Major indices ended the week on a weaker note, with frontline indices extending losses amid poor market breadth. The NIFTY 50 declined 0.53%, marking a second straight weekly loss, while the NIFTY BANK slipped 0.65%, snapping its four-week winning streak. Midcap stocks also remained under pressure, with the NIFTY MIDCAP SELECT falling 0.64%, while the NIFTY IT declined 1.10%, ending its recent rally.

Sectoral performance was largely weak. The NIFTY AUTO fell 0.42%, pausing after recent gains. Defensive sectors underperformed, with the NIFTY FMCG declining 1.29% and NIFTY PHARMA easing 0.60%. The NIFTY REALTY index slipped 0.74%, extending its slump. NIFTY ENERGY was the lone gainer, rising 0.20% for the week. Overall, the week reflected a cautious tone, with broader participation remaining subdued amid weak market breadth.

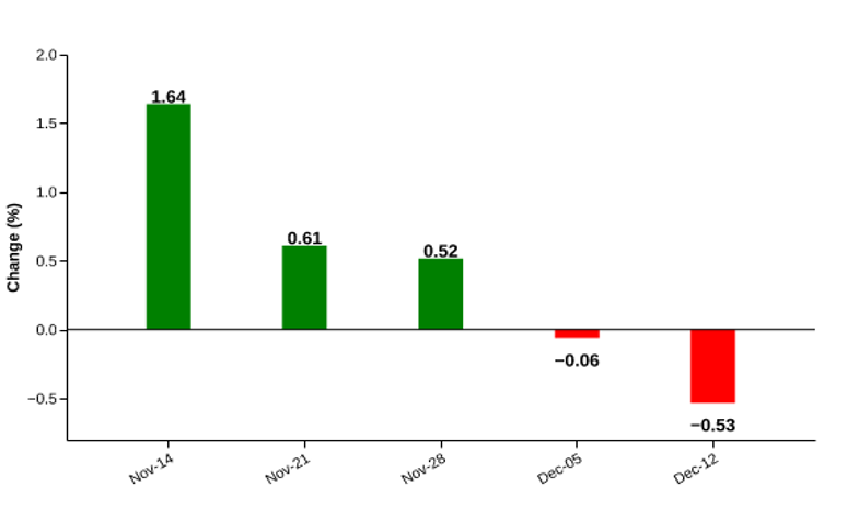

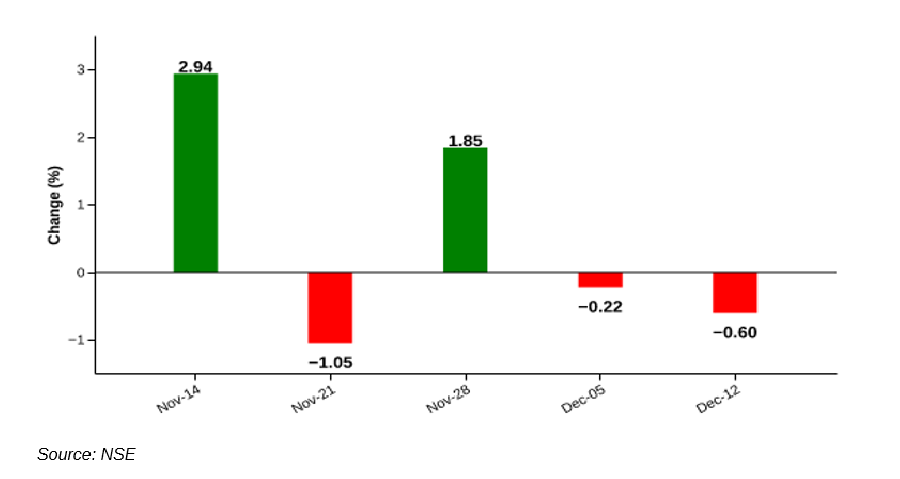

NIFTY 50 – Second Weekly Decline

Weekly Performance: -0.5%

| date | open | high | low | close |

| 2025-12-05 | 25999.8 | 26202.6 | 25985.3 | 26186.5 |

| 2025-12-08 | 26159.8 | 26178.7 | 25892.2 | 25960.5 |

| 2025-12-09 | 25867.1 | 25923.7 | 25728.0 | 25839.7 |

| 2025-12-10 | 25864.0 | 25947.7 | 25734.5 | 25758.0 |

| 2025-12-11 | 25771.4 | 25922.8 | 25693.2 | 25898.5 |

| 2025-12-12 | 25971.2 | 26057.6 | 25938.5 | 26047.0 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY 50 declined 0.53% in the week ended 12 December 2025, marking its second consecutive weekly loss after three weeks of gains. Support came from select heavyweight stocks, led by Reliance Industries (+1.03%), along with L&T, Tata Steel, Hindalco and Eternal Technologies, which also posted gains, providing some support to the index. However, losses were led by ICICI Bank (-1.90%), Asian Paints (-6.86%), Hindustan Unilever (-3.34%), Bajaj Finance (-2.82%) and Bharti Airtel (-1.25%), which together weighed on overall index performance. Market breadth was weak, with 15 stocks advancing against 35 declining. That said, the market sentiment improved towards the end of the week after rate cuts from RBI and US Fed.

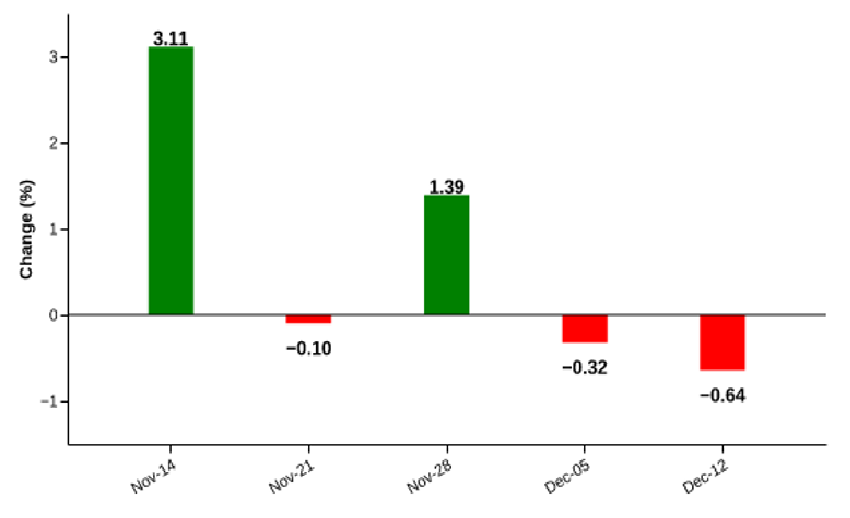

NIFTY MIDCAP SELECT - Index Slips as Breadth Weakens

Weekly Performance: -0.6%

| date | open | high | low | close |

| 2025-12-05 | 13882.0 | 14013.4 | 13833.4 | 13998.5 |

| 2025-12-08 | 14005.0 | 14052.9 | 13707.2 | 13764.7 |

| 2025-12-09 | 13732.1 | 13789.0 | 13498.9 | 13741.4 |

| 2025-12-10 | 13773.8 | 13819.2 | 13514.5 | 13534.4 |

| 2025-12-11 | 13551.1 | 13738.0 | 13524.1 | 13728.0 |

| 2025-12-12 | 13779.2 | 13919.6 | 13757.0 | 13908.2 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY MIDCAP SELECT declined 0.64% in the week ended 12 December 2025, extending its weak phase for the second straight week. On the positive side, SRF (+4.7%), HDFC Asset Management Company (+3.8%), Idea (+7.8%), Cummins India (+2.9%) and Voltas (+3.9%) provided some support and helped limit the downside. However, these gains were offset by declines in Coforge (-6.2%), BSE (-2.9%), Persistent Systems (-2.8%), Dixon Technologies (-2.7%) and Max Healthcare (-1.5%). Market breadth remained weak, with 12 stocks advancing against 13 declining.

