The United States GDP grew at 3.1% in Q3 of 2024, much higher than the estimates of 2.8%. The Q2 GDP growth of 3%was largely due to revision of exports and consumer spending which was supported by a healthy job market. The US inflation has been sticky in the last several months with November print at 2.7%. The Fed cut the benchmark rates by 25bps in December, marking the second consecutive 25bps rate cut after a 25bps cut in November and a 50bps cut in September. However, the tone was increasingly hawkish, and the policymakers also signaled for slower pace of rate cuts going forward. It has now penciled just two 25bps rate cuts in 2025, down from an earlier projection of four 25bps rate cut amidst risk of rising inflation.

The United States GDP grew at 3.1% in Q3 of 2024, much higher than the estimates of 2.8%. The Q2 GDP growth of 3%was largely due to revision of exports and consumer spending which was supported by a healthy job market. The US inflation has been sticky in the last several months with November print at 2.7%. The Fed cut the benchmark rates by 25bps in December, marking the second consecutive 25bps rate cut after a 25bps cut in November and a 50bps cut in September. However, the tone was increasingly hawkish, and the policymakers also signaled for slower pace of rate cuts going forward. It has now penciled just two 25bps rate cuts in 2025, down from an earlier projection of four 25bps rate cut amidst risk of rising inflation.

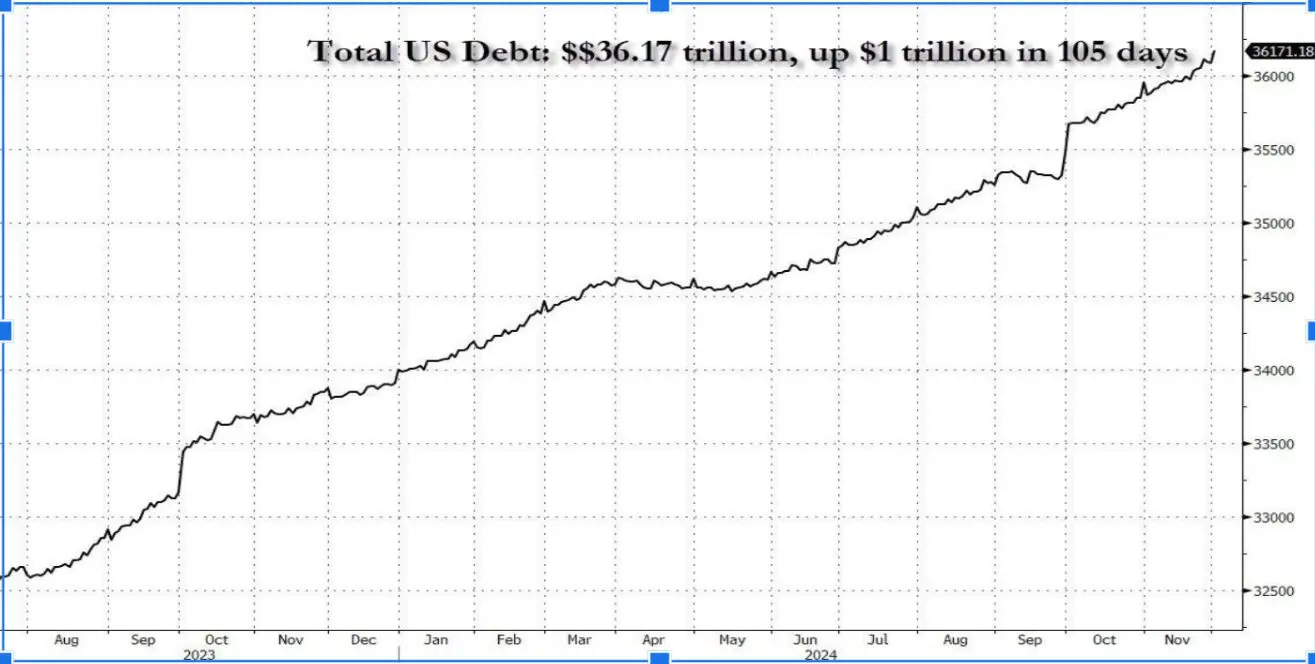

The Fed chairman Jerome Powell in his press conference post the monetary policy mentioned that the economy grew faster than expected in the second half of 2024. But what is fueling this growth? One possibility is an increase in debt. As can be seen in the graph below, the total US debt saw a spike in September and rose ~$1 trillion in just over 100 days.

