India’s CPI inflation rose modestly to 0.71% in November 2025, from 0.25% in October, marking a mild sequential rebound after a phase of broadly lower inflation every month. Despite the uptick, headline inflation remains at very low levels, having declined sharply from a peak of 5.22% in December 2024. Food, the largest component of the CPI basket (45.52% weight), continues to play a decisive role in shaping headline inflation. Other major components include miscellaneous (28.30%), housing (10.07%), and apparel (6.53%), which keep inflation momentum sensitive to food and housing trends.

Figure: CPI – A 3-year history

| date | YoY (%) |

| Dec-2024 | 5.22 |

| Jan-2025 | 4.26 |

| Feb-2025 | 3.61 |

| Mar-2025 | 3.34 |

| Apr-2025 | 3.16 |

| May-2025 | 2.82 |

| Jun-2025 | 2.1 |

| Jul-2025 | 1.61 |

| Aug-2025 | 2.07 |

| Sep-2025 | 1.44 |

| Oct-2025 | 0.25 |

| Nov-2025 | 0.71 |

Figure: CPI – Components

| date | Category | YoY (%) |

| 01/11/25 | CPI.Alcohol_Tobacco_And_Narcotics | 2.96 |

| 01/11/25 | CPI.Apparel | 1.49 |

| 01/11/25 | CPI.Food | -2.78 |

| 01/11/25 | CPI.Housing | 2.95 |

| 01/11/25 | CPI.Miscellaneous | 5.64 |

Source: MOSPI

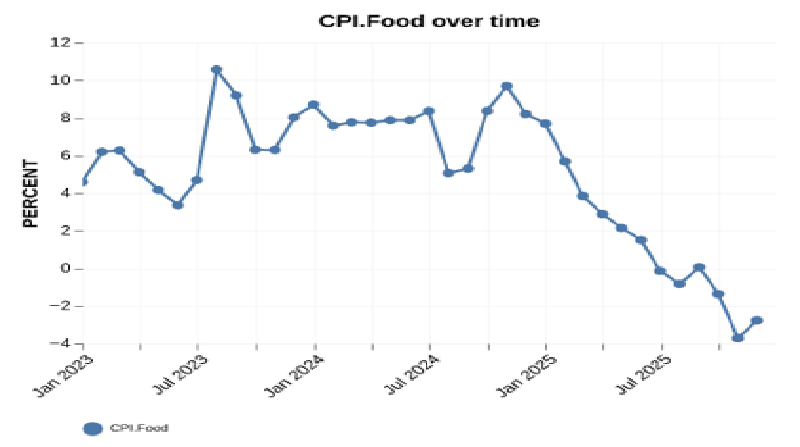

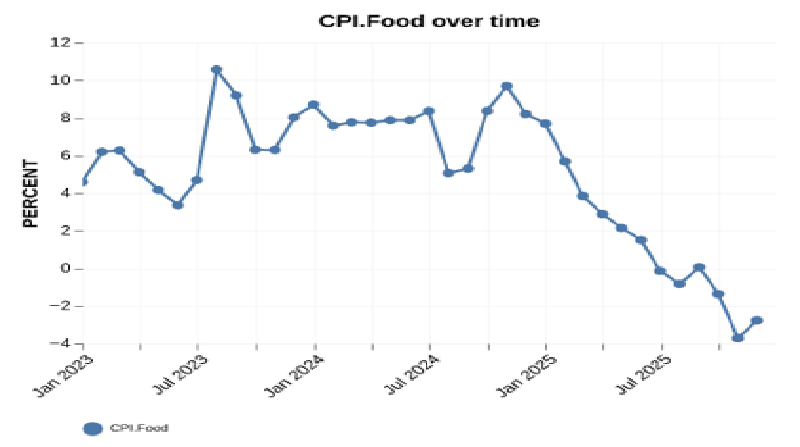

CPI.Food – India’s Food Inflation Remains Deflationary

Food inflation remained in deflationary territory in November 2025, easing to -2.78% from -3.72% in October. Vegetables (-22.2%) continue to witness sharp deflation. In addition, deflation persisted in Grains and Sugars/Spices. Among other components, edible oils showed moderating inflation while it picked up in Meat and Eggs. Inflation remained almost unchanged in Fruits and Dairy.