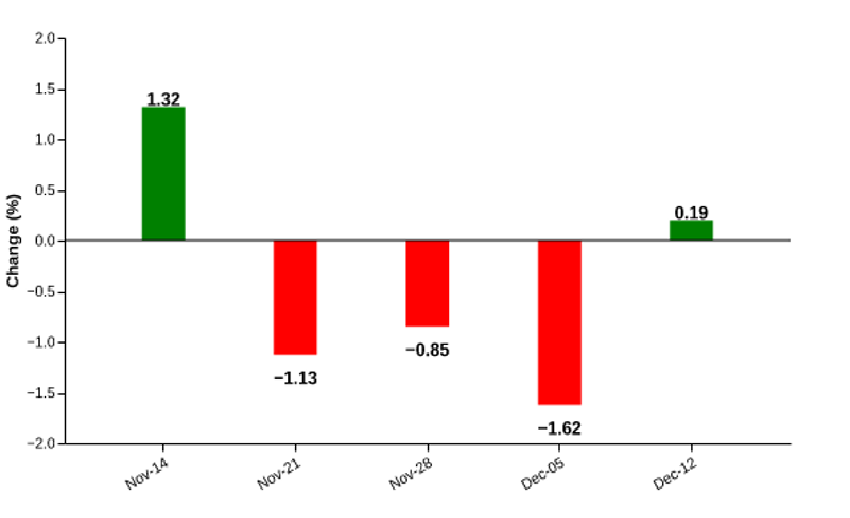

NIFTY IT – Weekly Decline Ends Multi-Week Rally

Weekly Performance: -1.1%

| date | open | high | low | close |

| 2025-12-05 | 38500.6 | 38920.6 | 38369.6 | 38703.6 |

| 2025-12-08 | 38783.4 | 38937.4 | 38322.4 | 38590.7 |

| 2025-12-09 | 38438.5 | 38463.9 | 37908.9 | 38130.6 |

| 2025-12-10 | 38273.8 | 38300.5 | 37745.2 | 37789.9 |

| 2025-12-11 | 37925.9 | 38136.4 | 37672.4 | 38097.0 |

| 2025-12-12 | 38203.9 | 38300.3 | 37901.8 | 38274.8 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY IT index declined 1.1% in the week ended 12 December 2025, snapping a four-week rally. The pullback marked the index’s first weekly decline. On the positive side, Tech Mahindra (+0.05%) and Wipro (+0.02%) posted marginal gains. However, losses in heavyweight stocks, led by Infosys (-0.27%), Coforge (-0.36%) and Persistent Systems (-0.17%), weighed on the index. HCLTech and Mphasis also contributed to the downside. The reversal was largely driven by weak market breadth, with only 2 stocks advancing out of the 10 constituents.

