12 May 2025 , 01:06 PM

Forex Reserves Decline. SDF Usage Increase:

India’s forex reserves witnessed a rare dip as they fell by USD 2bn to USD 686 bn. It was largely driven by a drop in Gold reserves as Gold price corrected. On the other hand, SDF utilization increased past INR 1.5trn after showing signs of easing in April.

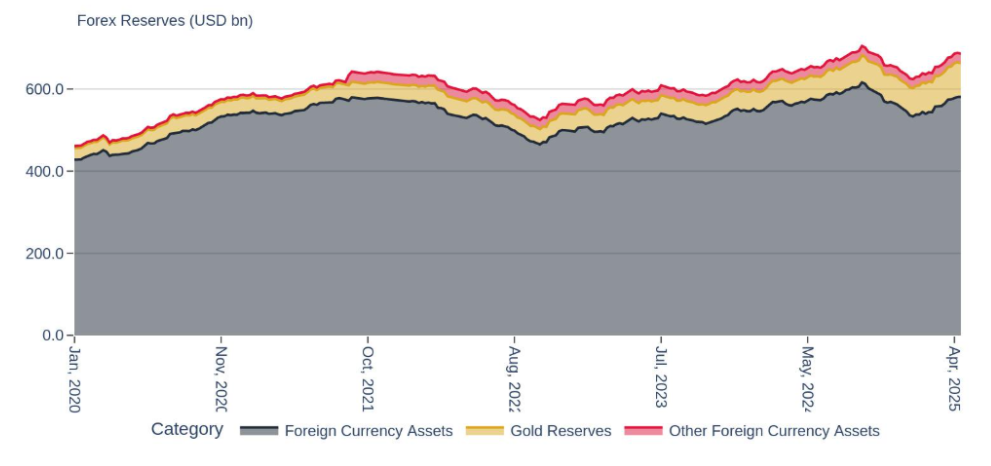

Forex Reserves Fall as Gold Weakens

As per the latest RBI data, India’s forex reserves fell by USD 2.1 bn week over week to USD 686 bn. The fall was primarily due to a decline in the value of Gold Reserves. Since peaking at USD 84.5 bn in April. Gold Reserves have fallen by nearly USD 2.7 bn. In the week ended 2nd May, a correction in Gold prices was the key reason for the overall fall in gold reserves.

Gold Reserves serve an essential role in diversifying the country’s forex reserves. The main component of forex reserves is the foreign currency assets. They contribute to more than 80% of forex reserves. In the week ended 2nd May, they increased to USD 58.1 bn.

India’s forex reserves are healthy and close to the peak reserves witnessed in 2023. In 2025, Gold Reserves had increased sharply due to the increase in the price of gold. While gold only accounts for 12% of total reserves, it contributed to 25% of these incremental reserves in 2025.

Figure: India’s Forex Reserves Are Nearing The Previous Peak

Source: RBI

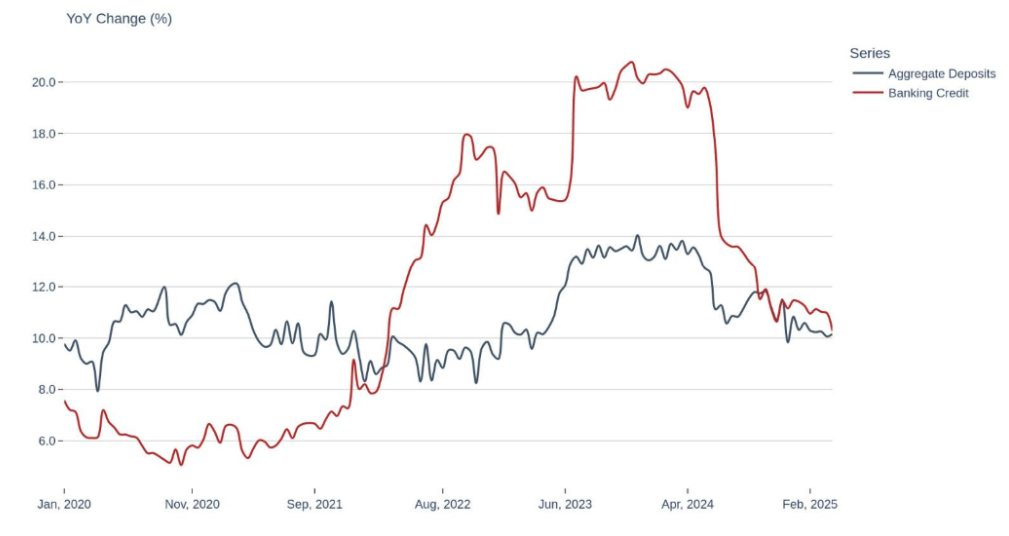

Moderating Credit Growth – Sustainable growth or Slowing economy?

