In another disappointing week for the markets, NIFTY fell 0.5%. This is the 4th consecutive week of losses. The fall amongst midcaps was worse as they corrected by more than 1.8%. Among sectoral indices, many witnessed sharp falls. IT and Realty fared the worst as they fell 4% each. Pharma stocks bucked the trend and extended the gains. Financials also recovered, buoyed by healthy earnings from ICICI and HDFC Bank. Overall, a lacklustre week with significant selling pressure across many heavyweight stocks.

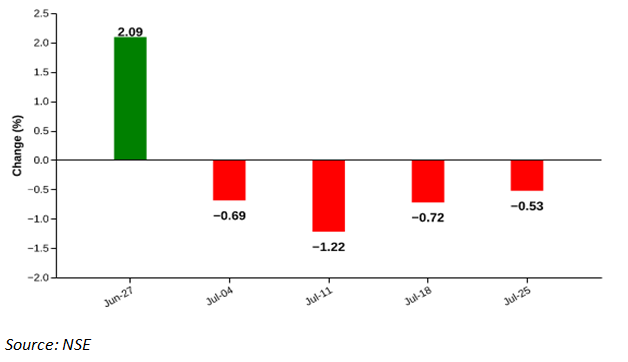

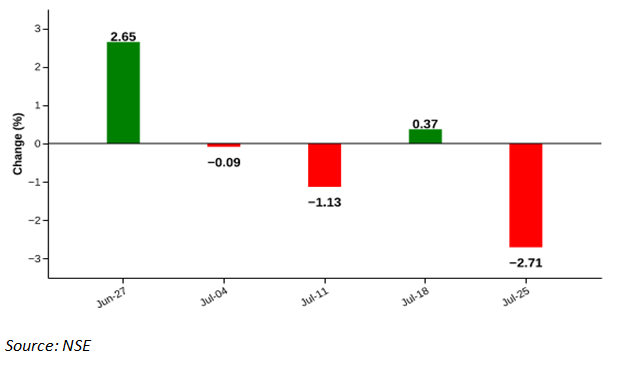

NIFTY 50 – 4th consecutive week of losses

Weekly Performance: -0.5%

| Date | open | High | low | close |

| 2025-07-25 | 25010.3 | 25010.3 | 24806.3 | 24837.0 |

| 2025-07-24 | 25243.3 | 25246.2 | 25018.7 | 25062.1 |

| 2025-07-23 | 25139.3 | 25233.5 | 25085.5 | 25219.9 |

| 2025-07-22 | 25166.7 | 25182.0 | 25035.6 | 25060.9 |

| 2025-07-21 | 24999.0 | 25111.4 | 24882.3 | 25090.7 |

| 2025-07-18 | 25108.6 | 25144.6 | 24918.7 | 24968.4 |

Source: NSE

Figure: Recent performance

The NIFTY 50 INDEX ended the week with another loss of 0.53%. Selling pressure continued in IT. Select FMCG names also witnessed selling pressure. Among the worst performers were Nestle, Trent, Reliance, Tech Mahindra, ITC Hotels and Indusind Bank. All of them lost more than 5% each. A select few bucked the trend and witnessed gains. ICICI Bank was the best performer at 3.5%. NIFTY 50 index has been under a constant selling pressure, exacerbated by lacklustre earnings in heavyweight sectors – IT and Banking. The advance-decline ratio of 0.27 also shows a bearish market breadth, as 37 stocks declined and 13 advanced.

