The NIFTY 50 index lost 1.22% for the week, its second consecutive weekly loss. Mid-caps performed worse. NIFTY MIDCAP SELECT index fell 2.90% during the week. Most of the other indices also fell, with only FMCG index bucking the trend.

Notably, IT stocks fell sharply after lacklustre earnings from TCS. On the other hand, positive pre-earnings update from Godrej Consumer set-off a rally in FMCG stocks. There were also notable stock moves. Glenmark was up 20% for the week on a licensing deal with AbbVie. JP Power was up ~25% on continued speculation of M&A interest from Adani Group.

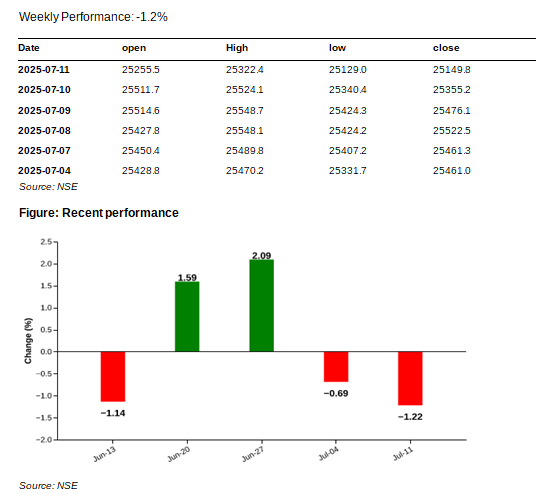

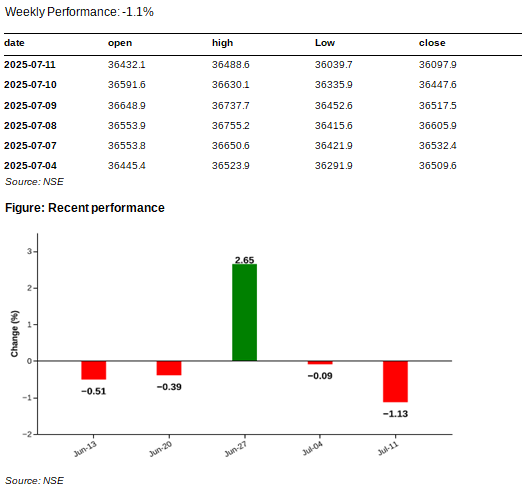

NIFTY 50 – Falls for the second consecutive week.

The NIFTY 50 index lost 1.22% for the week, the second consecutive weekly loss. Underperformance of its heavyweights led the way for the index’s underperformance, with Bharti Airtel, Infosys, Tata Consultancy Services, Reliance Industries, and ICICI Bank emerging as the top drags. On the other hand, Hindustan Unilever, Kotak Mahindra Bank, ITC, NTPC and Power Grid were the top gainers.

NIFTY has recorded losses in 3 of the past 5 weeks. Losses over the past two weeks have also eroded the strong gains the index has recorded in the week of 27th June; suggesting a reversal of trend. In addition to profit booking, lacklustre results from industry bellweathers like TCS added to the downtrend. The advance-decline ratio of 0.25, with only 12 advances and 38 declines, further reinforces the notion of broad-based weakness in the market.