The fortnightly credit growth data will be announced at the end of this week. This will be a keenly watched out metric as the last data had shown a sharper fall in credit growth. As per RBI’s last data release, credit growth dipped sharply in April. From 10.9% YoY growth at the beginning of April, it has fallen to 10.3%. The falling credit growth has happened despite RBI utilising its key policy tool to increase lending. RBI had lowered repo rate by 50bps in the recent past.

On the one hand, moderation in credit growth represents a significant change from the excessively hot conditions seen over the last year. During 2024, banking credit had jumped 20% on a year-on-year basis, supported by strong demand from corporates, retail borrowers as well as from services sector. The high pace was unsustainable and carries risks of asset quality deterioration and overheating in pockets of the economy.

However, the sharp fall in credit growth, is increasingly a cause for worry. At 10.3%, banking credit expanded at the slowest pace in three years. A slowdown in both retail and corporate credit is likely resulting in the slowdown. A variety of factors including tighter norms for NBFC credit and unsecured retail credit (credit cards, personal loans etc) are being attributed to.

Figure: Credit Growth had dipped to a 3 year low. This week’s data will be watched closely

Source: RBI

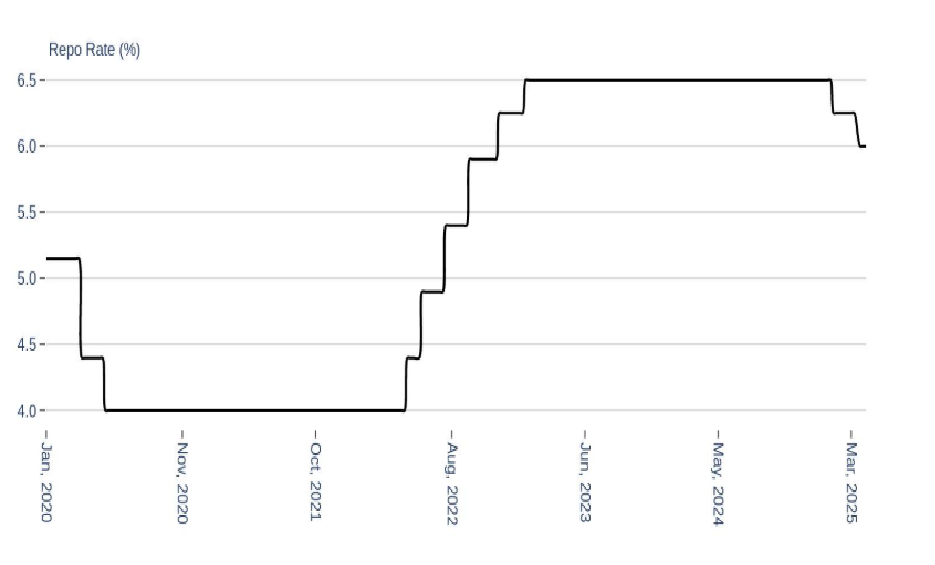

RBI’s Repo Rate Cut: A Strategic Move to Stimulate Economic Growth

After having maintained the benchmark policy interest rate (repo rate) at 6.5% for more than a year, Reserve Bank of India (RBI) had cut the benchmark rates in 2025. So far, RBI had cut the rate twice. After the latest cut in April, the repo rate is 6%. The move signals a shift in RBI’s monetary policy from ‘Neutral’ to ‘Accomodative’. In light of slowing credit growth and macroeconomic uncertainties, RBI has been proactive with its policy tools to offer support.

Figure: Repo Rate is coming off and policy stance is turning accommodative

Source: RBI

What is Repo Rate – A Primer

The repo rate is the rate at which the RBI lends to commercial banks. A lower rate of interest reduces the cost of borrowing for banks, and can ultimately mean lower interest rates for loans to consumers and businesses. It is the primary device employed by the RBI to manage the economic activity in the country.

Goals behind a cut in the Repo Rate

Encouraging Credit Demand: By making borrowing cheaper, it encourages households, firms to borrow and spend on consumption and investment goods. That can be particularly good for rate sensitive areas like housing, auto and small business.

Boosting The Economy: Economists say Reserve Bank of India’s cut will help lift economic activity by bringing down the cost of spending and investment.

Inflation Management: The RBI’s move to reduce the repo rate comes against the backdrop of inflation moderating particularly in food prices. Retail inflation dropped, giving the central bank a room to have a more accommodative stance without actually contravening its inflation targets.

Boost Liquidity: The rate reduction is combined with steps to provide liquidity to the banking system so banks have the required cash to lend more money.