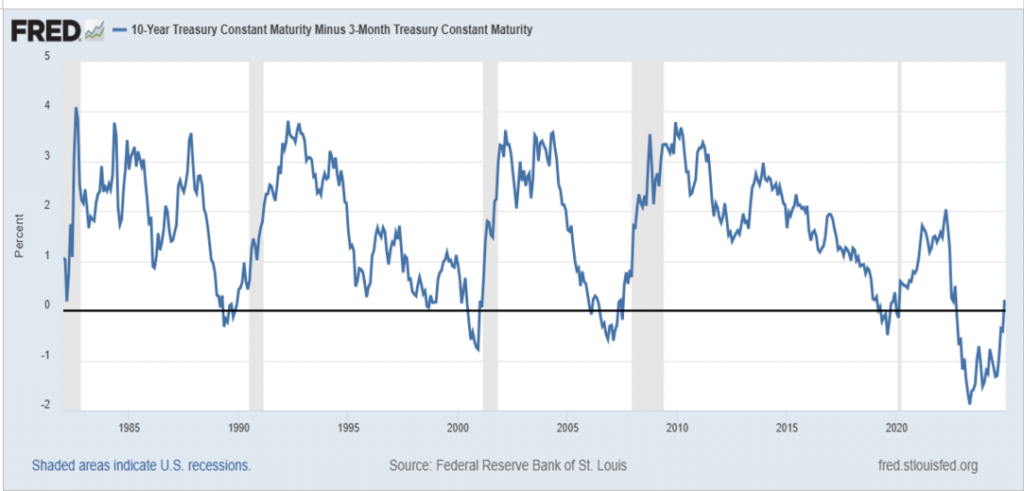

According to CRFB, the interest expense on the US debt was $882 billion. This was more than the expenses on national defense or Medicare and was the second largest federal expenditure after social security in FY2024. This has further increased to more than $1 trillion this year, up 30% from the previous year. The US 10-year treasury yield minus US 3-month treasury yield curve has reversed after remaining inverted for over 2 years. The chart below depicts the data from 1982. The shaded regions are the period of US recession. Since 1965, there are 8 instances of the curve going reversed after remaining inverted. 7 out of 8 times it has led to a recession, and on an average, it has taken ~6months on average for a recession to take hold.

Post Trump’s victory, the global macro setting is no longer the same. DXY, US bond yields and Bitcoin are up, and the odds of a trade war between the US and China are high. If Trump goes on to impose 60% (or some other very high) tariffs on Chinese imports, as proposed, thenChina will consider devaluing the yuan which could lead to other EMs devaluing their currency in response, eventually leading to a currency crisis. India’s inflation preparedness is relatively poor, and rupee devaluation will certainly increase inflation. In China, hopes of fiscal and monetary stimulus have risen after the Politburo meeting, although we are sceptical of any major stimulus getting announced. Chinese 10-year bond yields have fallen to record lows amidst expectation of rate cuts by PBoC, and resultantly the Yuan has weakened, which will ultimately benefit China if Trump’s planned tariffs are indeed imposed.

