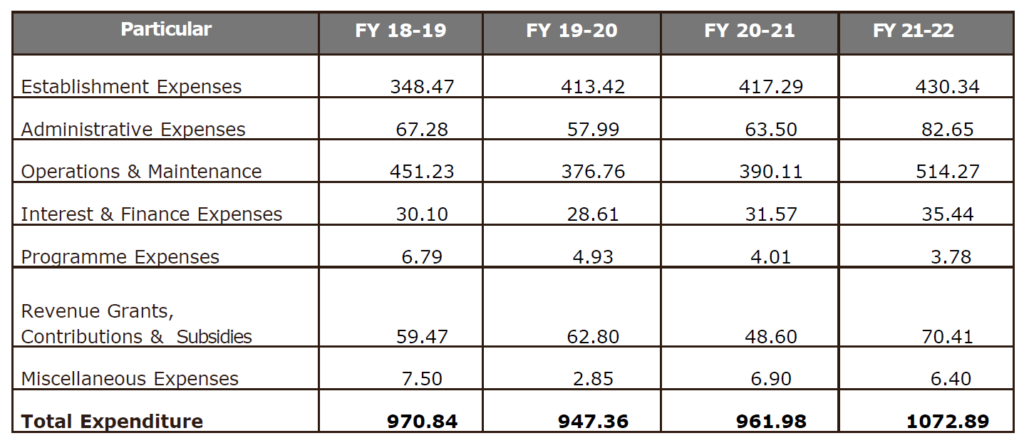

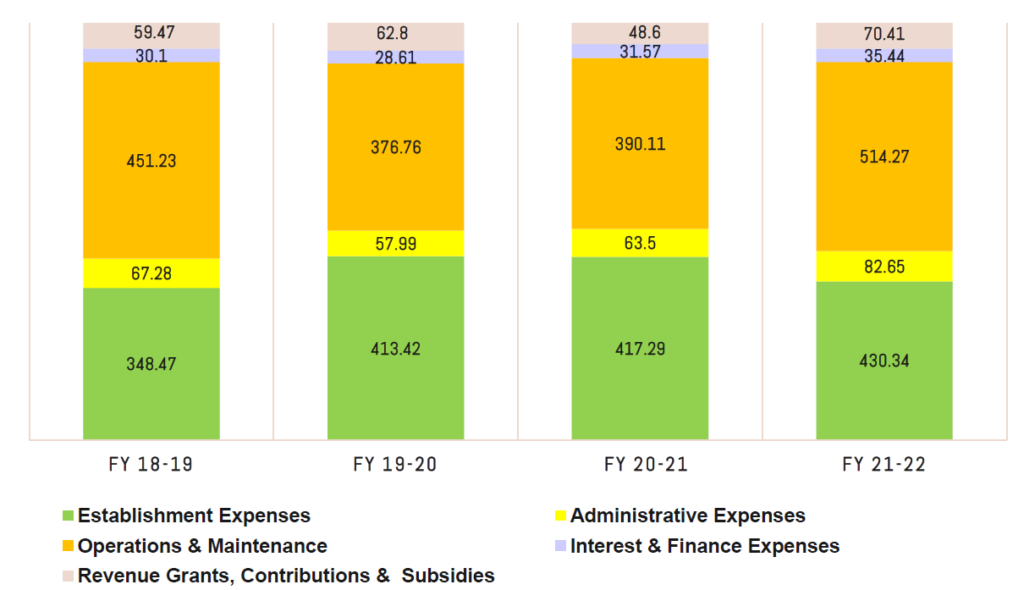

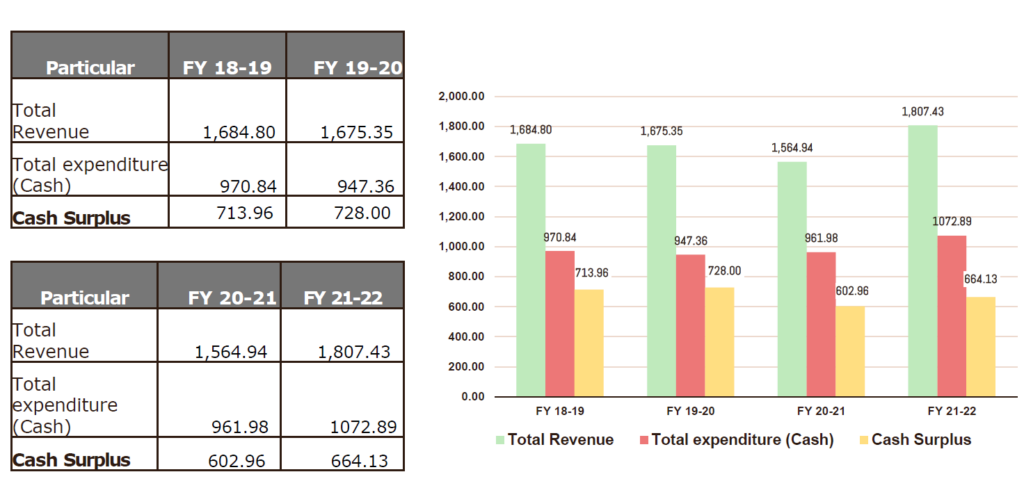

The corporation’s revenue income for the financial year 2021-2022 was Rs. 1,807.43 crore as compared to Rs 1,564.94 crore in the previous year. While the corporation expenditure Rs. 1,072.89 crore in FY21-22. The revenue and cash surplus of IMC are growing year by year. The financial snapshot is attached as under:

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.