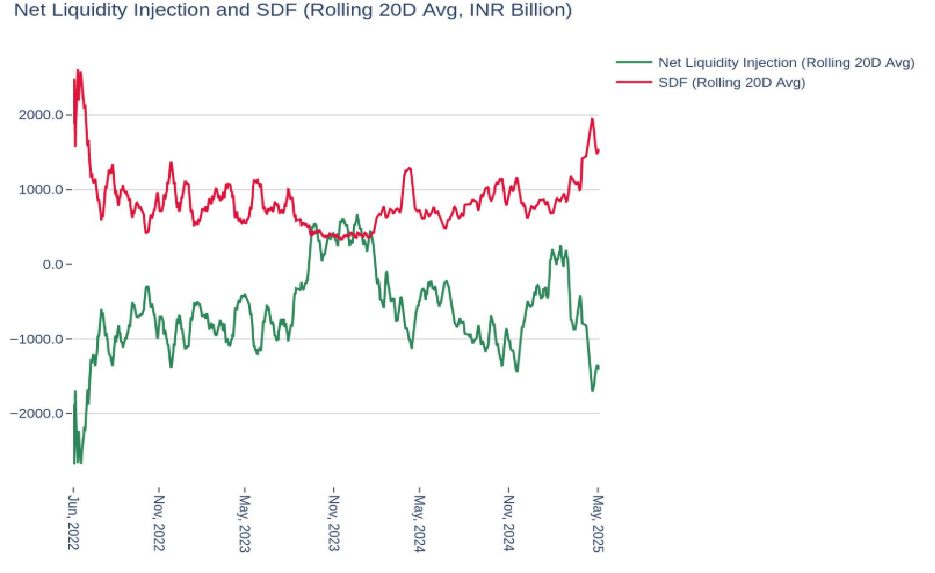

SDF Balances Are Increasing Again

As per RBI’s latest release, SDF balances are increasing again. A rapid acceleration in the RBI’s daily SDF started in April 2025. 20D average SDF utilization has increased to nearly INR 2 trn – a high not seen since 2022. This rise resulted in overall liquidity conditions tightening after the improving conditions witnessed during the early part of 2025. Subsequently, they had moderated to less than INR 1trn in the 3rd week of April. However, an analysis of recent data, shows that they are on the rise again. Towards the end of week of 4th May 2025, SDF has notched up to more than INR 1.5trn.

Figure: SDF utilization moderates after the spike

Source: RBI

What is SDF – A Primer

The SDF is a non-collateralised instrument which the banks can use for parking their surplus funds at the RBI and earn interest at a slightly lower rate than the repo. It was implemented in April 2022 as a cleaner and more efficient alternative to the conventional reverse repo.

Unlike reverse repo, the SDF does not mandate the RBI to transfer government securities as collateral, making it a more efficient tool to absorb liquidity. This has now become the de-facto floor of the RBI’s LAF corridor.

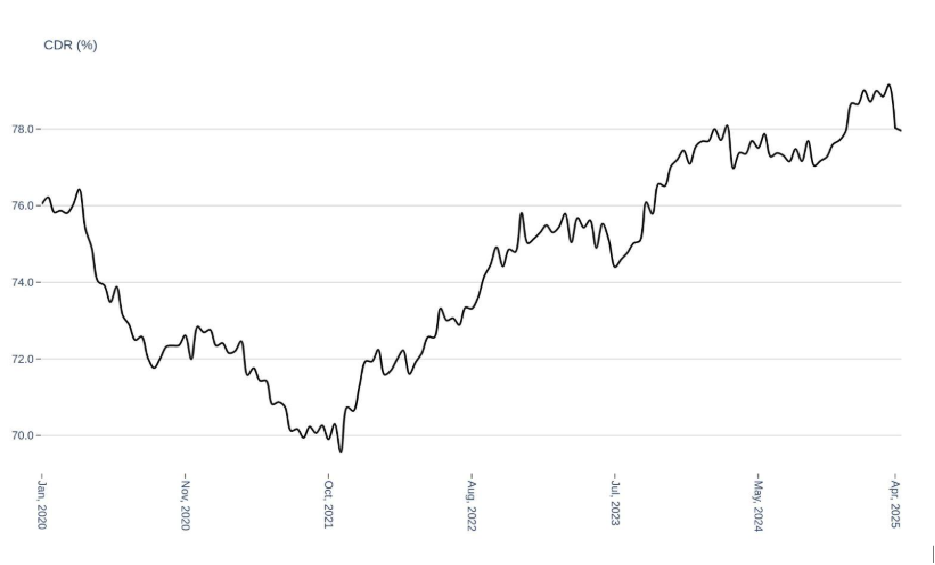

Credit Deposit Ratio eased even as Liquidity Remained tight

In the recent past, Indian banking witnessed high credit growth and rising credit deposit ratio. This had also resulted in tighter liquidity conditions, higher competition for funding and higher funding costs.

As per latest RBI data, CDR has moderated from its recent peak to marginally below 78%. A moderating CDR indicates either the relative pace of credit slowed or deposits picked up or a combination of both happened. A closer look at the net liquidity in the system indicates that the banks parked excess funds in low interest earnings SDF facilities as the demand for credit moderated. Despite the obvious ramification that credit growth might be slowing, a balanced and/or moderate CDR provides operational room to the banks in the event of a pickup in credit growth.

Figure: Banking Credit Deposit Ratio Drops – Improving Liquidity or Moderating Credit?

Source: RBI

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.