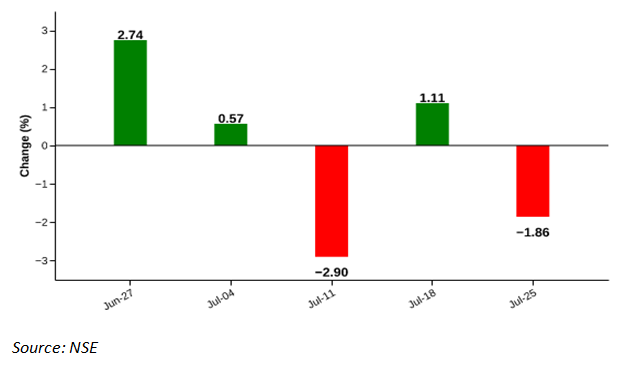

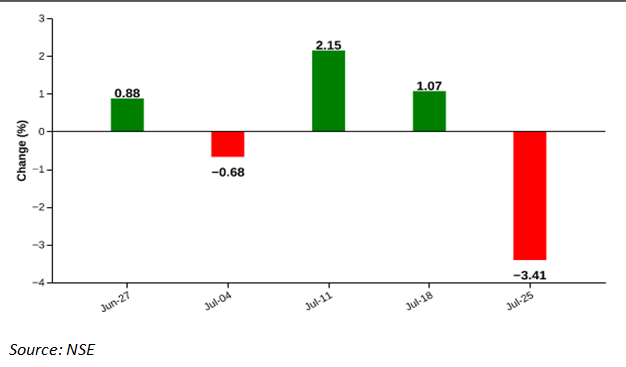

NIFTY MIDCAP SELECT – Underperformance Persists

Weekly Performance: -1.9%

| date | Open | high | low | close |

| 2025-07-25 | 13071.2 | 13110.5 | 12889.6 | 12925.9 |

| 2025-07-24 | 13267.0 | 13267.7 | 13074.5 | 13107.7 |

| 2025-07-23 | 13228.7 | 13284.5 | 13155.2 | 13276.3 |

| 2025-07-22 | 13365.2 | 13366.8 | 13190.2 | 13206.6 |

| 2025-07-21 | 13178.8 | 13312.3 | 13129.8 | 13301.0 |

| 2025-07-18 | 13277.6 | 13283.3 | 13121.2 | 13171.0 |

Source: NSE

Figure: Recent performance

Midcaps witnessed significant profit booking last week. NIFTY MIDCAP SELECT index closed the week with a loss of 1.86%. There were only 3 stocks in the green as the selloff was broad-based. Dixon bucked the trend and was up 4.64%. Top laggards were led by CoForge, Persistent Systems, Colgate Palmolive, AU Small Finance Bank and Mphasis, falling 7.15% to 9.17%.

A recent history of NIFTY MIDCAP performance shows a volatile performance. It had alternating gains and losses in the past 4 weeks. However, while it gained an average of 0.9% in gaining weeks, it lost an average of 2.35% in losing weeks. Overall, midcap stocks continue to witness significant selling pressure.

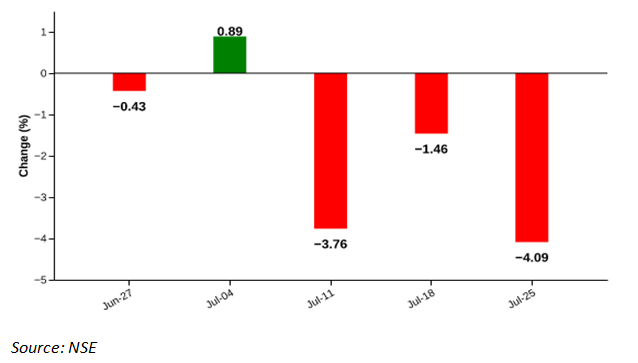

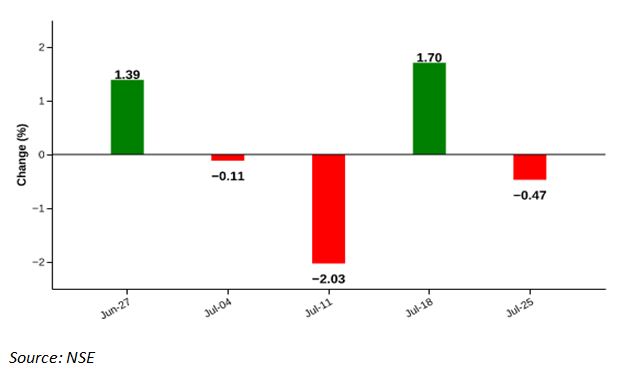

NIFTY IT – Another sharp decline.

