Last week, the Indian stock market witnessed a divergent performance across indices. Large cap – NIFTY 50 index – rallied sharply by 1.59%. Notable performances from HDFC Bank, Reliance and Infosys contributed to its gains. On the other hand, midcap indices lagged. NIFTY MIDCAP SELECT index witnessed only a 0.1% move.

The NIFTY AUTO performed the best. It gained 1.51% – led by Mahindra & Mahindra, Maruti Suzuki, and Eicher Motors. Following it closely was the NIFTY IT index, which gained 1.36% for the week. In contrast, the NIFTY PHARMA index struggled. On widespread profit booking, it fell 1.69%.

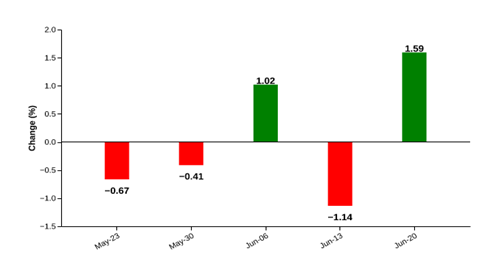

NIFTY 50 – Recovers from last week’s fall

Weekly Performance: 1.6%

| date | open | high | low | close |

| 2025-06-20 | 24787.7 | 25136.2 | 24783.7 | 25112.4 |

| 2025-06-19 | 24803.2 | 24863.1 | 24733.4 | 24793.2 |

| 2025-06-18 | 24788.3 | 24947.6 | 24750.4 | 24812.1 |

| 2025-06-17 | 24977.8 | 24982.1 | 24813.7 | 24853.4 |

| 2025-06-16 | 24732.3 | 24967.1 | 24703.6 | 24946.5 |

| 2025-06-13 | 24473.0 | 24754.3 | 24473.0 | 24718.6 |

Source: NSE

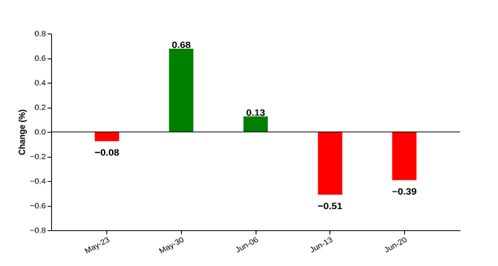

Figure: Recent performance

Source:NSE

NIFTY 50 gained 1.59% for the week ended 20 June 2025 and recovered from the losses of prior week. HDFC Bank, Reliance Industries, Bharti Airtel, Mahindra Mahindra, and Infosys were among the top contributors to the index’s performance, while Mahindra Mahindra emerged as the top mover with a gain of 5.93%. On the other hand, Tata Motors, Bajaj Finance, Adani Ports, Sun Pharmaceutical and Dr. Reddy’s Laboratories were the key detractors. Tata Motors slumped the most falling 5.03%. Positive market breadth was evident, with 35 advances to 15 declines during the week.

