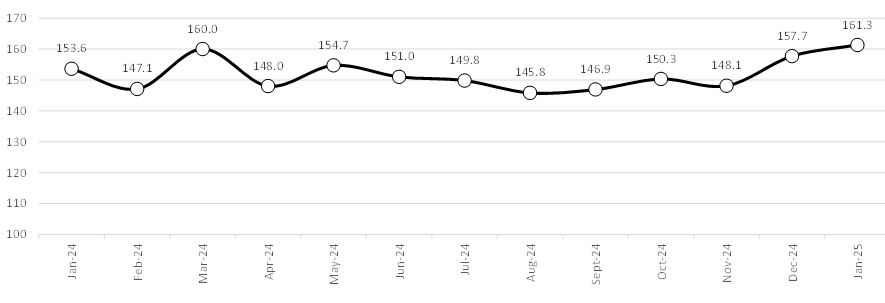

The January 2025 Index of Industrial Production (IIP) growth rate increased to 5% YoY, well ahead of the 3.4% market consensus. That is an impressive rebound from the 3.5% growth recorded in December 2024 and pushes the IIP to a year high. The surge was led by recovery across several major manufacturing industries, showing that industrial activity remains resilient.

*IIP data is reported with a lag of 40 days and undergoes changes. The recent months are still estimates and will be revised over the next two months.

Figure: IIP Trend

Source: mospi

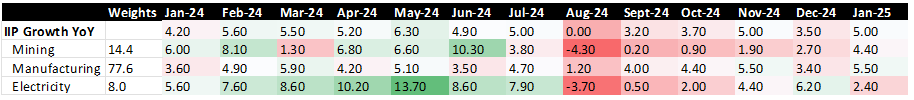

Manufacturing Rebounds; Electricity Weakens

In the industrial sector, there was a divergence across main segments. Manufacturing, the largest component of the IIP, continued its climb towards recovery, accelerating to 5.5% YoY in Jan-2025, from 3.4% in Dec-2024. Its strongest expansion in four months, it also suggests a revival in production activity. However, the electricity sector, which had been expanding steadily since August 2024, moderated at 2.4% YoY in January, down from 6.2% in December, indicative of moderation in power demand too.

Figure: Analysis of IIP Growth YoY – Sectoral Classification

Source: mospi

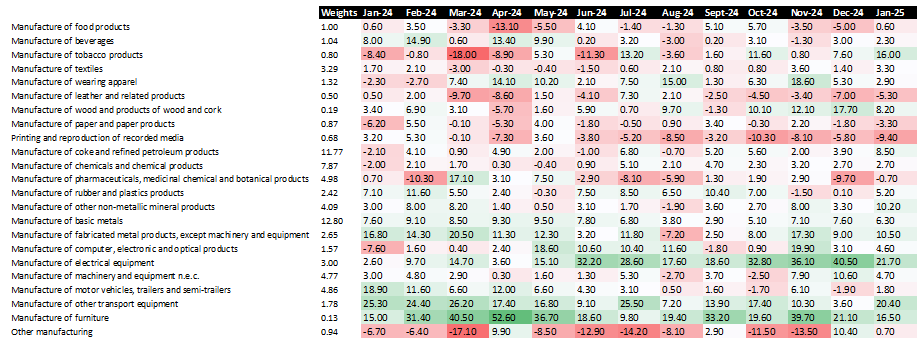

Food & Pharma Weigh Down Manufacturing, But Petchem, Tech & Capital Goods Performed Well

As per sector-wise analysis of manufacturing, in January 2025, 20% of sub-sectors witnessed contraction. Food products advanced to 0.6% YoY, a small recovery from December’s -5% and pharmaceuticals remained weak at -0.7% YoY. The decline in pharmaceuticals happened after a 9.7% decline in December. Such sluggish performances held overall manufacturing expansion back.

But many technology and capital goods sectors showed robust expansion. Computer, electronic and optical products increased by 11.6% YoY while electrical equipment and machinery & equipment were up 4.6% and 4.7%, respectively. This indicates better momentum in tech-driven industries and capital goods. Also, large contributors like refined petroleum products and petchem witnessed sharp growth.

Figure: Trends in Manufacturing – IIP

Source: mospi

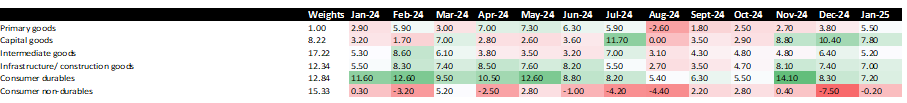

Broad-Based Growth, With the Exception of Non-Durables

Most of the sectors saw strong momentum in January 2025. All major segments were growing in excess of 5% YoY, barring consumer non-durables. Capital goods was up 7.8%, still leading the pack but down a tad. Intermediate goods grew at 5.2%, while consumer durables and infrastructure/construction goods showed robust growth at 7.2% and 7%, respectively.

Consumer non-durables were the only weak spot, however, contracting -0.2% YoY following December’s -7.5% YoY plunge. This prolonged slowdown reads as continued weakness in demand for staple goods, tarnishing an otherwise robust showing for industry.

Figure: Analysis of IIP Growth YoY – Usage Based Classification

Source: mospi

Can this indicate improving capex and discretionary spending?

The stellar industrial outturn for January 2025, with virtually all sectors growing at > 5% yoy, reflects a plethora of factors, including strong investment activity, steady improvement in external demand and sustained infrastructure spending.

Capital goods have been one of the key drivers, with the sector continuing to post strong numbers, hinting at greater capital expenditure by businesses. A 7% YoY growth in the infrastructure and construction goods sector as well indicates ongoing public and private sector outlays toward infrastructure projects, which has positively impacted industrial activity.

The consumer durables goods at 7.2% YoY suggests a resurgence in discretionary consumption, better household sentiments, pickup in exports and steady urban demand. At the same time, 5.5% intermediate goods growth indicates that supply chain bottlenecks have dissipated and production processes are flowing more smoothly between industries.

Still, consumer non-durables continued to weigh on the index, decreasing for a second month in a row. Such continued weakness mirrors muted rural demand and likely price pressures on necessities. With industrial momentum seeming robust, securing a more steady revival in non-durables will be necessary.

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.