In the last week (week ending June 27, 2025), Indian stock market indices traded mostly bullish and closed in the green. The broad-based NIFTY 50 index gained 2.09% on strong performances by HDFC Bank, Reliance Industries, and ICICI Bank. Nifty Midcap index too did well, gaining 2.74 % during the week. Banking and Energy were the top performing sectoral indices. Notably, Banking stocks gained in 4 of the past 5 weeks. On the other hand, IT and Realty indices witnessed selling pressure and were the worst performing indices.

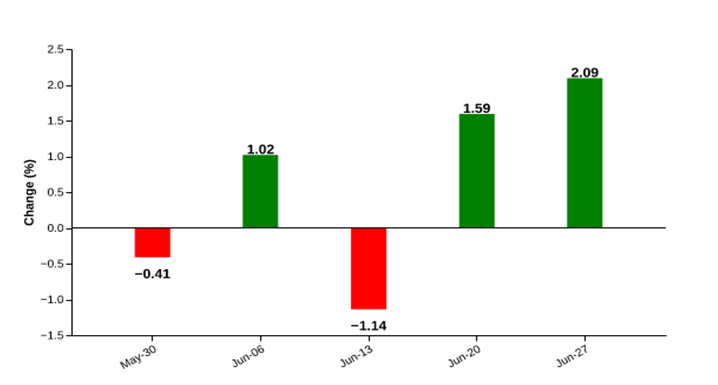

NIFTY 50 – Gains for 2nd consecutive week

Weekly Performance: 2.1%

| date | open | high | low | close |

| 2025-06-27 | 25576.7 | 25654.2 | 25523.6 | 25637.8 |

| 2025-06-26 | 25268.9 | 25565.3 | 25259.9 | 25549.0 |

| 2025-06-25 | 25150.3 | 25266.8 | 25125.1 | 25244.8 |

| 2025-06-24 | 25179.9 | 25317.7 | 24999.7 | 25044.3 |

| 2025-06-23 | 24939.8 | 25057.0 | 24824.8 | 24971.9 |

| 2025-06-20 | 24787.7 | 25136.2 | 24783.7 | 25112.4 |

Source: NSE

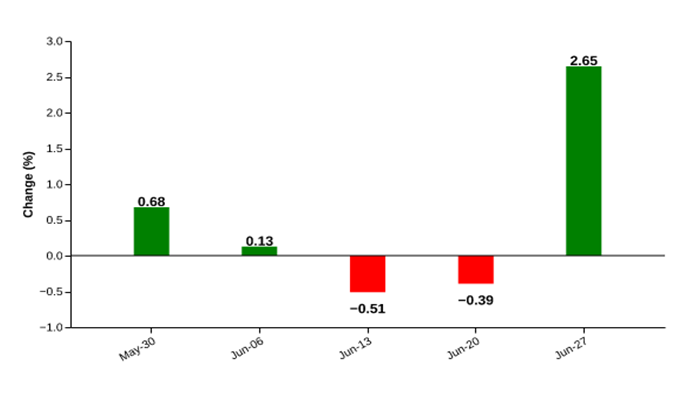

Figure: Recent performance

Source: NSE

NIFTY 50 index closed the week 2.09% higher. This is the second consecutive week that the index has ended in the green. It was led by the likes of HDFC Bank, Reliance Industries, ICICI Bank, Bharti Airtel and Bajaj Finance. HDFC Bank and Reliance Industries contributed significantly as they individually lifted the index by 0.31% and 0.27%, respectively. An analysis of index performance indicates that the index has been positive in three of the last five weeks. Last week’s rally was led by Financials while IT stocks underperformed. .