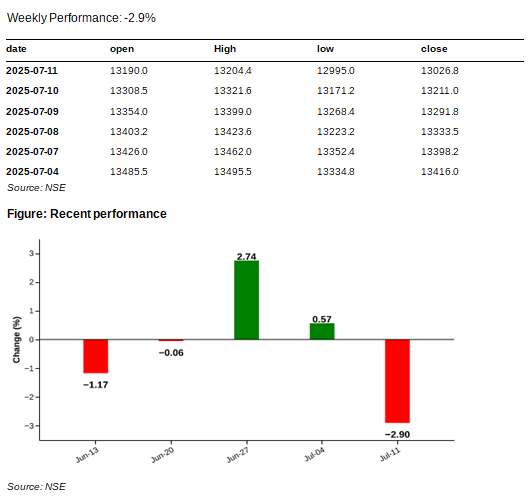

NIFTY MIDCAP SELECT – Sharp Correction

The NIFTY MIDCAP SELECT index ended the week with a decline of 2.90%, marking one of the worst performances in recent times. The correction was broadbased as only 7 stocks advanced while 18 declined; suggesting a bearish market breadth. IT stocks took a hit after the lacklustre results from TCS. Persistent Systems was the worst performer for the week with a fall of 5.4%. Joining the bottom performers list were Bharat Forge, Coforge, Lupin, and Indus Towers. On the other hand, Cummins India, Dixon Technologies, MRF, HDFC Asset Management Company, and Container Corporation of India bucked the trend. Cummins India was the largest contributor to the index with a 6.12% gain.

The index made losses in three of the past five weeks; that included significant moves (2.5%+) in two of the weeks. Mid-caps have underperformed large-caps YTD and the trend continues. Expensive valuations and lack of broadbased/structural triggers have been some of the reasons keeping mid-cap performance in check.

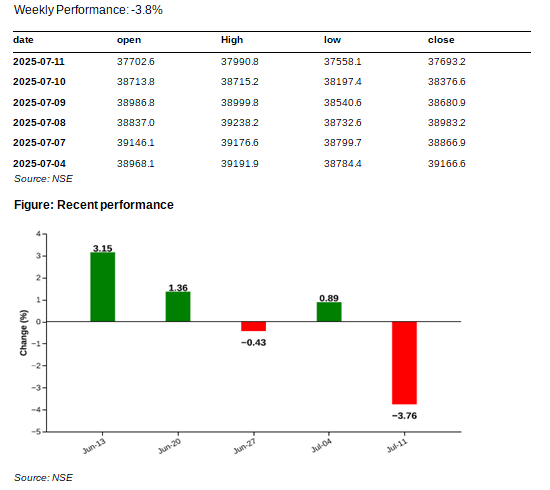

NIFTY IT – TCS results sour investor appetite

The NIFTY IT index ended the week with a decline of 3.76%, marking a reversal from the previous week’s gain of 0.89%. Nearly all of the index constituents fell. The top contributors to the index’s decline were Tata Consultancy Services, Infosys, and HCL Technologies, which together accounted for over 2.35% of the index’s decline. Lacklustre 1QFY26 earnings from TCS were the key reason behind the index’ sharp fall for the week.

An analysis of recent performance indicates that NIFTY IT has been among the best performing indices in the recent past. Prior to this, the index was up in 3 of the past 4 weeks. With other large-caps reporting earnings soon, the focus will be on their earnings.

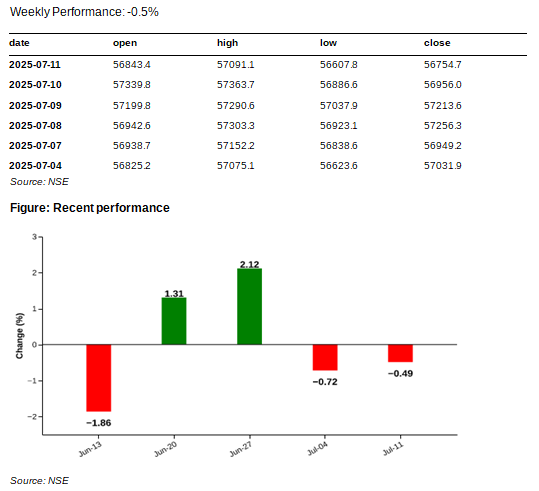

NIFTY BANK – Kotak Mahindra Leads In a Weak Week

NIFTY BANK index closed a lacklustre week with a loss of 0.49%. Kotak Mahindra Bank was the highest gainer, rising 4.26% during the week, even as performance of the index remained weak. Advance Decline Ratio was skewed towards the declines, 3 stocks advanced and 9 declined.