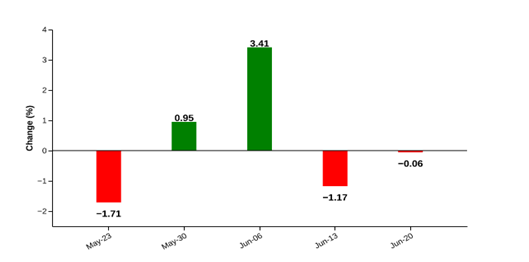

NIFTY MIDCAP SELECT – A tepid week

Weekly Performance: -0.1%

| date | open | high | low | close |

| 2025-06-20 | 12721.1 | 13013.4 | 12720.8 | 12984.3 |

| 2025-06-19 | 12968.2 | 12976.5 | 12704.7 | 12727.7 |

| 2025-06-18 | 12969.0 | 13071.3 | 12907.4 | 12943.3 |

| 2025-06-17 | 13140.8 | 13178.5 | 13015.6 | 13039.8 |

| 2025-06-16 | 12977.6 | 13122.5 | 12869.8 | 13107.5 |

| 2025-06-13 | 12769.8 | 13018.7 | 12756.2 | 12991.6 |

Source: NSE

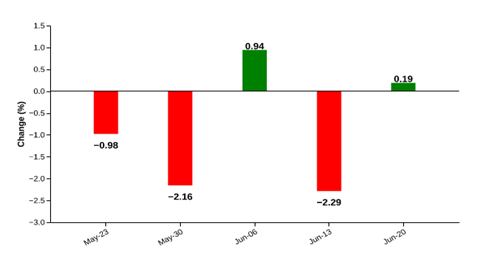

Figure: Recent performance

Source:NSE

In a mixed week, NIFTY MIDCAP SELECT index ended the week slightly lower by 0.1% and significantly underperformed the broader NIFTY. Indian Hotels, Indus Towers, Persistent Systems, Coforge, and AU Small Finance Bank were the top gainers for the week, gaining approximately 3.5% to 7%. On the other hand, Aurobindo Pharma, Lupin, Dixon Technologies, SRF and Bharat Forge, were the top detractors on the index. They fell 3.3% to 5.2%. Market breadth was even as advances closely matched declines.

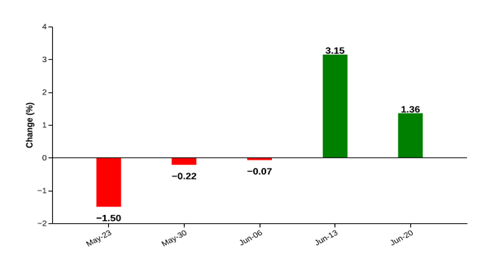

Nifty IT – Picks Up Pace.

Weekly Performance: 1.4%

| date | open | high | low | close |

| 2025-06-20 | 38674.2 | 39041.1 | 38454.1 | 38991.4 |

| 2025-06-19 | 38945.4 | 38966.8 | 38429.4 | 38664.9 |

| 2025-06-18 | 39220.4 | 39572.5 | 38963.8 | 39030.9 |

| 2025-06-17 | 39123.0 | 39499.1 | 38977.9 | 39356.1 |

| 2025-06-16 | 38440.9 | 39258.4 | 38369.1 | 39073.1 |

| 2025-06-13 | 37769.5 | 38687.6 | 37722.2 | 38469.2 |

Source: NSE

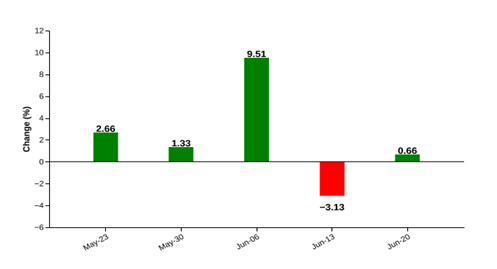

Figure: Recent performance

Source: NSE

The NIFTY IT index added 1.36% for the week after gaining 3.15% in the prior week. The last five weeks’ performance indicates a change in the trend, with the index snapping its three-week losing streak. Also, Accenture’s strong results bode well for the coming week for Indian IT. Infosys, HCL Technologies, Persistent Systems, Tech Mahindra and Wipro were the top index gainers, adding 1.3% to 3.8%. On the other hand, TCS was a notable loser as it fell 0.3%. Among the only other losers were LTI and LTTM. They fell 1% to 1.5% each. Needless to say, the market breadth was extremely positive with 7 advances to only 3 declines.

