Table of Content

The Permanent Account Number or PAN is a 10-digit number issued to every individual residing in India. It is an important and mandatory document that a person should have. It helps a person to carry out important work like opening a bank account and tax filing, and it also works as an identity proof. However, there can be situations where a person may wish to opt for PAN Card cancellation.

Some reasons among them can be wrong details in the PAN card, loss of the previous card, etc. PAN Card cancellation has become hassle-free and does not require an individual to invest a lot of time in the process. In the blog, let’s explore the process of PAN Card cancellation and the various reasons why an individual may need to do so.

If you need to know how to cancel pan card in online, follow these steps:

If you need to cancel your PAN Card offline, follow these steps:

You can check the progress of your PAN cancellation application on the Income Tax Department of India’s website. Follow the steps to find out how to check the application status of the form.

Firstly, the person applying for PAN Card cancellation must visit India’s Income Tax Website to check the application status.

You need to open the Income Tax Website’s “homepage” first. Select the “Services Option” available on the homepage.

On the “Services Tab” of the homepage, select “Know the status of PAN/TAN application.” Here, the status of the application will be shown.

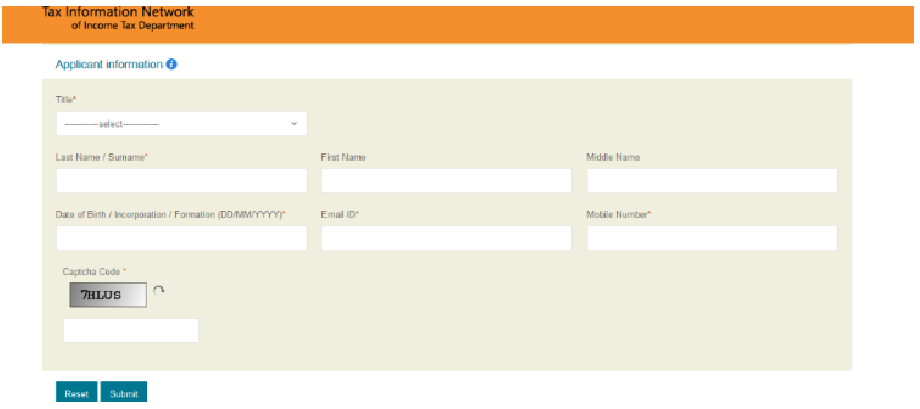

The website will ask for the acknowledgement number after clicking on the “Know status of PAN/TAN application” option. When you were applying for your PAN card, you were asked to enter a 15-digit acknowledgement number.

After entering the acknowledgement number, click on the “Submit” option to display the status of the application for PAN Card cancellation.

After the status of the application is displayed, read the information properly. First, the “Under Process” status can indicate that the process is yet to be completed and is under review. Second, the “Accepted” status can be displayed on the screen, implying that the request has been accepted and the process is completed. Lastly, the “Rejected” status can also be displayed. This will imply that the authority has rejected the application due to unavoidable reasons or errors on behalf of the applicant.

In case of rejection of the form, the concerned authority should be contacted. This will help in finding out the reason for rejection. A new one has to be submitted by the individual again to cancel the PAN Card.

The pointers given above will make a person understand how to check the application status of a form.

The information given in the blog will give an answer to the query, ‘how to cancel old pan card?’ It is important first to understand the process and then proceed with it to avoid errors or chances of rejection. A person should know how to check the application status of the form. Moreover, the correct and original identity proof documents should be provided to cancel a PAN Card without additional hindrances.

