7 Jan 2025 , 05:33 PM

Investments inherently involve volatility, which is a bleak reality for investors. Yet, it gives the investor an opportunity to generate additional returns if one applies the right strategies. Derivatives, which most people regard as complex and risky can be instrumental in risk management, speculation, and boosting returns. When employed correctly and at the right time, derivatives can help hedge risks and increase returns, especially in volatile market circumstances.

Investments inherently involve volatility, which is a bleak reality for investors. Yet, it gives the investor an opportunity to generate additional returns if one applies the right strategies. Derivatives, which most people regard as complex and risky can be instrumental in risk management, speculation, and boosting returns. When employed correctly and at the right time, derivatives can help hedge risks and increase returns, especially in volatile market circumstances.

Financial Derivatives Overview:

Derivatives are financial instruments whose values are determined by an underlying asset such as currency, bonds, commodities, Interest rate, equity or Index. Value of such an instrument usually moves with the price movement of the underlying asset.

The types of derivatives include:

Derivatives Usages

Derivatives Protect the Portfolio from Market Turbulence

Asset price volatility during periods of market turbulence impacts even diversified portfolios. Here are some ways in which derivatives can be used to mitigate such risks:

Example: If you have 1000 shares valued at Rs. 100 and expect there to be a downturn, then you can buy a put option with a strike price of Rs. 100 for Rs. 5. If the share price decreases to Rs. 80, the value of the put option would rise to Rs. 20, limiting the loss.

Example: If you own a stock at Rs 100, you can buy a put option of 100 strike for Rs 5 and sell a call option of 120 strike for Rs 2. Therefore, the net cost for that hedge comes to Rs. 3, which provides protection against a drop while capping any gains above Rs. 120.

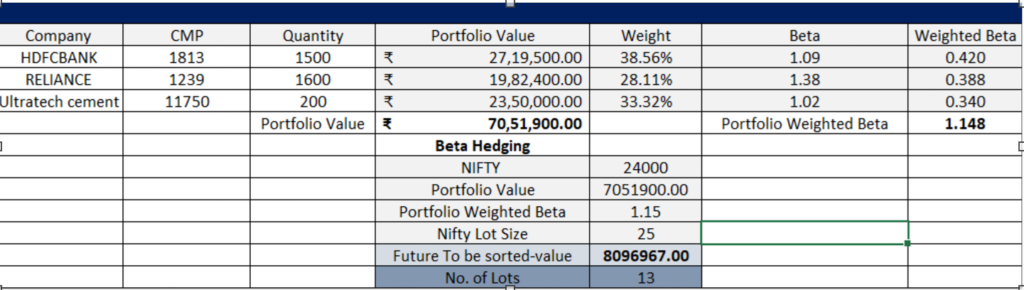

Example: Consider the portfolio in below table with weighted beta of 1.148. This portfolio can be hedged using a) shorting Nifty futures of Rs. 8,096,967 (portfolio value * portfolio weighted beta) or b) acquiring put options with matching exposure.

Derivatives can be strategically used to enhance returns in many ways:

Example: For example, an investor capable of buying only 100 shares of Reliance priced at Rs. 1200 may use futures to get exposure as high as 1000 shares, paying only a fraction of this future value (i.e., the margin requirement).

Example: For instance, the investor who owns 1000 shares of Reliance at Rs. 1200 could sell call options whose strike price ranges somewhere between Rs. 1300-1350 or, as per the investor’s return appetite, earn a premium while still retaining ownership of those shares if the stock remains below the strike price.

Example: An investor anticipating growth in Reliance stock will invest in options or buy futures contracts with apparent price increases in mind.

Risks and Considerations

Derivatives are tools that help in risk management as well as return enhancement. However, derivatives carry inherent risks such as:

General Advice for Investors in Turbulent Markets

Derivatives are multi-faceted financial instruments which are available to the investor either for protection of their portfolios, improvement in monetary return, or for dealing with market volatility. They serve very well for hedging positions, speculating, or income generation. However, it is important to exercise care in understanding their workings and the risks involved while dealing in them.

The careful strategic use of derivatives can allow an investor to gain an early competitive advantage in volatile markets and still get the most efficient performance possible from that portfolio. Hence, it is important to invest in it wisely, after carefully assessing one’s own financial goals and risk tolerance

Manish Batwara

Senior Director – Fund Manager

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.