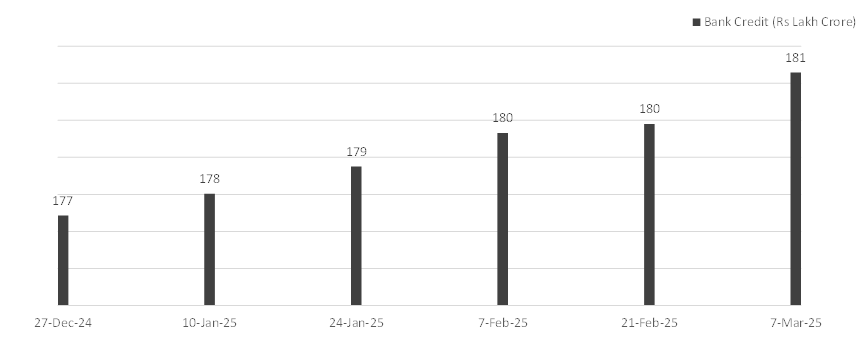

Total Outstanding Banking Credit in India continues to witness a modest expansion. However, the pace of expansion had moderated in February 2025. It is yet to pickup materially in March. As per the latest RBI release, the total growth has been 11.1% in the first week of March 2025. In comparison, the average loan growth in India over the past 13 years has been 11.8%. These include the worst growth that India witnessed during March 2017 (4%).

Source: RBI

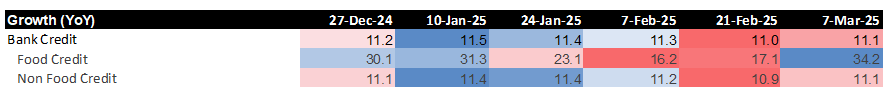

Trends in Food and Non-Food Credit

Food Credit:

Food credit accounts for only 1% of the total banking credit. It includes the credit provided by banks to FCI and other governmental agencies. It has picked up sharply in the first week of March. After experiencing a sharp slowdown in February (16-17% YoY), it has picked increased to 34% in the first week of March.

Non Food Credit:

Non Food Credit accounts for 99% of the total banking credit. It encompasses loans given to services, industries and personal sectors. It had accelerated in January to 11.4% and decelerated materially in February. In the first week of March, it has shown a modest recover as it improved to 11.1%.

Why is the credit growth decelerating?

Inflation & Wage Growth:

While Inflation is moderating, it has been persistently high and wage growth has not kept pace with it. This has had a detrimental impact on consumption. Retail loans have been among the faster growing categories. A likely slowdown is impacting overall credit growth.

Higher RBI Scrutiny:

There has been higher RBI scrutiny over loans to NBFCs. As they have also been a fast growing category of loans, the higher scrutiny and concomitant slowdown has likely impacted overall credit growth.

Macro Worries & Economic Slowdown:

Macro factors including a slowdown in major economies, a depreciating INR and the ongoing worries about a tariff war have also likely contributed to a slowdown in economic activity.

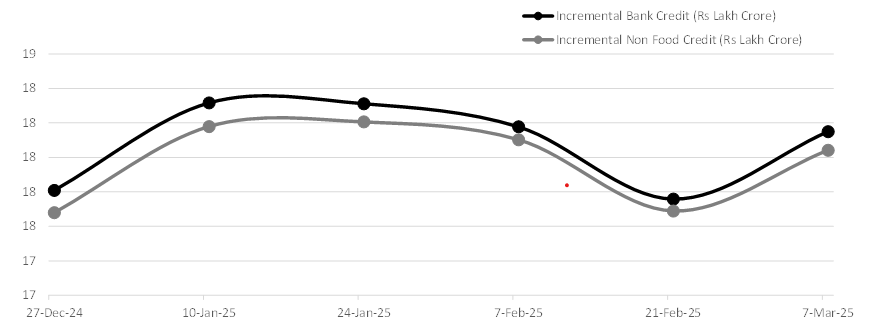

Figure: Incremental Credit at Indian Banks

Source: RBI

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.