A demat account is mandatory to invest in many segments of the stock markets. It holds the shares an investor buys in the share market in digital form. However, an overt reliance on technology coupled with low financial literacy has left many investors vulnerable to financial fraud and mismanagement. A simple set of do’s and don’ts can help you take care of your demat account. It is, however, important to discuss the safety of electronic trading before moving to the dos and don’ts.

The safety of accounts

A trading account and demat account are mandatory to invest in the stock markets. The depository participant manages the trading account, which interfaces the investors and the stock exchanges. However, after you buy the shares of a company, they are stored in the demat account and are transferred directly to the buyer’s demat account when you sell the holdings. The demat account is managed by depositories like CDSL and NSDL, which are backed by large financial institutions. Depositories hold the securities securely and protect investors from frauds and financial irregularities of different service providers.

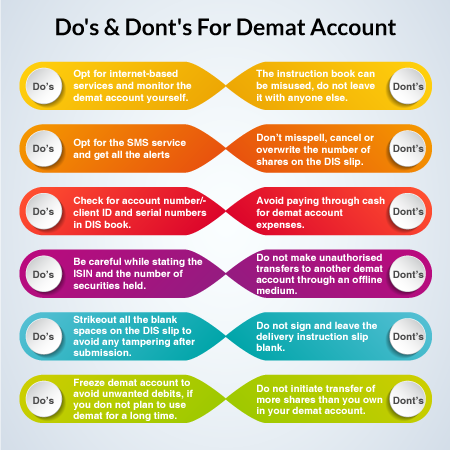

Even though your securities are safe in the demat account, an investor should remain vigilant. Here are some crucial dos and don’ts you should ensure after demat account opening.