Liquidity Without Lending: What the Surge in SDF Usage Is Telling Us

Over the past few weeks an obscure yet potent signal in India’s monetary system has quietly surged to its highest in several years: the Standing Deposit Facility (SDF). For those tracking liquidity trends, this is not a minor technical noise, it’s a signal of how uneven the credit dynamics in the Indian banking system are becoming.

The SDF: RBI’s Passive Liquidity Absorber

The SDF is a non-collateralised instrument which the banks can use for parking their surplus funds at the RBI and earn interest at a slightly lower rate than the repo. It was implemented in April 2022 as a cleaner and more efficient alternative to the conventional reverse repo.

Unlike reverse repo, the SDF does not mandate the RBI to transfer government securities as collateral, making it a more efficient tool to absorb liquidity. This has now become the de-facto floor of the RBI’s LAF corridor.

The Quick Rise: A Look at the Increase in SDF Balances

A rapid acceleration in the RBI’s daily SDF started in April 2025. 20D average SDF utilization has increased to nearly INR 2 trn – a high not seen since 2022. This rise is resulting in overall liquidity conditions tightening after the improving conditions witnessed during the early part of 2025.

Figure: SDF utilization surges

Source: RBI

Credit Deposit Ratio eased even as Liquidity Remained tight

In the recent past, Indian banking witnessed high credit growth and rising credit deposit ratio. This had also resulted in tighter liquidity conditions, higher competition for funding and higher funding costs.

As per latest RBI data, CDR has moderated from its recent peak to around 78%. A moderating CDR indicates either the relative pace of credit slowed or deposits picked up or a combination of both happened. A closer look at the net liquidity in the system indicates that the banks parked excess funds in low interest earnings SDF facilities as the demand for credit moderated. Despite the obvious ramification that credit growth might be slowing, a balanced and/or moderate CDR provides operational room to the banks in the event of a pickup in credit growth.

Figure: Banking Credit Deposit Ratio Drops – Improving Liquidity or Moderating Credit?

Source: RBI

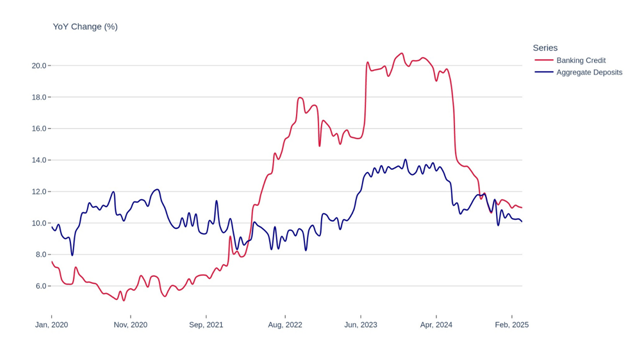

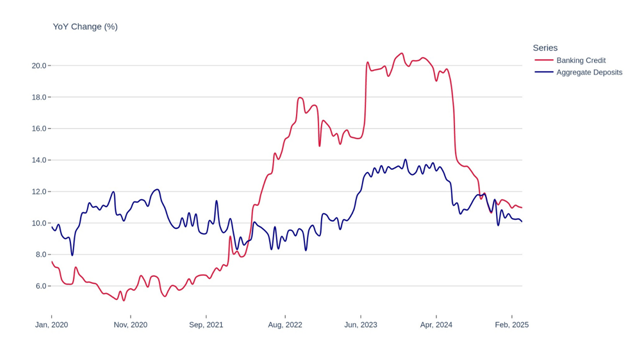

Moderating Credit Growth – Sustainable growth or Slowing economy?

A moderation in credit growth represents a significant change from the excessively hot conditions seen over the last year. During 2024, banking credit had jumped 20% on a year-on-year basis, supported by strong demand from corporates, retail borrowers as well as from services sector. The high pace was unsustainable and carries risks of asset quality deterioration and overheating in pockets of the economy.

Since then, credit growth has tempered to more sustainable levels, 10–12%, as a wider normalization of financial conditions has taken place.

Figure: Credit Growth Moderated to Healthier from Overheated Levels

Source: RBI

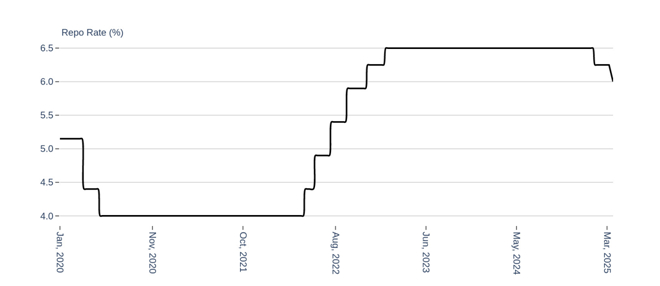

RBI’s Repo Rate Cut: A Strategic Move to Stimulate Economic Growth

The Reserve Bank of India (RBI) cut its benchmark policy interest rate (repo rate) by 0.25% points to 6.00% in April 2025. It is the second rate cut in 2025 year and takes the total cut to 50 basis points. The move signals a shift in RBI’s monetary policy from ‘Neutral’ to ‘Accomodative’.

What is Repo Rate – A Primer

The repo rate is the rate at which the RBI lends to commercial banks. A lower rate of interest reduces the cost of borrowing for banks, and can ultimately mean lower interest rates for loans to consumers and businesses. It is the primary device employed by the RBI to manage the economic activity in the country.

Goals behind a ut in the Repo Rate

Encouraging Credit Demand: By making borrowing cheaper, it encourages households, firms to borrow and spend on consumption and investment goods. That can be particularly good for rate sensitive areas like housing, auto and small business.

Boosting The Economy: Economists say Reserve Bank of India’s cut will help lift economic activity by bringing down the cost of spending and investment.

Inflation Management: The RBI’s move to reduce the repo rate comes against the backdrop of inflation moderating particularly in food prices. Retail inflation dropped, giving the central bank a room to have a more accommodative stance without actually contravening its inflation targets.

Boost Liquidity: The rate reduction is combined with steps to provide liquidity to the banking system so banks have the required cash to lend more money.

Figure: Repo Rate is coming off and policy stance is turning accommodative

Source: RBI

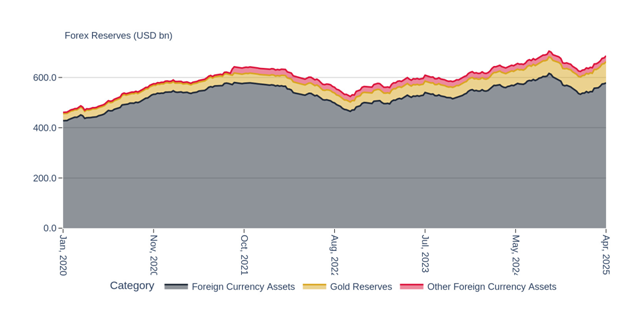

Forex Balances Are Rising Again

India’s forex reserves hit a six-month high of $686.15 billion for the week ending April 18, 2025. This is the seventh straight week of increase in reserves which during the week increased by USD 8.31 bn. The gain since January bottom is more than USD 60 bn. This jump in reserves now puts India within USD 19 bn of the record high of USD 704.89 bn achieved in September 2024.

Figure: India’s Forex Reserves Are Nearing The Previous Peak

Source: RBI

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.