One of the most common activity in the stock market is arbitrage. Let us first understand what is arbitrage and the actual arbitrage definition. Arbitrage is defined as an anomaly in pricing in the market. Arbitrage trading is about taking advantage of such anomalies in pricing which can be capitalized for riskless profits.

Arbitrage can occur if the same stock is priced differently in different exchanges. The trader can buy in the exchange with the lower price and sell in the exchange with higher price to earn risk less arbitrage. That is what is the arbitrage definition. It is all about pricing anomalies. Arbitrage trading can also be done between mispriced options. But the most popular is the arbitrage between cash market price and futures price. Known as cash-futures arbitrage, this is a riskless method of earning profits. Let us look at in detail at arbitrage definition and understand what is arbitrage trading?

What do we really mean by the word arbitrage and arbitrage trading? At a conceptual level, arbitrage is the anomalies in pricing. When NSE had commenced operations, there used be huge price differences between the exchanges. Brokers would buy the stock at a lower price on one exchange and sell at a higher price on the other exchange. However, as markets became more efficient, this arbitrage trading vanished.

Then came the era of futures. With the introduction of futures came the cash-futures arbitrage strategy. Stock futures in India have monthly expiry cycles and expire on the last Thursday of each month. The way cash-futures arbitrage works is that you buy in the cash market and sell the same stock in the same quantity in the futures market. Since futures trade in minimum lot sizes, you must buy in cash market also in equivalent lot sizes. Since futures price and spot price expire at the same level on the F&O expiry day, the difference or the future premium, becomes the risk-free spread for the arbitrageur.

A look at the structure of a real futures contract

Futures price, as the name suggests, pertain to a contract that is typically 1 month down the line. Hence there is cost of carry, which is like the interest cost in case of stock futures which are cash settled. In commodities, the cost of carry includes storage, transportation and insurance, but since stock futures are cash settled, there is only interest as cost of carry. On an average, if the annual rate of interest is 12% then the 1-month futures price must be at a 1% premium to the cash price. Normally, returns on cash-futures arbitrage are closer to 6-8% annualized.

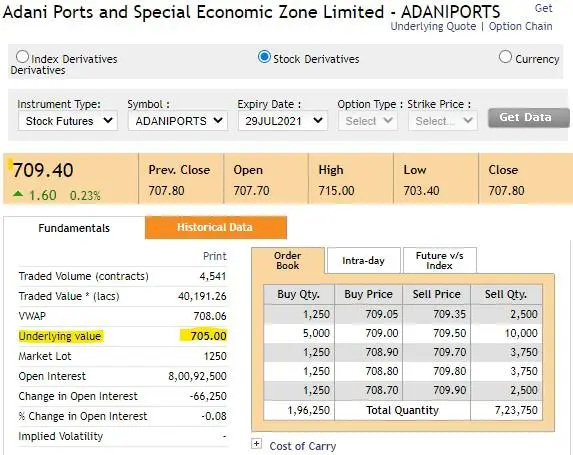

Let us now go to the next step and understand cash futures arbitrage trading with a live example. Here we look at the live price data of Adani Ports for Jul-21 Contract futures.

Source: NSE

In the above live price chart of Adani Ports, the cash price on 02 July is Rs.705.00 while the July 29th Futures price is Rs.709.40. So, the arbitrage spread is {(709.40-705.00)/705.00} which works out to 0.62%. That is the return for a period of 1 month. So, the annualized return in this case works out to {(1+0.62%)12 – 1} = 7.70%

Normally arbitrageurs are happy with an annualized return of around 7-9% as they normally compare these returns with liquid funds, which give just about 4-5% returns. For cash-futures arbitrage the trader will buy 1250 shares of Adani Ports in the cash market and simultaneously sell 1 lot of Adani Ports futures equivalent to 1250 shares in futures.

Realizing the profits on an arbitrage position

The proof of the pudding lies in the eating so even in arbitrage you need to book profits. You have locked in riskless arbitrage profit but how do you actually realize the profits you have locked. In arbitrage trading there are two ways of realizing the locked-in profits.

Here is how the trades would look in practice.

How is the trade unwound in an arbitrage?

In an arbitrage trade you buy in cash and sell in futures. That means you are long on equities and short on futures on the same stock and in the same quantity. You just unwind arbitrage by reversing positions either on the expiry date or before that if you get a good spread.

| Arbitrage Trade | Amount |

|---|---|

| Cash price of Adani Ports (purchased) on 02 July 2021 | Rs.705.00 |

| July Futures price of Adani Ports (sold) on 02 July 2021 | Rs.709.40 |

| Cash Futures spread | Rs.4.40 (0.62%) |

| Annualized spread on arbitrage | 7.70% |

| How will this arbitrage position get unwound on expiry date | |

| Cash price of Adani Ports on Jul 29 | Rs.723 |

| July Futures price of Adani Ports on Jul 29 | Rs.723 |

| Cash Futures spread | Rs.0 |

| Profit on Adani Ports Cash Position | Rs.18.00 (723.00-705.00) |

| Loss on Adani Ports Futures Position | Rs.(-13.60) (709.40-723.00) |

| Net profit / loss on arbitrage | Rs.4.40 |

As you can see in the illustration above, you have realized the assured spread of Rs.4.40, which you locked on the arbitrage day. This is done by unwinding the cash and the futures position. You can interpret this as the assured arbitrage realized or the spread encashed. It means one and the same thing. Remember, in this case you are totally indifferent to the market price of Reliance. Irrespective of whether the stock closes 20% higher or 20% lower, your profit of Rs.4.40 or 0.62% is assured. Of course, the actual return will be lower as there is brokerage and statutory charges to content with. Hence you need to factor those costs into your arbitrage calculation.

In reality, the more popular method is rolling over short futures

Unwinding of futures looks simple but it is practically never done. Normally, the cash position is held on to and the short futures position is rolled over each month. Since the next month futures is always at a premium to the current futures, the short roller will earn the spread. So, the arbitrage trader holds on to the cash market position and keeps rolling the short futures position each month, just earning the spread and pocketing the profit on the short roll spread each month. This is also more efficient from a taxation perspective.

In arbitrage, the arbitrage trader normally buys the stock in the cash market and sells in the futures market to lock in the spread. Then the arbitrage position is either unwound fully or the short futures position is rolled over each month to lock in profits, which is almost riskless.

Arbitrage is important because it removes pricing anomalies and makes the market more efficient and smoother. It also result in better price discovery in the market and thus plays a major role in creating market liquidity.

The best case of arbitrage is the purchase of a stock and sale of equal quantity in the futures market. The gap is the assured spread as the spot and the futures would expire at the same price on the expiry date. On the date of expiry, the arbitrage position can be wound up and the spread pocketed by the arbitrageur.

Arbitrage is absolutely legal and is a fairly large business in the Indian markets. Not only in India, but even globally, the arbitrageurs help to create liquidity and narrow the spreads in the market and thus make the markets substantially safer.

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.