Some of the other gainers in the pack included IndusInd Bank (up 0.30%) and AU Small Finance Bank (up 0.18%). On the other hand, ICICI Bank, Federal Bank and IDFC First Bank were the top losers, slipping 1.5% to 3.7%.

NIFTY BANK index has been witnessing a modest correction in the recent weeks. After two strong weeks during week ending June 20th and 27th, it has seen corrections (inline with the broader market) for the past two weeks. Profit booking and lack of a fresh set of triggers are the likely reasons for its meek performance.

NIFTY ENERGY – Down Moves Continues With Mixed Performances

NIFTY ENERGY index closed week on a down note, losing 1.13%. This follows the lacklustre performance in the past week (where it closed flat). While some stocks like JSW Energy, NTPC, Power Grid and Adani Power gained 1..5% to 3.3%, the broader trend was bearish. Top performing stock, JP Power, was up 25% during the week on speculation about Adani acquiring the firm. With an Advance/Decline ratio of less than 0.25x, most of the index constituents witnessed losses. Among the top losers were GAIL, Reliance and Siemens, down 5.96, 2.10 and 5.31 %, respectively.

An analysis of recent performance shows a bearish trend; with the index falling for 4 of the past 5 weeks. Earnings of key stocks, including Reliance and ONGC will be closely watched for a fresh set of triggers for the index.

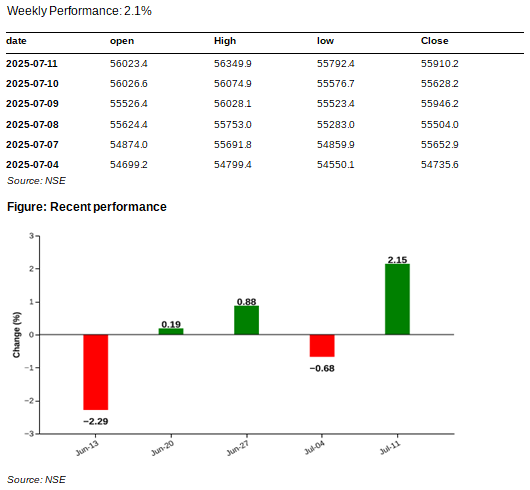

NIFTY FMCG – A smart rally on optimistic outlook

Positive pre-earnings outlook from Godrej Consumer set off a rally in FMCG stocks last week. The NIFTY FMCG outperformed NIFTY for week ending 12th July. It registered a smart rally of 2.15%. Hindustan Unilever, ITC, Godrej Consumer Products, Dabur and ITC Hotels were the biggest gainers. Godrej Consumer and Hindustan Unilever were up 7.7% each. Despite these gains, there were many stocks that declined. Advance Decline ratio was evenly split between gainers and losers. Tata Consumer Products, United Spirits, VBL and Colgate Palmolive were the top losers, shedding up to 2.89%.

The index’s five-week performance indicates a shifting trend. NIFTY FMCG index has witnessed a subpart YTD performance. However, it has gained in 3 of the past 5 weeks.

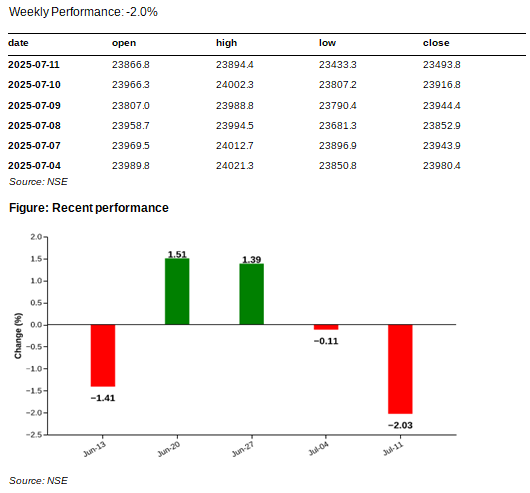

NIFTY AUTO – Broad Based witnessed

NIFTY AUTO extended its losses and ended the week with a fall of 2.03%. Most of the stocks declined as there were only 3 gainers in the 12 stock index. MRF, Balkrishna Industries, and Bosch were the only gainers – gaining 2.97%, 1.83%, and 1.66%, respectively. The poor market breadth and steep falls in M&M, Bajaj Auto and TVS Motor which declined 2.82%, 4.34% and 4.36% more than offset these gains.