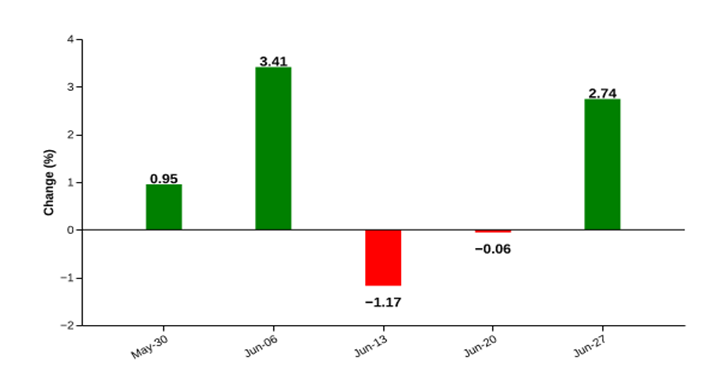

NIFTY MIDCAP SELECT – Strong rebound – Outperforms large caps

Weekly Performance: 2.7%

| date | open | high | low | close |

| 2025-06-27 | 13358.7 | 13468.7 | 13319.5 | 13340.5 |

| 2025-06-26 | 13256.3 | 13315.8 | 13190.9 | 13305.1 |

| 2025-06-25 | 13199.7 | 13238.2 | 13176.8 | 13221.3 |

| 2025-06-24 | 13207.7 | 13236.2 | 13123.3 | 13147.8 |

| 2025-06-23 | 12890.1 | 13080.7 | 12856.1 | 13033.1 |

| 2025-06-20 | 12721.1 | 13013.4 | 12720.8 | 12984.3 |

Source: NSE

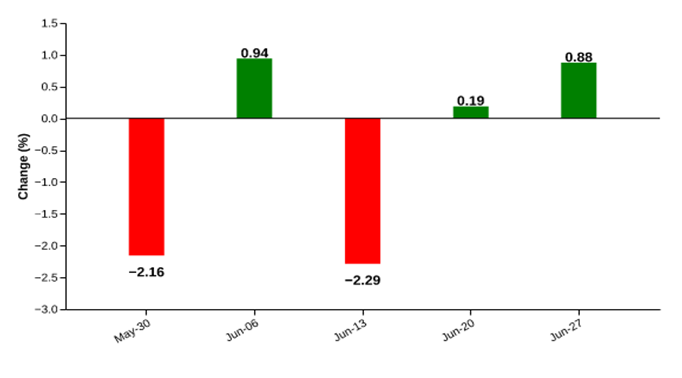

Figure: Recent performance

Source: NSE

It was a rebound week for NIFTY MIDCAP SELECT. After significantly underperforming the large caps the week before, midcaps witnessed buying interest last week. Overall, the index gained 2.74% through the week. Top gainers Polycab, MRF, Ashok Leyland, HPCL and Idea Cellular soared 6% to 12.50%. These five stocks contributed to ~50% of the index gain. Conversely, the top losers were Godrej Properties, Persistent Systems, Colgate-Palmolive and Lupin with a correction of 0.65% to 2.87%. Index breadth was also positive with only 4 declines and 21 advances.