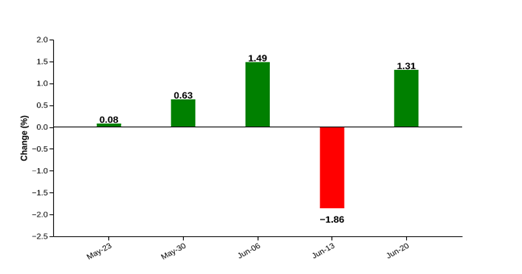

NIFTY BANK – Recovers smartly from last week’s fall

Weekly Performance: 1.3%

| date | open | high | low | close |

| 2025-06-20 | 55566.7 | 56328.2 | 55566.4 | 56252.9 |

| 2025-06-19 | 55784.9 | 55942.4 | 55475.4 | 55577.4 |

| 2025-06-18 | 55544.9 | 55933.6 | 55511.8 | 55828.8 |

| 2025-06-17 | 55975.0 | 56067.3 | 55643.9 | 55714.1 |

| 2025-06-16 | 55554.1 | 55999.9 | 55381.4 | 55944.9 |

| 2025-06-13 | 55149.3 | 55688.0 | 55149.3 | 55527.4 |

Source: NSE

Figure: Recent performance

Source: NSE

NIFTY BANK index ended up 1.31% for the last week. The index has closed positive in 4 of the past 5 weeks, indicative of the strong investor interest in the space. For the past week, the major gainers in the index were HDFC Bank, Kotak Mahindra Bank, ICICI Bank, IndusInd Bank and Axis Bank – each gaining 0.8% to 2.9%. On the other hand, Canara Bank, Punjab National Bank, Bank of Baroda were the top losers. Each of them lost 3% to 4%. Overall market breadth was positive as 8 stocks advanced and only 4 fell. Banking stocks continue to see optimism fueled by RBI’s rate cuts and FII flows.

NIFTY ENERGY – Weakness Persists with Mixed Contributions

Weekly Performance: -0.4%

| date | open | high | low | close |

| 2025-06-20 | 35248.6 | 35760.4 | 35181.1 | 35600.2 |

| 2025-06-19 | 35671.4 | 35848.4 | 35180.6 | 35273.9 |

| 2025-06-18 | 35831.2 | 35941.9 | 35544.1 | 35667.6 |

| 2025-06-17 | 36067.2 | 36107.8 | 35736.0 | 35836.0 |

| 2025-06-16 | 35796.8 | 36029.2 | 35429.6 | 36010.4 |

| 2025-06-13 | 35408.0 | 35819.0 | 35304.9 | 35740.6 |

Source: NSE

Figure: Recent performance

Source: NSE

The NIFTY ENERGY index was down 0.39% for week, and extended its losses from the prior week. Notably, the index has dropped in three of the last 5 weeks. While heavyweight – Reliance Industries – was a notable performer last week, it was not sufficient to prop up the index. Among top gainers were Reliance Industries, Power India, IGL, Schneider and MGL. They each gained 2.7% to 5%. On the other hand, the biggest losers were Adani group firms (Adani Power and Adani Gas), along with GAIL, Gujarat Gas and NHPC.

Market breadth was negative with 13 gainers and 27 losers among constituents of the index. The spike in oil and heightened geopolitical tensions dominated the newsflow. With new developments around supply chain disruptions to Oil, it could be another choppy week for oil related stocks.

NIFTY FMCG - A mildly positive week

Weekly Performance: 0.2%

| date | open | high | low | close |

| 2025-06-20 | 54316.9 | 54690.1 | 54265.7 | 54630.9 |

| 2025-06-19 | 54418.7 | 54603.8 | 54158.4 | 54283.5 |

| 2025-06-18 | 54647.1 | 54804.8 | 54284.3 | 54452.4 |

| 2025-06-17 | 54842.0 | 54932.1 | 54540.1 | 54708.8 |

| 2025-06-16 | 54534.7 | 54908.6 | 54414.4 | 54873.3 |

| 2025-06-13 | 54373.6 | 54688.6 | 54349.1 | 54527.1 |

Source: NSE

Figure: Recent performance

Source: NSE

NIFTY FMCG index has been amongst the worst performing indices YTD. Over the past five weeks, it closed in the red in 3 of them. However, it eked out a modest 0.2% gain in the prior week. The top gainers were ITC, Tata Consumer Products and Colgate-Palmolive. On the other hand, Varun Beverages, Hindustan Unilever and United Breweries closed in the red. Varun Beverages and UBL were down 2.2% to 5% each. The market breadth was mildly positive with 9 of the 16 index stocks ending up as gainers.