After two weeks of strong performance during the weeks ending 20th June and 27th June 2025, NIFTY AUTO has seen profit-booking and a modest correction over the past two weeks.

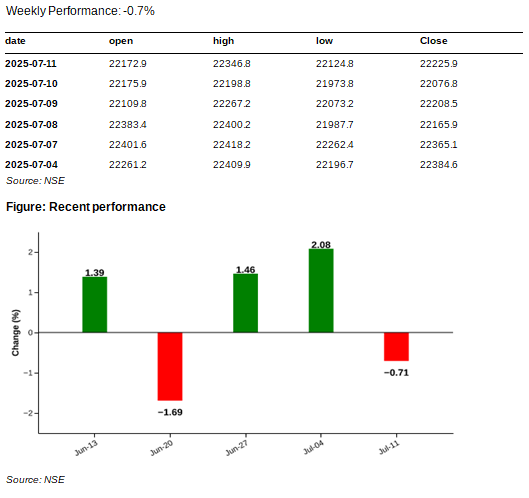

NIFTY PHARMA – Mixed Bag with Glenmark and Mankind Leading the Charge

The NIFTY PHARMA index ended the week with a decline of 0.71%, as the index constituents witnessed a mixed performance. Heavyweights – Glenmark Pharmaceuticals and Mankind Pharma were the top contributors to the index, with gains of 19.16% and 5.69%, respectively. Glenmark surged after a USD 2 billion licensing deal with AbbVie. On the other hand, Dr. Reddy’s Laboratories, Lupin, and Aurobindo Pharma were among the bottom contributors, with declines ranging from 4.03% to 5.58%. Also, the market breadth was weak as 80% of the constituents declined.

The past five weeks’ performance of the NIFTY PHARMA index suggests that the index has been among the best performing indices. It witnessed strong gains (1.4% to 2.1%) in three of the past five weeks.

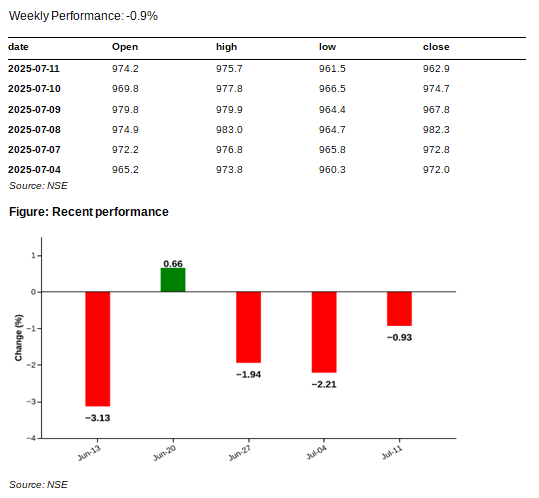

NIFTY REALTY – Index in a Downtrend Trend

The NIFTY REALTY index corrected another 0.93% during the week; and recorded a third straight week of losses. The index has seen significant profit booking over the past five weeks as it ended in the red in 4 of the past 5 weeks. Prior to that, it had rallied sharply on news on jumbo rate cut from RBI.

8 of the 10 constituents fell. Godrej Properties and DLF, were the biggest laggards, shedding 4.24% and 2.5%, respectively. The only 2 stocks that gained were – Prestige Estates and Lodha Developers, up 5.08% and 2.34%.

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.