Figure: CPI.Food – A 3-year history

| date | YoY (%) |

| Dec-2024 | 7.69 |

| Jan-2025 | 5.68 |

| Feb-2025 | 3.84 |

| Mar-2025 | 2.88 |

| Apr-2025 | 2.14 |

| May-2025 | 1.5 |

| Jun-2025 | -0.15 |

| Jul-2025 | -0.84 |

| Aug-2025 | 0.05 |

| Sep-2025 | -1.37 |

| Oct-2025 | -3.72 |

| Nov-2025 | -2.78 |

Source: MOSPI

Figure: CPI.Food – Components

| date | Category | YoY (%) |

| CPI.Dairy | Nov-2025 | 2.45 |

| CPI.Edible_Oils | Nov-2025 | 7.87 |

| CPI.Eggs | Nov-2025 | 3.77 |

| CPI.Fruits | Nov-2025 | 6.87 |

| CPI.Grains | Nov-2025 | -3.29 |

| CPI.Meat | Nov-2025 | 4.0 |

| CPI.Packaged_Food | Nov-2025 | 3.65 |

| CPI.Poultry | Nov-2025 | 0.38 |

| CPI.Seafood | Nov-2025 | 3.25 |

| CPI.Sugars_And_Spices | Nov-2025 | -1.23 |

| CPI.Vegetables | Nov-2025 | -22.2 |

Source: MOSPI

Core_CPI – India’s Core CPI Cools Slightly, Yet Inflation Remains Resilient

Core CPI inflation in November 2025 eased slightly to 4.62%, compared with 4.70% in October, indicating a modest moderation in underlying inflation pressures. Despite the sequential dip, core inflation remains elevated and broadly range-bound in the 4.4–4.7% band after peaking around 4.74% in mid-2025. This suggests continued resilience in non-food, non-energy prices even as headline CPI remains subdued.

Figure: Core_CPI – A 3-year history

Source: MOSPI

| date | YoY (%) |

| Dec-2024 | 3.91 |

| Jan-2025 | 4.0 |

| Feb-2025 | 4.36 |

| Mar-2025 | 4.44 |

| Apr-2025 | 4.43 |

| May-2025 | 4.56 |

| Jun-2025 | 4.74 |

| Jul-2025 | 4.41 |

| Aug-2025 | 4.41 |

| Sep-2025 | 4.59 |

| Oct-2025 | 4.7 |

| Nov-2025 | 4.62 |

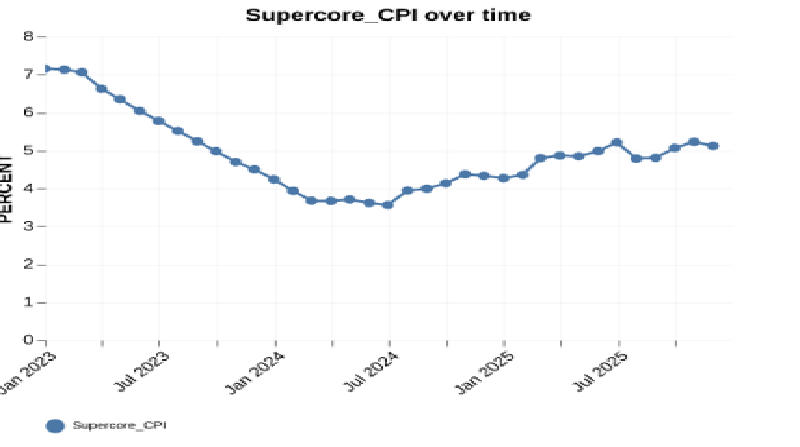

Supercore_CPI – India’s Supercore CPI Eases Slightly, Yet Remains Sticky

Supercore excludes housing-related components from Core CPI. Supercore CPI inflation eased to 5.12% in November 2025, compared with 5.22% in October, indicating a modest sequential moderation. A significant part of the inflation is due to inflation in precious metals like Gold and Silver..

Figure: Supercore_CPI – A 3-year history

Source: MOSPI

| date | YoY (%) |

| Dec-2024 | 4.26 |

| Jan-2025 | 4.35 |

| Feb-2025 | 4.8 |

| Mar-2025 | 4.86 |

| Apr-2025 | 4.84 |

| May-2025 | 4.98 |

| Jun-2025 | 5.21 |

| Jul-2025 | 4.78 |

| Aug-2025 | 4.8 |

| Sep-2025 | 5.06 |

| Oct-2025 | 5.22 |

| Nov-2025 | 5.12 |

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.