The Finance Minister of India presented the Union Budget 2026 on February 01, 2025, making a pivotal move towards becoming a $5 trillion economy. This budget was introduced against the backdrop of a challenging global macro-economic outlook with global growth growing below the historical averages. The size and pace of US rate cuts are receding, the dollar has strengthened, bond yields have hardened and emerging economies experiencing large capital outflows leading to a sharp depreciation in their currencies. This coupled with slowing domestic economic growth and consumption.

The Finance Minister of India presented the Union Budget 2026 on February 01, 2025, making a pivotal move towards becoming a $5 trillion economy. This budget was introduced against the backdrop of a challenging global macro-economic outlook with global growth growing below the historical averages. The size and pace of US rate cuts are receding, the dollar has strengthened, bond yields have hardened and emerging economies experiencing large capital outflows leading to a sharp depreciation in their currencies. This coupled with slowing domestic economic growth and consumption.

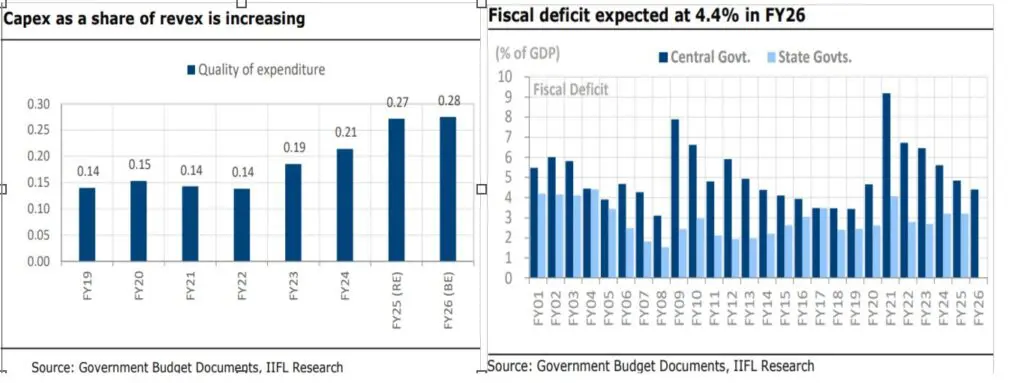

Budget FY26 features a 17% rise in effective capex following a significant shortfall in FY25. It also features a large personal tax cut that can add 1-2% to consumption expenditure (but this can come at the expense of aggregate capex) and of fiscal consolidation (at 4.4%, below earlier FY26 target), though the latter could have been relaxed a bit, given flagging growth. FY26BE total capital outlay is pegged at ₹11.2 trillion, +10% yoy vs FY25RE of ₹10.18 trillion. Debt/GDP is expected to come off slightly. Though the revenue assumptions are a bit optimistic, the difference isn’t significant. Low growth and tight fiscal will make for lower yields.

Positively impacted sectors: 1) Auto 2) Aviation 3)Banks 4) Building Material 5) Hotels 6)Consumer Electricals 7)Consumer 8) Infrastructure 9) Consumer Durables 10) Internet 11) Power Generation, Transmission & Distribution 12) New Energy & Cleantech 13) Real Estate/ REITs 14) Tourism

Negatively impacted sectors: 1) Oil and Gas 2) Telecom 3) Insurance 4) NBFC

Neutral: 1) Agriculture 2) Capital Goods, and EMS 3) Cement 4) Chemicals

Effective capex up 17%: Nominally, FY25 Budget capex increase seems to be only 10% but adding capital grants and subsidies for creation of capital assets, FY26 Budget aims for a 17% increase. FY25 had aimed for a 20% increase but delivered only 5%. But in the past several years, the Modi government has had a good track record in achieving the budgeted capex numbers, so we would not be sceptical about FY26 capex targets.

Flat roads, rising MSME: Within capex, defence has seen an under-achievement for FY25 of 7% but is set to grow by 13% for FY26. Roads and overall railways are broadly flat, though coaches and wagons saw sharp increases. MSME classifications are now at a higher threshold. Credit guarantee scheme limits for MSME have also been raised.

Water and renewables look up: So sharp was the capex under-achievement of FY25, that mere restoration of the run rate implies a large jump for FY26 for some items as seen in Jal Jeevan Mission (rural water) and affordable urban housing (but interest subsidy scheme ISS has seen lower allocation). Urban housing may also get a lift as deemed rental income from a 2nd property will no longer be taxable. The favoured sectors are renewables, power transmission and batteries, besides increase in PLIs for various sectors suggesting that the government is rotating its emphasis out towards clean energy and mfg.

Personal tax cuts => Consumption boost of 1-2%: There have been substantial personal tax rate and slab changes in this budget which should add 1% to 2% to the economy’s consumption expenditure after factoring in a reasonable multiplier. The annual hit on insurance was missing (thankfully). Other tax rates have been left unchanged though FIIs will have to now pay 12.5% long-term capital gains tax for unlisted equities also. TCS / TDS simplification is a positive. The new tax bill will likely further drive simplification. No income tax on income < Rs12.75lakh will have a positive impact on discretionary consumption including FMEG. New slabs in Income Tax are expected to result in more disposable incomes, especially in the hands of the middle-class population. This is expected to give a bigger boost to urban demand due to higher number of taxpayers vs rural.

Subsidies cut rationally: Budget revenue assumptions seem slightly optimistic, starting with NGDP growth at 10.1% and there might be a 1% disappointment. Revenue expenditure is only 300bps below NGDP growth, compared to 640bps run rate in the last few years. This was to be expected because of coalition compulsions. This has been achieved by cutting fertiliser subsidies and overall rural spend including MNREGA, the rural jobs guarantee programme.

Overall, capex compromised: It was a popular demand that taxes be cut, but we don’t see what is earth-shaking about a 1-2% consumption expenditure boost. 4.4% fiscal deficit is unnecessarily tight. Currently India faces tight financial conditions, including a strong dollar and high interest rates in the US. RBI has also contributed to this by defending the rupee. Under the circumstances, a small stimulus through fiscal expansion would not have been out of place. Low growth and tight fiscal make for lower yields (good for NBFCs). Promoting consumption is a short-term sugar high that can hurt capex in future.

In conclusion, the Union Budget for FY26 presents a mix bag of opportunities and challenges. The focus on capex, personal tax cuts, and fiscal consolidation amid a challenging global macro and slowing domestic economy bring both, optimism and caution. The intended increase in capex for sectors like infrastructure, renewable energy and MSMEs is a positive step towards achieving the $5 trillion economy, though sectors like telecom and oil &gas are likely to feel the impact of tighter fiscal environment. The personal tax cuts are expected to give a necessary boost to consumption. Overall, we believe that the budget has ticked most of boxes and is expected to help in achieving sustainable economic growth

Jayesh Bhanushali

Fund Manager – Equities

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.