Weekly Performance: -4.1%

| date | open | high | low | close |

| 2025-07-25 | 35998.0 | 36271.1 | 35531.6 | 35623.8 |

| 2025-07-24 | 36949.3 | 36974.1 | 36097.6 | 36135.8 |

| 2025-07-23 | 36958.3 | 37086.6 | 36745.2 | 36951.5 |

| 2025-07-22 | 36963.6 | 37121.0 | 36827.4 | 36858.9 |

| 2025-07-21 | 37109.8 | 37164.9 | 36780.1 | 37031.8 |

| 2025-07-18 | 37366.7 | 37419.6 | 36951.9 | 37141.9 |

Source: NSE

Figure: Recent performance

The NIFTY IT index lost 4.09% for the week to close at the lowest level in over 2 months. To date, the index has lost nearly 10%. Midcap stocks, Persistent, Coforge and Mphasis witnessed significant declines due to lacklustre earnings. Each of them was down 7-9%. Infosys was down 4% and was the single biggest drag (-1.26%) on the index. There were no stocks that advanced, indicating an extremely bearish market breadth.

Over the past 5 weeks, the index has closed positive in only one of the weeks and has closed in the red for 3 consecutive weeks.

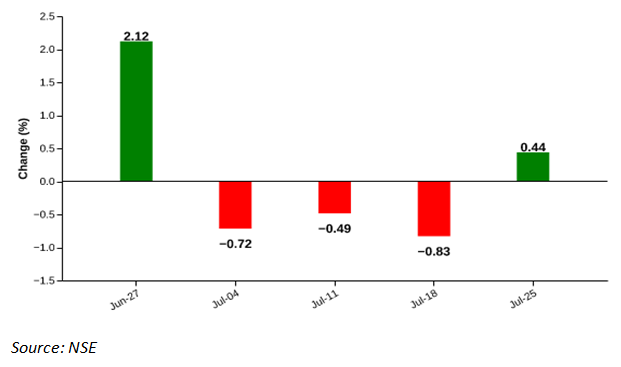

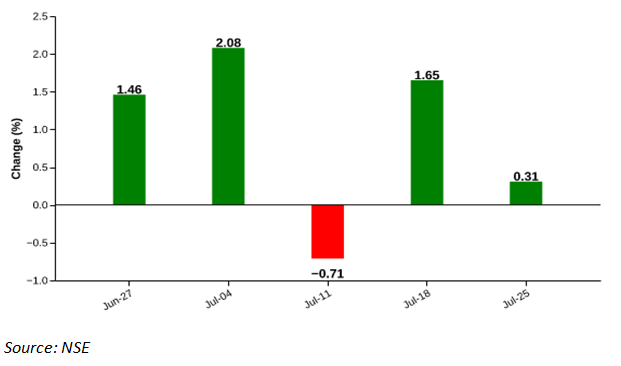

Nifty Bank: Mixed Bag with ICICI and HDFC Leading The Way

Weekly Performance: 0.4%

| date | Open | high | low | close |

| 2025-07-25 | 57170.7 | 57170.7 | 56439.4 | 56528.9 |

| 2025-07-24 | 57316.6 | 57316.6 | 56850.9 | 57066.1 |

| 2025-07-23 | 56918.1 | 57249.0 | 56715.8 | 57210.4 |

| 2025-07-22 | 57253.4 | 57286.1 | 56692.0 | 56756.0 |

| 2025-07-21 | 56558.9 | 56983.4 | 56255.7 | 56952.8 |

| 2025-07-18 | 56524.2 | 56705.1 | 56204.9 | 56283.0 |

Source: NSE

Figure: Recent performance

NIFTY BANK snapped back after 3 consecutive weeks of losses. Healthy earnings from private sector heavyweights – ICICI and HDFC Bank – set the tone for the bounce-back in banking stocks. ICICI was the top performer at 3.6%. HDFC Bank was also up strongly at 2.4%. However, select midcap stocks witnessed selling pressure – IndusInd Bank and AU Bank were the top losers, falling 5.33% and 7.74% respectively.