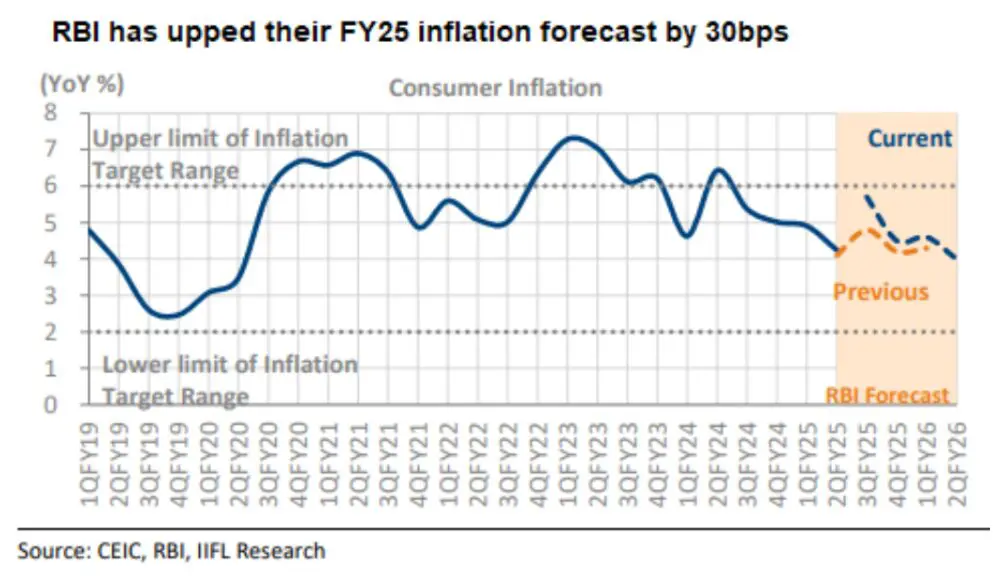

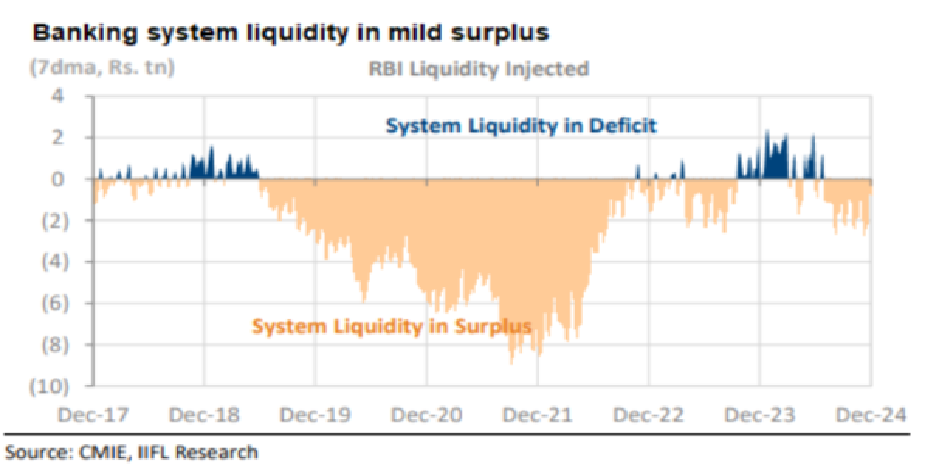

Coming to India, India’s 2Q real GDP growth on the other hand came at 5.4% Y-o-Y (GVA 5.6%), much below IIFLe/consensus of 6.5%. Manufacturing was the worst hit and grew just 2.2% Y-o-Y v/s 7% in 1Q. Government consumption expenditure picked up and grew 4.4% (v/s -0.2% in 1Q due to elections). Investments, which had driven growth so far, grew only 5.4% as the Centre and State government capex was down 15%/11% Y-o-Y in 1HFY25. Centre capex did not pick up even in Oct and is down by 15% Y-o-Y in Apr-Oct FY25 YTD. The central government has achieved only 42% of its FY25 budgeted capex and to meet its target, capex needs to grow by 60% in Nov-March. RBI decided to keep policy rate unchanged in the December policy meet but cut CRR by 50bps and lowered its GDP growth forecast to more reasonable levels of 6.6% for FY25. India’s CPI inflation cooled to 5.48% in November after reaching 6.21% in October. Although it was still above the RBI’s target of 4%, it has kept the hopes for a rate cut alive. Food inflation remained high at 9%, though vegetable prices cooled significantly due to good kharif harvest.

The 50bps cut in CRR brings it back to the pre-covid level of 4%. Although it will bring the necessary boost to the durable liquidity in the system (~Rs1.16trn), we expect liquidity to be tight as USD can strengthen further in 2025. In such a scenario, we estimate 4-5bps of NIM and 0.5-1% PAT benefit for banks and expect PSU banks with low LDR to be a key beneficiary. In terms of second order impact, we expect retail term deposit rates to have peaked out and bulk deposit rates to ease.

To conclude, the current global economic environment remains challenging due to the change in the US government, possible trade wars, geopolitical tensions, uncertain inflation and GDP growth, leading to a cloud over future interest rates. This has led to heightened volatility in the financial market. In such an environment, we expect banks and HFCs to navigate successfully as a delayed and shallow repo rate-cut cycle is an incremental positive for them. We expect central government capex activity to pick up in the coming months, supporting GDP growth & rural employment and benefiting capital goods & construction companies.

Jayesh Bhanushali

Fund Manager – Equities

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.