FPI flows continued to be negative in the week ended 12 December 2025, with foreign investors withdrawing INR 112.6 billion, marking a deeper sell-off than the previous week. Equity markets led the selling, as heavy secondary-market sales outweighed primary issue inflows, resulting in net equity outflows of INR 59.84 billion. Debt markets also saw withdrawals of INR 56.67 billion. This reversal follows a brief mid-October rally that saw weekly inflows peak at INR 167.3 billion and reflects a cooling of FPI appetite for Indian markets.

FPI flows for the week ended 2025-12-12 INR -112.6 billion

FPI flows continued to be in the negative territory in the week ended 12 December 2025, recording net outflows of INR 112.6 billion, a deeper outflow compared with the previous week. Equity markets led the selling, as heavy secondary-market sales resulted in net equity outflows of INR 59.84 billion despite primary inflows. Debt markets also saw significant withdrawals of INR 56.67 billion. In contrast, hybrid funds recorded a small inflow of INR 2.94 billion, and mutual funds saw marginal inflows of INR 0.97 billion, insufficient to offset broad-based selling.

Figure: FPI/FII flows for the week ending 2025-12-12

| Asset Class | Net Investment (INR Billions) |

| Foreign_Investors | -112.6 |

| Foreign_Investors.Debt | -56.67 |

| Foreign_Investors.Equity | -59.84 |

| Foreign_Investors.Equity.Primary | 37.35 |

| Foreign_Investors.Equity.Secondary | -97.19 |

| Foreign_Investors.Mutual_Fund | 0.97 |

| Foreign_Investors.Hybrid | 2.94 |

| Foreign_Investors.AIF | 0.0 |

Source: NSDL

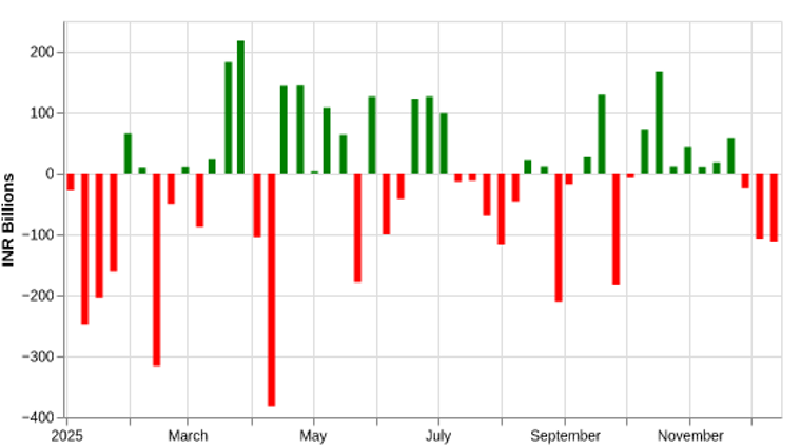

Figure: Recent history of FPI flows

| Week Ending | Net Investment (INR Billions) |

| 12 Dec, 2025 | -112.6 |

| 05 Dec, 2025 | -107.49 |

| 28 Nov, 2025 | -24.68 |

| 21 Nov, 2025 | 58.18 |

| 14 Nov, 2025 | 18.14 |

| 07 Nov, 2025 | 10.89 |

| 31 Oct, 2025 | 43.61 |

| 24 Oct, 2025 | 11.51 |

| 17 Oct, 2025 | 167.29 |

| 10 Oct, 2025 | 71.71 |

Source: NSDL

Figure: History of FPI flows

Source: NSDL

FPI flows in Equity for the week ended 2025-12-12 INR -59.8 billion

FPI equity activity weakened in the week ended 12 December 2025, resulting in net outflows of INR 59.8 billion. Selling pressure was concentrated in the secondary market, with significant withdrawals of INR 97.2 billion, while the primary market provided partial support with inflows of INR 37.4 billion. FIIs have been net sellers in secondary equity markets in six of the past seven weeks.