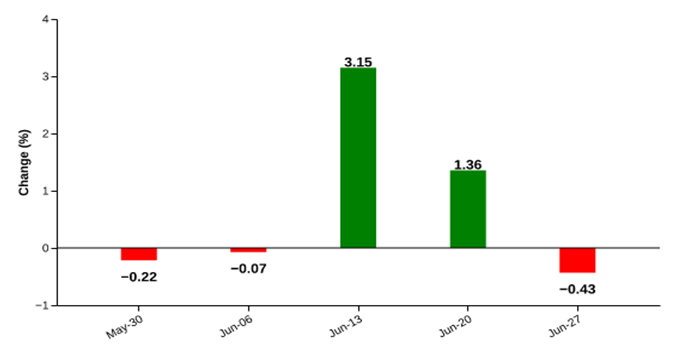

NIFTY IT – Lackluster Performance as profit booking dominates

Weekly Performance: -0.4%

| date | open | high | low | close |

| 2025-06-27 | 39125.8 | 39357.8 | 38707.1 | 38822.9 |

| 2025-06-26 | 38996.6 | 39103.4 | 38760.1 | 38996.2 |

| 2025-06-25 | 38635.0 | 39109.2 | 38605.5 | 39046.3 |

| 2025-06-24 | 38852.6 | 38936.6 | 38380.0 | 38417.9 |

| 2025-06-23 | 38642.1 | 38646.5 | 38278.7 | 38414.1 |

| 2025-06-20 | 38674.2 | 39041.1 | 38454.1 | 38991.4 |

Source: NSE

Figure: Recent performance

Source: NSE

NIFTY IT index settled with a loss of 0.43% last week. There were only two stocks that gained in the 10 stock index. Shares of Coforge rose 3.68% while Mphasis gained 3.85%. Among the key losers were Infosys, Tech Mahindra and HCL Technologies as each of them fell ~1% each. The fall happened despite strong FII inflows and a rally in US indices. It indicate there was likely profit booking after two weeks of strong performance. In the past five week, while the index witnessed strong gains in 3, it registered modest losses in two of them.

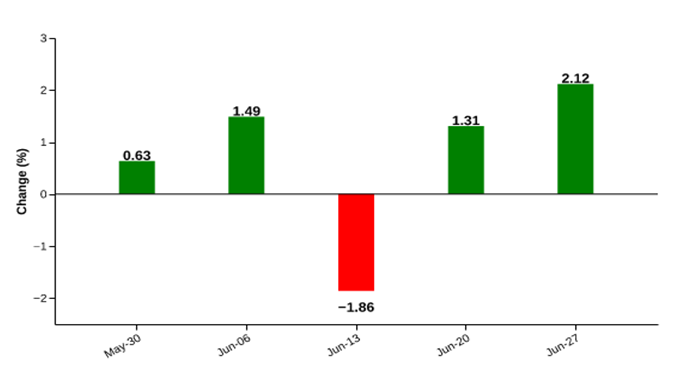

NIFTY BANK – A key driver of overall market performance

Weekly Performance: 2.1%

| date | open | high | low | close |

| 2025-06-27 | 57234.7 | 57475.4 | 56993.9 | 57443.9 |

| 2025-06-26 | 56693.6 | 57263.4 | 56558.4 | 57206.7 |

| 2025-06-25 | 56564.5 | 56681.4 | 56420.6 | 56621.1 |

| 2025-06-24 | 56529.4 | 56862.0 | 56276.1 | 56461.9 |

| 2025-06-23 | 55832.4 | 56233.6 | 55779.2 | 56059.4 |

| 2025-06-20 | 55566.7 | 56328.2 | 55566.4 | 56252.9 |

Source: NSE

Figure: Recent performance

Source: NSE

Ending the week as among the top performing indices was the NIFTY BANK, which gained 2.12% over the previous week. None of the index stocks witnessed a decline as both the PSU and Private Sector heavyweights rallied strongly. Among the PSUs, Canara Bank, PNB and Bank of Baroda gained 3% to 3.5% each. HDFC Bank, ICICI Bank and Kotak Bank witnessed 2% to 2.5% gains. The index has closed positive in 4 of the past 5 weeks – indicating continued buying interest in Indian Banks. The strong performance is also likely driven by continued strong FII flows in Indian markets.

NIFTY ENERGY – Reverses prior week’s loss and gains strongly

Weekly Performance: 2.6%

| date | open | high | low | close |

| 2025-06-27 | 36300.7 | 36707.6 | 36289.6 | 36542.6 |

| 2025-06-26 | 35885.6 | 36208.9 | 35873.6 | 36179.1 |

| 2025-06-25 | 35923.1 | 35974.4 | 35765.4 | 35820.6 |

| 2025-06-24 | 35836.7 | 35952.8 | 35627.4 | 35727.1 |

| 2025-06-23 | 35361.0 | 35711.0 | 35280.1 | 35608.9 |

| 2025-06-20 | 35248.6 | 35760.4 | 35181.1 | 35600.2 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY ENERGY index had a robust performance for the week ended June 27, 2025 after two weeks of downward trend and closed up 2.65%. Adani group stocks witnessed significant rallies and were up 7-10%. HPCL was the top performer and gained 11%. Heavyweights – Suzlon, Reliance and Gail also added 100 bps to the index gains. On the other hand, ONGC lost heavily (-3.6%) and was a major drag on the index. Among other top losers were Oil India, CG Power, Siemens and Thermax. Overall, the index had positive market breadth as only 7 stocks declined in the 40 stock index.