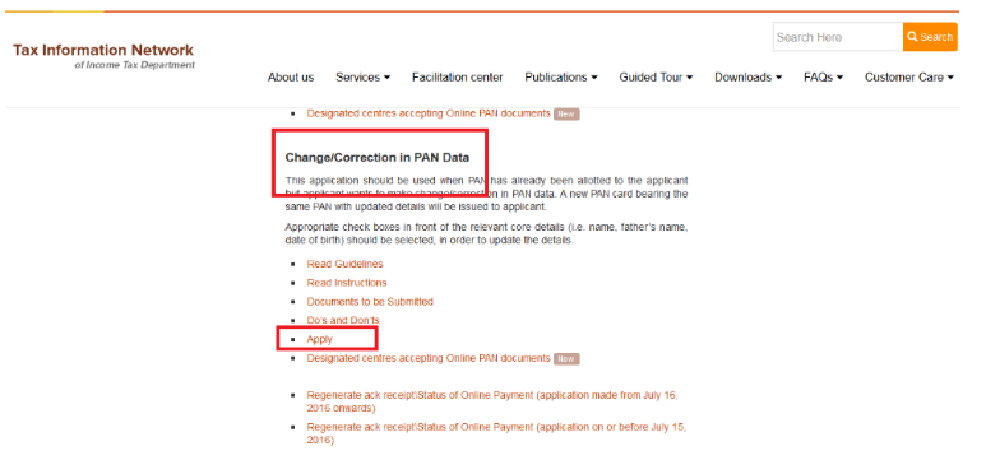

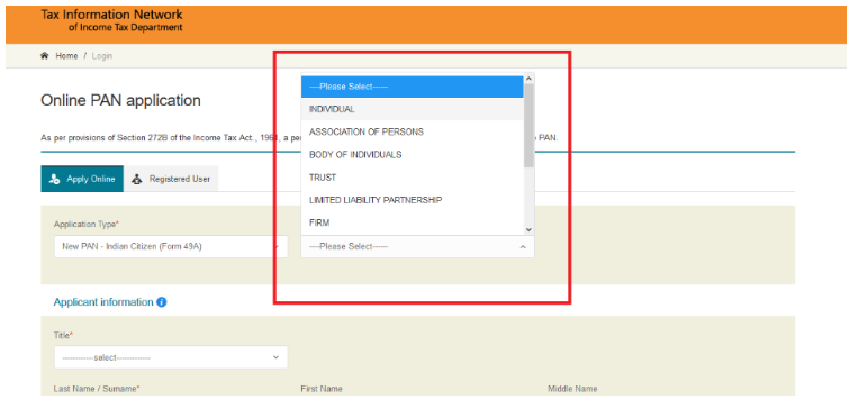

Start by visiting the official NSDL website. Click on the “Services” tab, select “PAN,” and choose “Changes or Correction in existing PAN data.” Fill out the application form, providing details of the PAN to be surrendered, and submit it. You can also submit a request letter to your local Income Tax Assessing Officer along with the necessary documents.

You can check the status of your PAN cancellation by visiting the NSDL website and navigating to the PAN services section. Enter your details as required, including the acknowledgement number received during the application process, to view the current status of your cancellation request.

Yes, there is a penalty for holding more than one PAN card. Under Section 272B of the Income Tax Act, a penalty of ₹10,000 can be imposed for possessing multiple PANs. However, surrendering an additional PAN card does not incur a penalty if done properly.

No, the fees paid for obtaining a PAN card are non-refundable. This applies regardless of whether the PAN card is used or surrendered later. The government does not provide refunds for the application fees once the PAN card is issued.

Make sure your PAN details are not shared without reason. Keep regular checks on all your financial transactions and raise a complaint if anything appears to be suspicious. Further, apply for a new PAN if you think the one you have has been misused.

On average, the procedure to cancel a PAN card account will take around 10-15 days after a successful application. Once the cancellation is done, you will receive confirmation for the deactivation of the PAN card.

To unlink Aadhaar from your PAN, you must raise a request with the Income Tax Department. This may be accomplished by completing a form with the relevant information. Make sure you mention the reason why you would like to unlink in your application.

In order to erase or delete your father’s name from your PAN card, you will have to apply for a PAN Change Request. Provide all the details in the form, along with the corrections that you’d like to make and submit it either to your NSDL or to the Income Tax office in your city, with attached documents.

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.