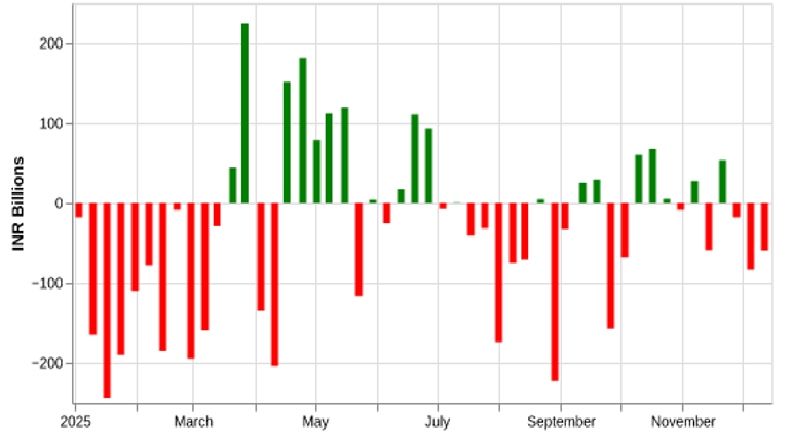

Figure: Recent history of FPI flows in equity

| Week Ending | FPI.Equity | FPI.Equity.Primary | FPI.Equity.Secondary |

| 12 Dec, 2025 | -59.8 | 37.4 | -97.2 |

| 05 Dec, 2025 | -83.5 | -17.3 | -66.2 |

| 28 Nov, 2025 | -18.5 | 4.8 | -23.3 |

| 21 Nov, 2025 | 53.5 | 36.7 | 16.8 |

| 14 Nov, 2025 | -59.2 | 41.9 | -101.1 |

| 07 Nov, 2025 | 27.6 | 35.8 | -8.2 |

| 31 Oct, 2025 | -8.7 | 0.3 | -9.0 |

| 24 Oct, 2025 | 5.3 | 1.0 | 4.4 |

| 17 Oct, 2025 | 67.1 | 45.9 | 21.2 |

| 10 Oct, 2025 | 60.8 | 48.7 | 12.0 |

Source: NSDL

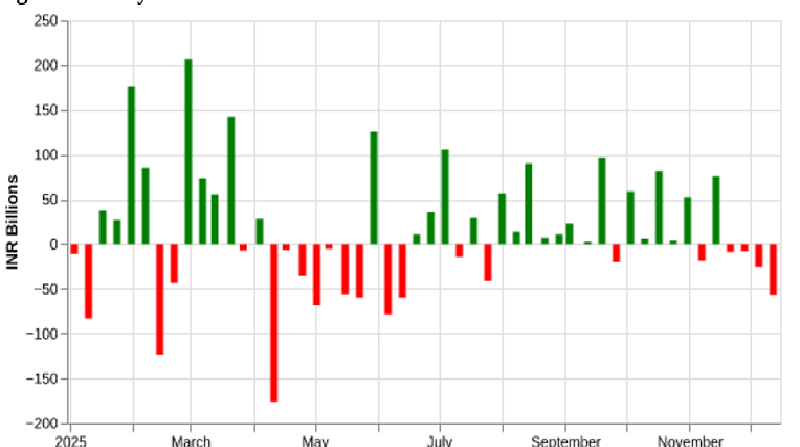

Figure: History of FPI flows in equity

Source: NSDL

FPI flows in Debt for the week ended 2025-12-12 INR -56.7 billion

The latest weekly data shows that FPIs withdrew INR 56.7 billion from the Indian debt market in the week ended 12 December 2025, marking the largest weekly outflow in the recent period. This follows modest inflows in prior weeks and represents a reversal from the strong buying phase seen during October and mid-November. Overall, the data points to renewed selling pressure and weakening sentiment in debt markets too.

Figure: Recent history of FPI flows in debt

| Week Ending | Net Investment (INR Billions) |

| 12 Dec, 2025 | -56.7 |

| 05 Dec, 2025 | -25.8 |

| 28 Nov, 2025 | -8.0 |

| 21 Nov, 2025 | -8.6 |

| 14 Nov, 2025 | 75.6 |

| 07 Nov, 2025 | -18.9 |

| 31 Oct, 2025 | 52.0 |

| 24 Oct, 2025 | 3.6 |

| 17 Oct, 2025 | 81.8 |

| 10 Oct, 2025 | 5.9 |

Source: NSDL

Figure: History of FPI flows in debt

Source: NSDL

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.