FMCG NIFTY – Extends prior week’s gains

Weekly Performance: 0.9%

| date | open | high | low | close |

| 2025-06-27 | 55246.5 | 55298.4 | 55044.8 | 55109.0 |

| 2025-06-26 | 54882.8 | 55165.9 | 54709.2 | 55118.8 |

| 2025-06-25 | 54575.2 | 54892.4 | 54518.4 | 54747.2 |

| 2025-06-24 | 54597.0 | 54792.9 | 54303.3 | 54346.3 |

| 2025-06-23 | 54395.3 | 54459.1 | 54066.1 | 54226.9 |

| 2025-06-20 | 54316.9 | 54690.1 | 54265.7 | 54630.9 |

Source: NSE

Figure: Recent performance

Source: NSE

The FMCG index gained 0.88% for the week ended June 27, 2025 continuing its up move for the week. ITC Hotels was the top performer with a 6% gain. Nestle India, Britannia Industries, Marico, Tata Consumer Products, and Dabur India were the other big gainers on the index and together contributed 0.96% to the index’s gain. On the contrary, the top drags were United Spirits, Godrej Consumer Products, Colgate-Palmolive, Radico Khaitan, and P&G Hygiene and Health Care, collectively pulling the index down by 0.16 %. The index has been volatile in the recent past. While it gained in three of the past five weeks, the gains were modest compared to heavy losses of 2%+ in the losing weeks.

NIFTY AUTO – Performance improved with 2 consecutive weeks of gains

Weekly Performance: 1.4%

| date | open | high | low | close |

| 2025-06-27 | 23994.2 | 24142.7 | 23937.9 | 24007.9 |

| 2025-06-26 | 23883.1 | 23979.2 | 23768.9 | 23961.7 |

| 2025-06-25 | 23725.1 | 23848.8 | 23668.1 | 23827.8 |

| 2025-06-24 | 23670.9 | 23885.3 | 23572.3 | 23598.2 |

| 2025-06-23 | 23526.0 | 23615.2 | 23360.8 | 23461.2 |

| 2025-06-20 | 23462.9 | 23720.2 | 23403.7 | 23679.3 |

Source: NSE

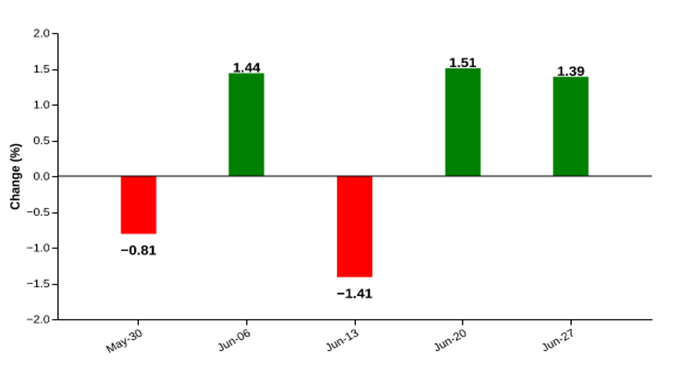

Figure: Recent performance

Source: NSE

At the close of the week, the NIFTY AUTO gained by 1.39%. MRF, Ashok Leyland and TVS Motors were the top performers – with each gaining 4.5% to 6.5%. On the other hand, Maruti and Hero Motors lost 0.4% to 1% and were bottom performers. Market breadth was positive as 12 shares advanced while 3 fell. After falling 0.81% for the week ending 2025-05-30 the index has been advancing and has gained in three of the last four weeks.