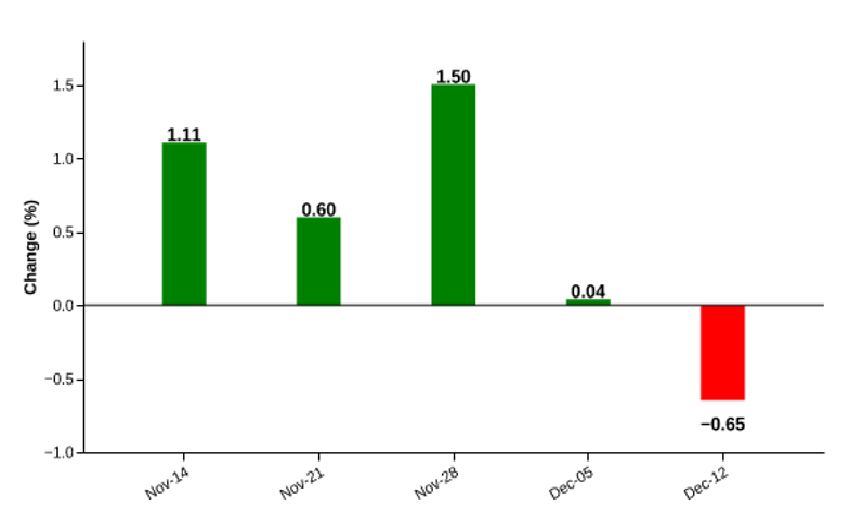

NIFTY BANK – Index Pulls Back After A Multi-Week Rally

Weekly Performance: -0.6%

| date | open | high | low | close |

| 2025-12-05 | 59133.2 | 59806.6 | 59106.6 | 59777.2 |

| 2025-12-08 | 59672.1 | 59713.1 | 59030.6 | 59238.6 |

| 2025-12-09 | 58918.9 | 59358.2 | 58878.4 | 59222.4 |

| 2025-12-10 | 59281.6 | 59440.9 | 58853.9 | 58960.4 |

| 2025-12-11 | 58966.2 | 59423.4 | 58799.9 | 59209.9 |

| 2025-12-12 | 59401.5 | 59545.7 | 59224.9 | 59389.9 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY BANK index declined 0.65% in the week ended 12 December 2025, ending a four-week winning streak. The pullback marked a pause after the recent advance, driven largely by weakness in select heavyweight constituents. The decline was primarily led by ICICI Bank (-1.90%), IndusInd Bank (-2.75%), Bank of Baroda (-2.79%), and State Bank of India (-0.86%). On the positive side, Kotak Mahindra Bank (+0.96%), IDFC First Bank (+1.76%), Federal Bank (+0.83%) and AU Small Finance Bank (+0.77%) provided modest support. Market breadth was neutral, with six stocks advancing and six declining.

NIFTY ENERGY – Slight Recovery With Mixed Sector Trends

Weekly Performance: 0.2%

| date | open | high | low | close |

| 2025-12-05 | 34989.8 | 35018.1 | 34768.3 | 34971.8 |

| 2025-12-08 | 34987.1 | 35032.2 | 34325.6 | 34447.9 |

| 2025-12-09 | 34334.0 | 34725.2 | 34040.6 | 34666.8 |

| 2025-12-10 | 34708.3 | 34945.8 | 34560.6 | 34635.2 |

| 2025-12-11 | 34649.8 | 34799.7 | 34427.4 | 34751.9 |

| 2025-12-12 | 34868.9 | 35071.2 | 34868.9 | 35039.9 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY ENERGY index edged up 0.2% in the week ended 12 December 2025, snapping a three-week losing streak, with a modest uptick. Gains were led by GVT, which surged over 10%, providing the bulk of the upside. Other contributors included Suzlon (+2.5%), Reliance (+1.0%), Coal India (+0.9%) and BHEL (+2.7%). However, the advance was partially capped by weakness in Siemens, which fell over 5%, alongside declines in ONGC, Power Grid, RPOWER and Inox Wind. Market breadth was positive, with 23 stocks advancing against 17 declining.

NIFTY FMCG – Continued Weakness as Heavyweights Weigh on Index

Weekly Performance: -1.3%

| date | open | high | low | close |

| 2025-12-05 | 55147.2 | 55254.2 | 54476.6 | 55202.9 |

| 2025-12-08 | 55235.9 | 55282.6 | 54377.6 | 54540.5 |

| 2025-12-09 | 54448.2 | 54723.3 | 54134.5 | 54521.2 |

| 2025-12-10 | 54545.1 | 54903.9 | 54447.2 | 54506.0 |

| 2025-12-11 | 54485.4 | 54712.3 | 54246.9 | 54619.6 |

| 2025-12-12 | 54671.1 | 54744.7 | 54236.1 | 54490.8 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY FMCG index declined 1.29% in the week ended 12 December 2025, extending its recent underperformance. The decline was led by Hindustan Unilever, which fell 3.34% and emerged as the largest drag on the index. ITC also weakened by 1.20%, while Dabur, Tata Consumer Products and Nestlé India added to the downside, keeping sentiment subdued across FMCG stocks. On the positive side, Godrej Consumer Products (+1.57%) and Emami (+2.71%) posted gains. Market breadth remained weak, with only 3 stocks advancing against 11 declining.

NIFTY AUTO – Index Slips as Selling Pressure

Weekly Performance: -0.4%

| date | open | high | low | close |

| 2025-12-05 | 27706.2 | 27957.0 | 27663.3 | 27939.1 |

| 2025-12-08 | 27914.0 | 27960.1 | 27503.8 | 27596.8 |

| 2025-12-09 | 27472.2 | 27546.8 | 27116.5 | 27399.2 |

| 2025-12-10 | 27506.8 | 27632.7 | 27313.2 | 27358.2 |

| 2025-12-11 | 27357.7 | 27683.9 | 27307.8 | 27661.0 |

| 2025-12-12 | 27687.8 | 27852.4 | 27683.9 | 27820.8 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY AUTO index declined 0.42% in the week ended 12 December 2025, reversing its four-week run of moderate gains. Gains in select heavyweights such as Maruti Suzuki (+1.47%), while Motherson (+3.90%), Ashok Leyland (+1.86%) and Bharat Forge (+1.47%) also advanced. However, sharp losses in Hero MotoCorp (-6.15%), along with declines in Tata Motors (-1.97%) and M&M (-1.01%), weighed on the index. Bajaj Auto and Exide Industries added to the downside pressure. Market breadth was weak, with 5 stocks advancing against 10 declining.

