Table of Content

When you hold multiple funds in your portfolio, there are bound to be some common stocks in the two portfolios. More so, if both are the same category of funds. For instance, there would not be an overlap between a large cap fund and a small cap fund. However, if you have 3 large cap funds, then the possibility of stocks being common are very high For instance stocks like Reliance, TCS, Infosys and SBI would be there in all the large cap portfolios. So, some portfolio overlap is inevitable in such cases.

There are two aspects why portfolio overlap important. When you buy mutual funds as an investment vehicle, one of the main ideas is to diversify your risk. If you have too many funds of a similar category with substantial portfolio overlap, then you are not diversified. In other worlds, the additional funds are only resulting in risk substitution not in risk reduction. The second aspect is of risk. If you have too many mid-cap funds with substantial similar portfolios, then any downturn in the mid-cap space would damage your portfolio in a big way. That is why an understanding of portfolio overlap is important. Before proceeding to understand what mutual fund portfolio overlap is, let’s first understand the definition of a mutual fund portfolio.

A mutual fund (MF) is an intermediary which collects small units of capital from a plethora of small investors and invests the money in different stocks. For investors in the mutual fund, they get an indirect exposure to a diversified portfolio of stocks by investing a small amount. That is not possible in direct equities.

Normally, investors invest in funds that help them to meet their long term and medium term goals. For instance, you can design your mutual fund portfolio by investing in funds that suit your goals and objectives. The portfolio can be an equity portfolio or a debt portfolio. For instance an equity fund has a portfolio of equity stocks while a debt fund has a portfolio of debt instruments like G-Secs, corporate bonds etc.

mutual funds are broadly classified into debt, hybrid and equity funds, depending on the equity exposure. Normally, a fund with an equity exposure of 65% and above is classified as an equity fund while the reverse is true in case of debt funds. In between, you have a range of hybrid funds. If the fund you are investing is debt-dominated, then it is termed as a debt fund, if not, then it termed as an equity fund. Hybrid or balanced funds have equal or strategically unequal exposures to debt and equity.

Mutual fund portfolio overlap occurs when you invest in two or more different funds investing in the same asset such as shares of a company. As stated earlier, when you own two or more fund of the same category like large caps / mid-caps / small caps / commodity funds etc, overlap is inevitable. Such overlap tends to gravitate towards the large and most liquid stocks. However, the trick here is to reduce the portfolio overlap to the extent possible. Let us understand portfolio overlap with live examples.

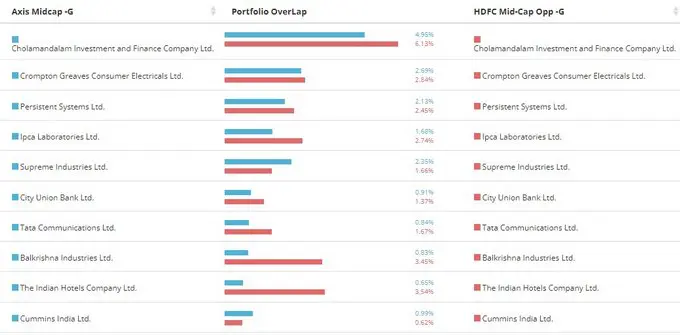

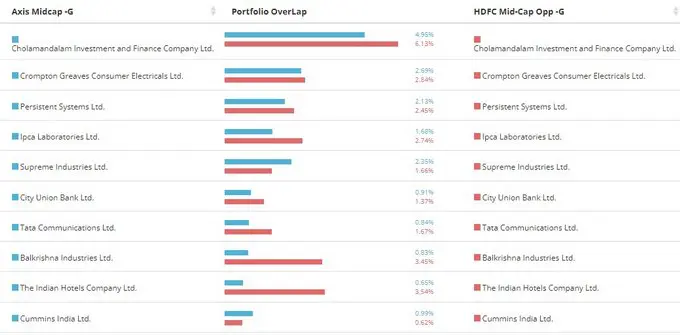

The table below captures a comparison of portfolio in two mid-cap funds viz. Axis Mid Cap Fund and HDFC Mid Cap Opportunities. As you can see, there is substantial overlap.

Let us now turn to an illustration of small cap funds. The table below captures a comparison of portfolio in two mid-cap funds viz. DSP Small Cap Fund and SBI Small Cap Fund. As you can see, there is substantial overlap here also.

That is why, when you select mutual funds for your portfolio, one of the things to check is the extent to which your portfolios overlap with one another. The lesser the overlap the better, although some overlap is inevitable. You invest in various funds to diversify your investment portfolio. If the funds you invested in purchase the same assets, then your objective of diversifying the portfolio will not be served. You are not mitigating risk; you are just substituting risk.

Let us look at this portfolio overlap from a financial planning perspective. One of the things you look for in any portfolio is how well you can diversify your risk or the extent to which your portfolio acts as an automatic risk mitigator. Portfolio overlap beyond a level is the enemy of portfolio diversification, undermines its impact and therefore adds to the risk of your portfolio.

This is an important lesson for mutual fund investors. As a mutual fund investor, you don’t get your mutual fund portfolio diversified by merely adding more funds to your portfolio. The funds have also got to be dissimilar in terms of strategy, portfolio overlap and in terms of asset mix. A genuine and meaningful diversification of the portfolio happens only when the funds you invest, in turn, allocates across multiple asset classes.

If the asset class in which your funds have invested suffer losses, then the overall loss of the portfolio would be magnified if there is an overlap. That is the reason to minimize the overlap. Overlap cannot be eliminated as you need multiple fund classes to avoid too much dependence on one fund. However, take a close hard look at the portfolio composition.

The good news is that mutual fund portfolio overlap can be avoided. To avoid mutual fund portfolio overlap, you must check the asset classes in which the funds invest as well as the specific stock / bond portfolios. Today, these are public document and you can access the fact sheets of the fund on the website. There are comparative websites where you can measure portfolio overlap at the click of button. Just check it out before investing.

To reduce portfolio overlap, diversification of the portfolio must be understood in the right perspective. Portfolio diversification helps to optimize returns on the investment on a risk adjusted basis. You may miss out some outliers of performance, but overall over the longer time frame, you would be a lot better off.

Investing in different asset classes facilitates risk mitigation. Remember that diversification does not guarantee the prevention of losses, but it does help minimise losses. Portfolio diversification is all the more essential for long-term investments since the long time frame itself exposes the portfolio to uncertainties and makes it riskier.

Better portfolio diversification helps in downside protection amidst market volatility. Here, diversification refers to spreading the portfolio mix across asset classes that have a low correlation with each other. This would ensure that if one asset class performs below expectations, then your overall portfolio is not impacted in a big way as it is diversified. Once your goals are crystallized, the diversification happens during asset allocation, which is the next stage. The golden rule is to reduce overlapping to the extent possible as it has the bad habit of magnifying downside risks.

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.