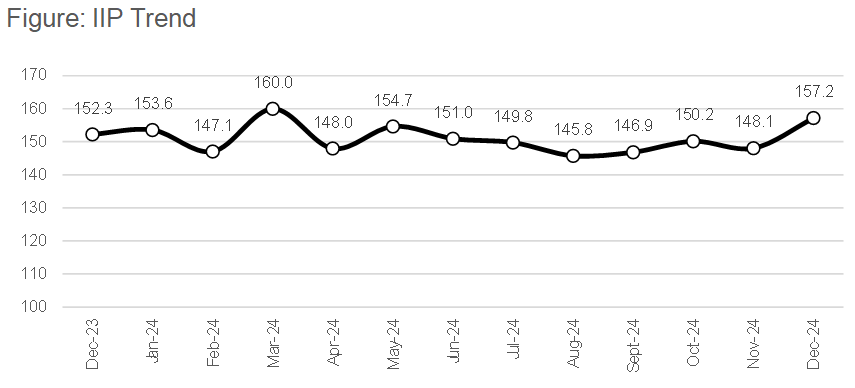

In December 2024, the Index of Industrial Production (IIP) reached a six-month high of 157.2. However, from 5.2% in November 2024, its growth rate significantly dropped to 3.2%. According to a Reuters economist poll, market expectations were for 3.9% growth, and this decline is the lowest expansion in the last four months. Furthermore, the forecast for November 2024 was lowered from the initial 5.2%, highlighting the inherent unpredictability of industrial output figures.

*IIP data is subject to modifications and is reported with a 40-day lag. The last two months will see revisions to the recent months, which are still estimates.

Figure: IIP Trend

Source: MOSPI

Manufacturing Slumps; Electricity Gains

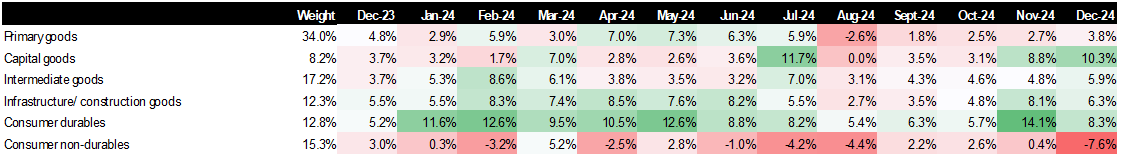

In December 2024, the Indian industrial sector has shown mixed performance. Manufacturing, the biggest component of the Index of Industrial Production (IIP), has experience sharp decline and grow only 3.03% in December. This was the second-lowest growth rate over the past year. It also indicated decrease in production capacity. On the contrary, the electricity sector has shown robust growth since August 2024. This indicates rising energy demand that is probably being driven by higher industrial consumption in some sectors.

Figure: Analysis of IIP Growth YoY – Sectoral Classification

Source: MOSPI

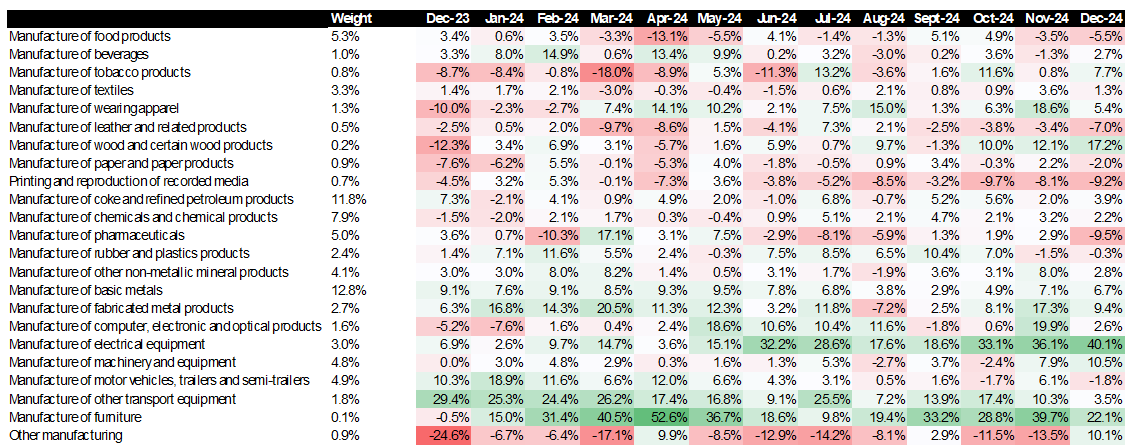

Food & Pharma pull down manufacturing growth:

A detailed analysis of the breakdown in manufacturing indicates that 30% of the sub-sectors witnessed a contraction during December. Two major industries, food and pharma have seen the severe slowdown at -5.5% and -9% respectively. These impacted the overall growth significantly.

However, many sectors performed well and helped counteract the slowdown. Computers, electrical equipment and machinery industries have shown rapid growth in the period. This suggests that sectors driven by capital investment and technology are gaining traction.

Figure: Trends in Manufacturing – IIP

Source: MOSPI

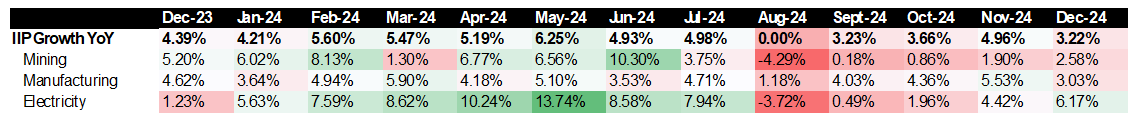

Non-Durables was a material drag on growth:

Capital goods – the smallest weight category was the fastest growing category in December. Also, growth in the largest category, Intermediate Goods, picked up. However, Consumer Non-Durables, witnessed its slowest growth in 12 months (-7.6%) and was a major dampener.

Figure: Analysis of IIP Growth YoY – Usage Based Classification

Source: MOSPI

Several micro and macro were behind the slowdown:

Manufacturing Sector Slowdown: The slowdown in manufacturing is inline with PMI data that indicated a softer December despite strong job growth. While still above 50, the PMI growth was the weakest in 12 months.

Inflationary Pressures: Inflation has been a concern for some time and has been mentioned even by RBI as a dampener on India’s growth. It continues to impact overall growth.

Global Economic Uncertainty: Uncertainty in the global economic environment has adversely affected business sentiment and export demand. Factors such as geopolitical tensions, fluctuating commodity prices, and varying global demand have contributed to this uncertainty, leading to cautiousness among manufacturers.

High Base Effect: The IIP’s growth rate in December 2024 was also influenced by a high base effect from the previous year.

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.