Table of Content

Dematerialisation is the process of converting physical share certificates and debentures into electronic format. The term ‘demat’ in Demat accounts stands for dematerialisation as investors essentially use the account to hold dematerialised shares and securities virtually.

To dematerialise your securities, you must approach a Depository Participant (DP) to open a demat account in India. The DPs utilise two depositories: the National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL) to open Demat accounts in India.

SEBI has made it mandatory to convert physical shares into electronic form through the process of Dematerialisation, for which you will need a Dematerialisation Request Form (DRF).

Step 1: Open a Demat and trading account with an online Depository Participant and submit the DRF after filling in all the necessary information with the share certificates. Remember to mention “Surrendered For Dematerialisation” on every share certificate.

Step 2: The Depository Participant will extend your Dematerialisation request to the respective depository, transfer agents and registrars with the submitted sage certificates.

Step 3: Upon confirmation by the registrar, the investor’s Demat account will show all the shares submitted as share certificates in electronic form. The process can take between 15-30 days.

Rematerialisation is the process of converting securities that are in digital format into physical certificates. Investors who have converted or have their securities in electronic format stored in Demat accounts can opt for the rematerialisation process. However, while securities are undergoing the rematerialisation process, investors cannot trade them on the relevant exchange.

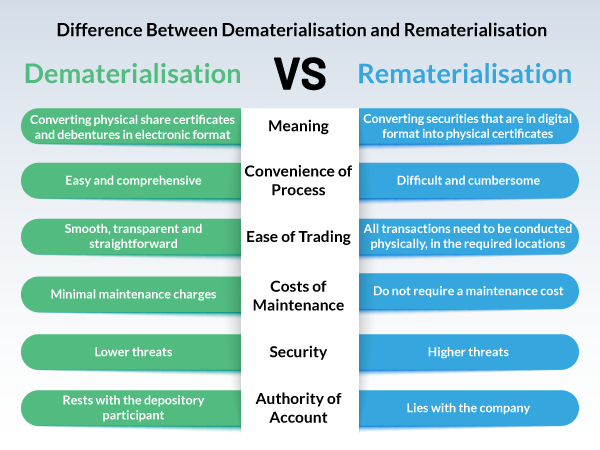

Apart from the difference in definitions and processes, there are various other differences between the dematerialisation and dematerialisation processes.

Dematerialisation is popular among investors owing to its easy and transparent process. The only thing you need to utilise in the dematerialisation process is a trusted Depository Participant of your choice to open a Demat account. Meanwhile, rematerialisation is a much more difficult and cumbersome process. The process can also take a long time and often requires professional expertise to be done properly.

Dematerialisation is a smooth, transparent and straightforward process. Regardless of where you are situated, all your transactions can easily take place online via your online demat account . this is not the case with rematerialisation. Since rematerialisation converts securities into physical formats, investors must conduct all transactions physically by visiting the required locations.

Rematerialised securities do not come with a maintenance cost. As they are stored as physical certificates, the investor takes responsibility for holding and maintaining the securities. However, dematerialised securities can only be held in a Demat account that brokers and financial institutions provide. Therefore, they levy a maintenance charge for the service and the Demat account maintenance. Although, these costs are minimal when considering the convenience of having your securities stored securely and conveniently in a digital format.

The matter of security of assets and transactions is an important distinction between dematerialisation and rematerialisation. In this regard, dematerialisation ensures a much higher level of security than rematerialisation.

In dematerialisation, securities are directly converted into a digital format and stored in demat accounts. As a result, there is a lesser chance of forgeries, fraud or theft, which is possible in the case of physical certificates. On the other hand, rematerialisation involves paperwork and dealing with physical forms of securities, thereby increasing the chances of encountering the problems mentioned above.

Another distinction between dematerialisation and rematerialisation is the matter of who holds the authority of your account. In the case of rematerialisation, the account maintenance authority lies with the company. However, in dematerialisation, the account maintenance authority rests with the depository participant (NSDL or CDSL). Since these services are instituted by the Securities and Exchange Board of India (SEBI), they are reliable and transparent.

Overall, the processes of dematerialisation and rematerialisation have opposite meanings and functions. While the dematerialisation process converts securities from physical to digital formats, rematerialisation converts them back to physical certificates. The two processes and features are completely different and the decision to opt for either of them depends on your requirements as a trader. You too can make the most of trading with dematerialised securities by opening a trading and Demat account in India with IIFL. With IIFL, investors and traders can avail of an all-in-one account to trade in multiple securities online at their convenience.

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.