NIFTY AUTO – Recovers strongly

Weekly Performance: 1.5%

| date | open | high | low | close |

| 2025-06-20 | 23462.9 | 23720.2 | 23403.7 | 23679.3 |

| 2025-06-19 | 23305.5 | 23496.2 | 23299.6 | 23434.7 |

| 2025-06-18 | 23208.9 | 23564.9 | 23130.1 | 23312.3 |

| 2025-06-17 | 23407.6 | 23416.8 | 23176.7 | 23227.3 |

| 2025-06-16 | 23302.7 | 23425.2 | 23074.2 | 23368.2 |

| 2025-06-13 | 22941.8 | 23365.2 | 22915.7 | 23327.4 |

Source: NSE

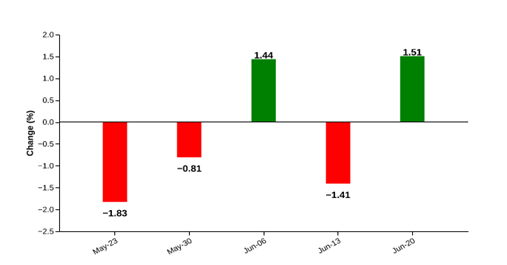

Figure: Recent performance

Source: NSE

NIFTY AUTO index was among the best performing indices for the week, with an increase of 1.51% in the week ending June 20, 2025. Index heavyweights – Mahindra Mahindra, Maruti Suzuki and Eicher Motors – contributed more than 70% of the gains on the index. Mahindra Mahindra was the top performer, rising 5.93% for the week. Meanwhile, Tata Motors was the worst drag on the index, down 5.03% for the week. A cautious margin outlook for JLR was the key reason for its disappointment.

In the past five weeks, the NIFTY AUTO index was down for 3 of them. However, it has shown green shoots with sharp rallies in 2 of the past 3 weeks.

NIFTY PHARMA – A sharp correction

Weekly Performance: -1.7%

| date | open | high | low | close |

| 2025-06-20 | 21443.7 | 21642.7 | 21424.8 | 21613.0 |

| 2025-06-19 | 21583.8 | 21619.3 | 21394.8 | 21441.8 |

| 2025-06-18 | 21587.2 | 21724.1 | 21534.8 | 21588.4 |

| 2025-06-17 | 22029.2 | 22057.2 | 21516.9 | 21622.8 |

| 2025-06-16 | 21899.3 | 22058.6 | 21840.3 | 22039.4 |

| 2025-06-13 | 21778.3 | 22008.9 | 21742.1 | 21985.2 |

Source: NSE

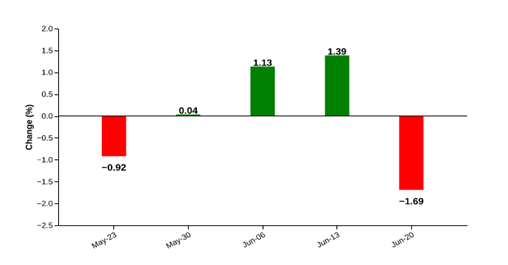

Figure: Recent performance

Source: NSE

NIFTY PHARMA index was down 1.69% for the week and was among the worst performing indices. After two weeks of strong performance, the index witnessed profit booking and saw widespread selling. 17 of the 20 constituents ended in the red. Only JB Chemicals (up 2.2%) and Glenmark Pharmaceuticals (up 1.99%) and Abbott India (up 0.33%) ended in the green. Aurobindo, Granules and Natco lost heavily, seeing declines of more than 4% each.

NIFTY REALTY – A mixed bag as the index ekes out a gain

Weekly Performance: 0.7%

| date | open | high | low | close |

| 2025-06-20 | 994.2 | 1018.0 | 993.8 | 1013.7 |

| 2025-06-19 | 1009.5 | 1015.5 | 989.5 | 992.8 |

| 2025-06-18 | 1016.5 | 1028.6 | 1004.8 | 1008.9 |

| 2025-06-17 | 1024.0 | 1038.7 | 1012.5 | 1013.7 |

| 2025-06-16 | 1007.0 | 1021.8 | 996.5 | 1020.3 |

| 2025-06-13 | 982.3 | 1010.2 | 981.9 | 1007.0 |

Source: NSE

Figure: Recent performance

Source: NSE

During the week ending 2025-06-20, the NIFTY REALTY index gained 0.6% and closed on a flat note. The index was led higher by Prestige Estates, Lodha Developers, Godrej Properties and Phoenix, which contributed to almost all of the gains. On the other hand, Brigade and Sobha lost 3.5% to 4.7% and were a significant drag. An analysis of the recent performance indicates that the sentiment in real estate has recovered strongly. The index was the best performing index in the week of 6th June when RBI had announced the jumbo rate cut. While the week after that saw profit booking, the recent week’s performance highlights that investors continue to see it favorably.

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.