Performance of the NIFTY BANK index over the last 5 weeks indicates it had negative returns in 3 of the last 5 weeks, with last week’s rally indicating a bounce-back.

NIFTY ENERGY – Lacklustre RIL results worsen the sentiment.

Weekly Performance: -2.7%

| date | open | high | low | close |

| 2025-07-25 | 35967.8 | 36009.7 | 35214.8 | 35250.5 |

| 2025-07-24 | 36319.6 | 36359.2 | 35950.4 | 36048.4 |

| 2025-07-23 | 36276.9 | 36340.5 | 36171.4 | 36302.9 |

| 2025-07-22 | 36296.6 | 36338.6 | 36090.7 | 36198.5 |

| 2025-07-21 | 36210.6 | 36282.3 | 35966.4 | 36248.6 |

| 2025-07-18 | 36502.1 | 36590.0 | 36144.0 | 36231.6 |

Source: NSE

Figure: Recent performance

NIFTY ENERGY index finished negative for the week with a loss of 2.71%. Lacklustre results from RIL added to the negative sentiment. RIL fell 5.7% and was the top drag. JP Power, MGL, Triveni Turbine, IGL and Adani Solar also lost heavily and were down 6% to 12%. Market breadth was extremely bearish as only 5 of the 40 stocks ended in the green. GV T&D, NLC India and Power India were the only stocks that closed above 1%.

The NIFTY ENERGY index has lost heavily in the recent past. It was down in 3 of the past 4 weeks, with a significant loss last week.

NIFTY FMCG – Reverses the gains

Weekly Performance: -3.4%

| Date | open | high | low | close |

| 2025-07-25 | 55046.0 | 55046.0 | 54463.3 | 54579.9 |

| 2025-07-24 | 55859.6 | 56015.5 | 55020.9 | 55085.9 |

| 2025-07-23 | 56163.8 | 56221.3 | 55586.6 | 55710.4 |

| 2025-07-22 | 56286.8 | 56288.6 | 55939.4 | 56003.9 |

| 2025-07-21 | 56496.9 | 56541.8 | 56086.6 | 56222.7 |

| 2025-07-18 | 56943.4 | 56943.4 | 56388.2 | 56506.9 |

Source: NSE

Figure: Recent performance

The NIFTY FMCG index ended the week with a decline of 3.41%, marking a reversal from the previous week’s gains. The index was dragged down by its heavyweights, with ITC, Nestle India, and Hindustan Unilever being the top detractors. ITC’s 3.16% decline was the most significant contributor (due to its large weight) to the index’s fall, followed by Nestle India’s 7.99% drop. On the other hand, United Breweries bucked the trend and was the only gainer, rising 1.54% during the week.

Up until last week, the FMCG index has been among the best-performing indices in July. Healthy pre-earnings commentary from industry majors had set off a sector rotation rally. However, lacklustre earnings led to a sharp fall last week. Barring 1, rest of the stocks ended in the red, indicating a pervasive risk-off rally.

NIFTY AUTO – A modest correction

Weekly Performance: -0.5%

| date | open | high | low | Close |

| 2025-07-25 | 24064.7 | 24078.0 | 23675.9 | 23781.6 |

| 2025-07-24 | 24070.6 | 24226.4 | 24051.2 | 24087.3 |

| 2025-07-23 | 23935.6 | 24157.2 | 23928.2 | 24079.4 |

| 2025-07-22 | 24067.7 | 24090.2 | 23826.9 | 23875.8 |

| 2025-07-21 | 23866.8 | 24075.9 | 23725.1 | 24055.0 |

| 2025-07-18 | 24050.4 | 24182.2 | 23874.2 | 23894.3 |

Source: NSE

Figure: Recent performance

NIFTY AUTO index closed the week with a decline of 0.47%. While the decline was broad-based, 2W stocks performed the worst. They were the worst performers, declining 2.6% to 3.7% for the week. On the other hand, M&M and Tata Motors bucked the trend and rose 1.69% and 1.05%, respectively. MRF also ended in the green with a gain of 0.78%.

