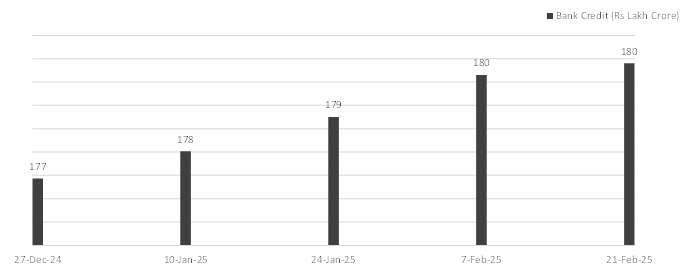

The Indian banking sector has shown a steady increase in total outstanding credit in 2025.

As per the latest RBI release, the total growth has been 11% in the week ending 21st February 2025. In comparison, the average loan growth in India over the past 13 years has been 11.8%. These include the worst growth that India witnessed during March 2017 (4%).

Figure: Total Outstanding Loans/Credit at Indian banks

Source: RBI

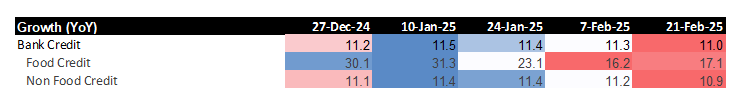

Trends in Food and Non-Food Credit

Food Credit:

Food credit accounts for only 1% of the total banking credit. It includes the credit provided by banks to FCI and other governmental agencies. It has experienced a sharp slowdown in 2025. At the start of the year, it was as high as 30%. However, it has slowed to 16-17% in February Food inflation.

Non Food Credit:

Non Food Credit accounts for 99% of the total banking credit. It encompasses loans given to services, industries and personal sectors. It accelerated in January to 11.4%. However, it has decelerated in February to less than 11%.

Why is the credit growth decelerating?

Inflation & Wage Growth:

While Inflation is moderating, it has been persistently high and wage growth has not kept pace with it. This has had a detrimental impact on consumption. Retail loans have been among the faster growing categories. A likely slowdown is impacting overall credit growth.

Higher RBI Scrutiny:

There has been higher RBI scrutiny over loans to NBFCs. As they have also been a fast growing category of loans, the higher scrutiny and concomitant slowdown has likely impacted overall credit growth.

Macro Worries & Economic Slowdown:

Macro factors including a slowdown in major economies, a depreciating INR and the ongoing worries about a tariff war have also likely contributed to a slowdown in economic activity.

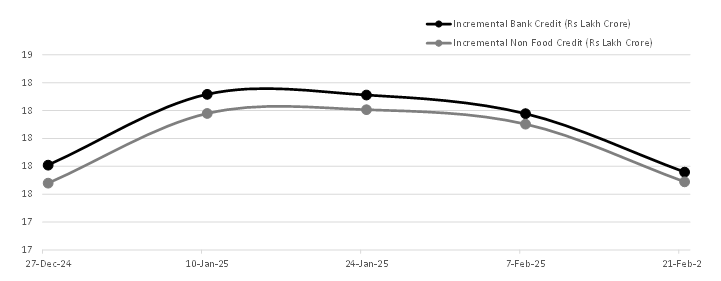

Figure: Incremental Credit at Indian Banks

Source: RBI

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.