NIFTY PHARMA – Broad-Based Decline Extends Short-Term Weakness

Weekly Performance: -0.6%

| date | open | high | low | close |

| 2025-12-05 | 22973.2 | 22974.0 | 22839.8 | 22947.2 |

| 2025-12-08 | 22938.1 | 22946.7 | 22556.3 | 22640.7 |

| 2025-12-09 | 22607.9 | 22660.2 | 22405.1 | 22522.8 |

| 2025-12-10 | 22583.8 | 22703.8 | 22488.2 | 22561.5 |

| 2025-12-11 | 22541.8 | 22799.3 | 22475.2 | 22783.4 |

| 2025-12-12 | 22825.7 | 22882.8 | 22742.1 | 22808.7 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY PHARMA index declined 0.60% in the week ended 12 December 2025, extending the weak trend after a brief rally in late November. The weakness was led by Sun Pharma (-0.65%), followed by declines in Divi’s Laboratories (-0.36%) and Aurobindo Pharma (-0.45%), keeping pressure on heavyweight constituents. On the positive side, Lupin (+1.12%), Dr. Reddy’s Laboratories (+0.74%), Granules India (+1.38%) and Ipca Laboratories (+0.96%) posted gains. Market breadth was negative, with 7 stocks advancing against 13 declining.

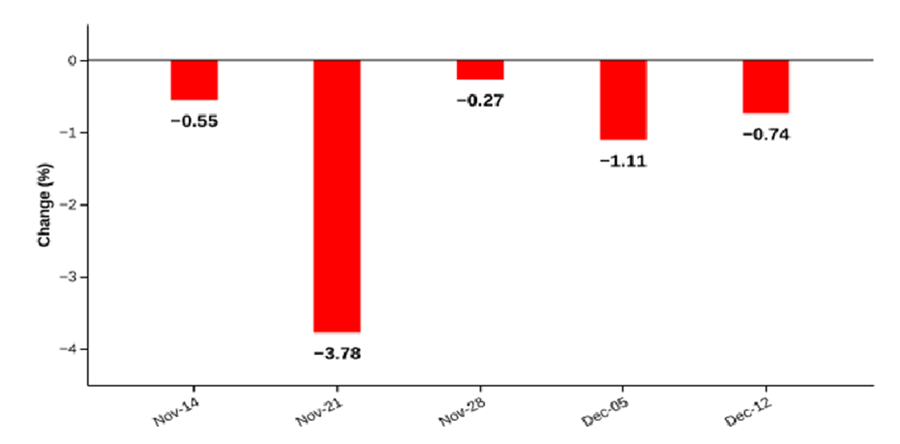

NIFTY REALTY – Weakness Persists Amid Ongoing Downtrend

Weekly Performance: -0.7%

| date | open | high | low | close |

| 2025-12-05 | 889.2 | 903.0 | 887.3 | 893.1 |

| 2025-12-08 | 893.7 | 898.4 | 857.4 | 861.6 |

| 2025-12-09 | 858.1 | 874.9 | 851.6 | 869.9 |

| 2025-12-10 | 871.5 | 879.0 | 864.2 | 866.7 |

| 2025-12-11 | 865.1 | 876.5 | 862.5 | 873.2 |

| 2025-12-12 | 876.6 | 888.5 | 873.8 | 886.5 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY REALTY index declined 0.74% in the week ended 12 December 2025, extending a five-week losing streak and maintaining a negative bias in real estate stocks. Selective gains offered limited relief, with Phoenix Mills (+2.65%) and Anant Raj (+4.59%), while Brigade Enterprises, Oberoi Realty and Raymond posted modest advances. However, these gains were capped by weakness in heavyweight names, led by DLF (-2.83%), Lodha Group (-1.84%), Prestige Group (-1.70%) and Sobha (-5.74%). Market breadth remained weak, with 4 stocks advancing against 6 declining.

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.