NIFTY PHARMA – Upwards Momentum Intact after last week’s pause

Weekly Performance: 1.5%

| date | open | high | low | close |

| 2025-06-27 | 21850.8 | 22001.0 | 21823.6 | 21928.6 |

| 2025-06-26 | 21835.9 | 21860.8 | 21665.3 | 21808.2 |

| 2025-06-25 | 21749.8 | 21832.4 | 21708.4 | 21804.8 |

| 2025-06-24 | 21728.2 | 21864.3 | 21655.8 | 21672.1 |

| 2025-06-23 | 21531.3 | 21672.7 | 21460.8 | 21626.2 |

| 2025-06-20 | 21443.7 | 21642.7 | 21424.8 | 21613.0 |

Source: NSE

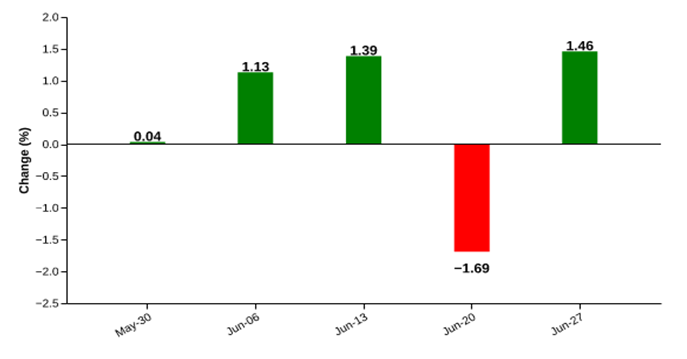

Figure: Recent performance

Source: NSE

The NIFTY PHARMA index closed the week with a gain of 1.46% over the previous week. Laurus Labs, Torrent Pharmaceuticals, Abbott India and Glenmark Pharmaceuticals were the top gainers on the index. They accounted for more than 50% of index total gains. Abbott and Laurus Labs witnessed significant rallies and were up 10% and 8% respectively. The top laggards on the list, on the other hand, were Dr. Reddy’s Laboratories, Lupin, IPCA Laboratories and Ajanta Pharma. Each of them fell 1.8% to 2.6%. Overall market breadth was positive as 16 advanced while only 4 fell. Notably, the index gained in 4 of the past 5 weeks indicating strong buying interest in the recent past.

NIFTY REALTY – Weak performance continues

Weekly Performance: -1.9%

| date | open | high | low | close |

| 2025-06-27 | 1013.0 | 1017.3 | 991.5 | 994.0 |

| 2025-06-26 | 1021.2 | 1022.5 | 999.3 | 1009.5 |

| 2025-06-25 | 1019.9 | 1021.2 | 1009.7 | 1019.7 |

| 2025-06-24 | 1024.6 | 1029.6 | 1012.8 | 1014.2 |

| 2025-06-23 | 1006.8 | 1018.2 | 1003.7 | 1012.7 |

| 2025-06-20 | 994.2 | 1018.0 | 993.8 | 1013.7 |

Source: NSE

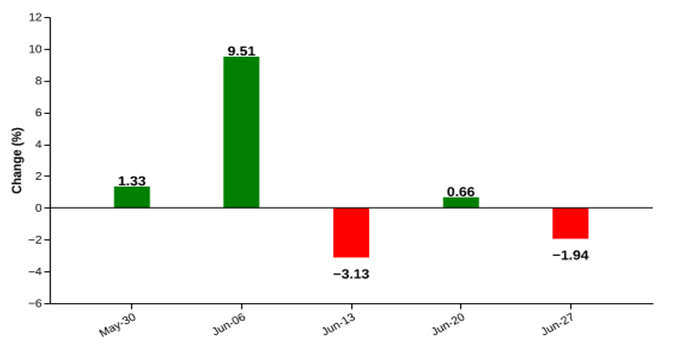

Figure: Recent performance

Source: NSE

The NIFTY REALTY corrected significantly as it fell 1.94% in the week ended June 27, 2025. Almost all of the stocks fell as investors continued to book strong profits after the gain in the 1st week of June. Only Raymond bucked the trend and was up 6.27%. Top losers were Lodha, Prestige, Godrej Properties, and Brigade Enterprises, with Lodha falling 4.11%. An analysis of recent performance shows that the index had witnessed a sharp rise in the week ended June 6th – when the RBI had announced its jumbo rate cut. Subsequently, it witnessed a week of profit booking. While it recovered modestly in the week of 20th June 2025, it again witnessed profit booking in the week of 27th June 2025.

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.