NIFTY auto index has been volatile in the recent past. After recovering in the prior week, it witnessed a sharp fall, led by 2-wheeler majors last week. The upcoming week will have the keenly watched vehicle sales numbers.

NIFTY PHARMA – Extends its gains

Weekly Performance: 0.3%

| date | open | high | low | Close |

| 2025-07-25 | 22525.6 | 22715.9 | 22440.1 | 22662.7 |

| 2025-07-24 | 22457.2 | 22618.7 | 22455.1 | 22541.1 |

| 2025-07-23 | 22326.1 | 22436.1 | 22297.4 | 22417.4 |

| 2025-07-22 | 22529.1 | 22570.4 | 22275.5 | 22307.2 |

| 2025-07-21 | 22567.9 | 22615.2 | 22439.2 | 22531.8 |

| 2025-07-18 | 22713.6 | 22720.3 | 22511.7 | 22592.8 |

Source: NSE

Figure: Recent performance

The NIFTY PHARMA index bucked the trend and closed in the green. For the week, it was up 0.31%. Major gainers in the index were Cipla, Dr. Reddy’s Laboratories and Torrent Pharmaceuticals that added 3.4%, 1.6% and 2.3%, respectively. On the other hand, the top losers were Divi’s Laboratories, Glenmark Pharmaceuticals, and Natco Pharma that fell 1.71 %, 3.60 % and 6.52 %, respectively.

Performance of NIFTY PHARMA Index over the last 5 weeks indicates a strong shift in allocation towards pharma stocks. It witnessed strong gains in 4 of the past 5 weeks, during which a majority of the indices witnessed a decline. The advance-decline ratio in the last week was also in favor of advances, indicating a broad-based buying.

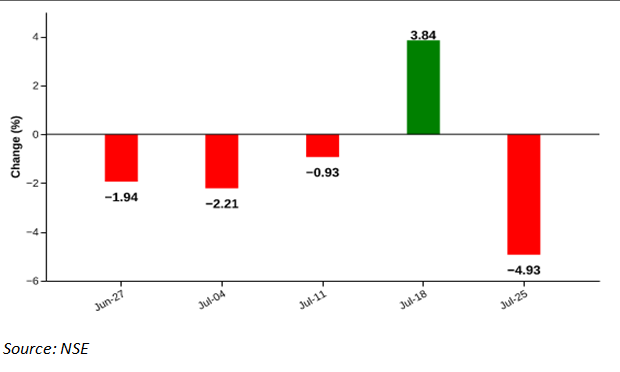

NIFTY REALTY – A Sharp Correction

Weekly Performance: -4.9%

| date | open | high | low | close |

| 2025-07-25 | 957.0 | 966.7 | 947.9 | 950.6 |

| 2025-07-24 | 970.8 | 972.0 | 954.3 | 960.1 |

| 2025-07-23 | 986.9 | 987.4 | 965.9 | 970.2 |

| 2025-07-22 | 1007.9 | 1009.3 | 993.8 | 996.0 |

| 2025-07-21 | 1000.9 | 1007.2 | 996.0 | 1006.2 |

| 2025-07-18 | 1005.5 | 1007.7 | 995.2 | 999.9 |

Source: NSE

Figure: Recent performance

The NIFTY REALTY closed the week as among the worst-performing indices. It fell by 4.93% as all stocks except 1 in the realty index witnessed selling. The biggest drags on the index were Lodha, Godrej Properties, Oberoi Realty, Prestige and DLF, which together were a drag on the index by 4.58%. On the other hand, Phoenix Mills was the only gainer at 2.6%.

NIFTY REALTY index fell in 4 of the past 5 weeks and continues to see continued selling pressure. Last week’s sharp fall was also accompanied by a weak market breadth.

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.