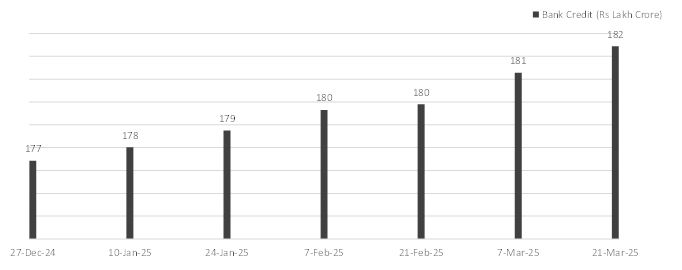

In March 2025, Indian banking sector did not show a pickup in credit growth. As per the latest report, banking credit growth moderated slightly to a year over year growth of 11%. The growth is just under the 13-year average of 11.8% and slows from the higher rates of the last few months. Non-food credit, which makes up the bulk of bank lending, also slowed to 10.9%.

Historical Context and Recent Trends

Over the last 13 years, average banking credit growth for India stood at 11.8% — including both phases of high growth and episodes of slowdown. In March 2017, credit growth fell to a low of 4%. After starting the year with a credit growth of 11.5%, it has moderated to 11% now.

Figure: Total Outstanding Loans/Credit at Indian banks

Source: RBI

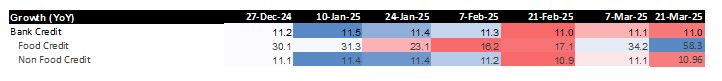

Trends in Food and Non-Food Credit

Food Credit:

Food credit accounts for only 1% of the total banking credit. It includes the credit provided by banks to FCI and other governmental agencies. It has picked up sharply in the first week of March. After experiencing a sharp slowdown in February (16-17% YoY), it has picked increased to 34-58% in March.

Non Food Credit:

Non Food Credit accounts for 99% of the total banking credit. It encompasses loans given to services, industries and personal sectors. It had accelerated in January to 11.4% and decelerated materially in February. In the first week of March, it has shown a modest recovery as it improved to 11.1%. However it has fallen to a tad below 11% now.

Why is the credit growth decelerating?

Inflation & Wage Growth:

While Inflation is moderating, it has been persistently high and wage growth has not kept pace with it. This has had a detrimental impact on consumption. Retail loans have been among the faster growing categories. A likely slowdown is impacting overall credit growth.

Higher RBI Scrutiny:

There has been higher RBI scrutiny over loans to NBFCs. As they have also been a fast growing category of loans, the higher scrutiny and concomitant slowdown has likely impacted overall credit growth.

Macro Worries & Economic Slowdown:

Macro factors including a slowdown in major economies, a depreciating INR and the ongoing worries about a tariff war have also likely contributed to a slowdown in economic activity.

Liquidity Conditions:

Domestic liquidity conditions have been tight due to many reasons. Lesser government spending, tax outflows and RBI’s interventions to shore up the INR have been among the key reasons. RBI has acknowledged the issue and has been trying to improve liquidity. For instance, RBI announced a significant liquidity infusion of more than USD21bn in March.

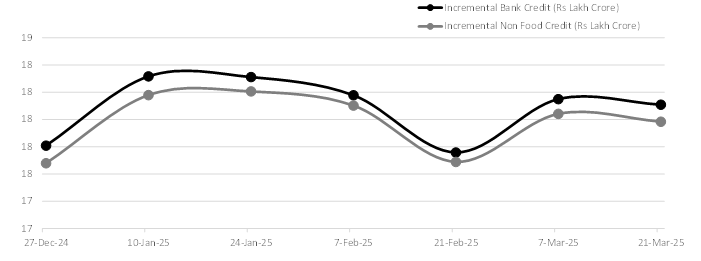

Figure: Incremental Credit at Indian Banks

Source: RBI

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.